Neat Accruals In Cash Flow Statement

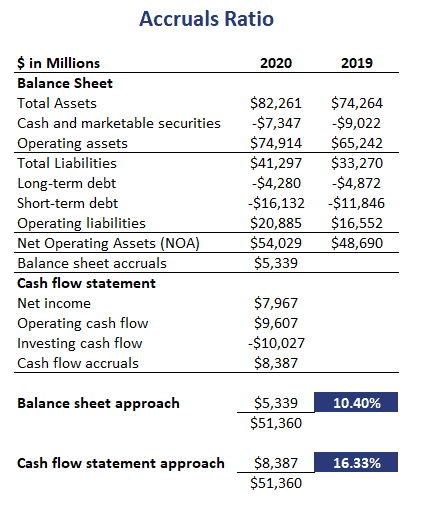

Company As cash-flow-based accrual ratio is 175 or 125000 - 25000 - 30000 40000.

Accruals in cash flow statement. Accrued liabilities can temporarily affect cash flow by the amount saved in taxes from an increase in expenses on the income statement. 31 20X1 statement of cash flows should not reflect the 10000 liability as an increase in accounts payable when reconciling net income to cash flows from operating activities. How an increase in accrued liabilities affects cash.

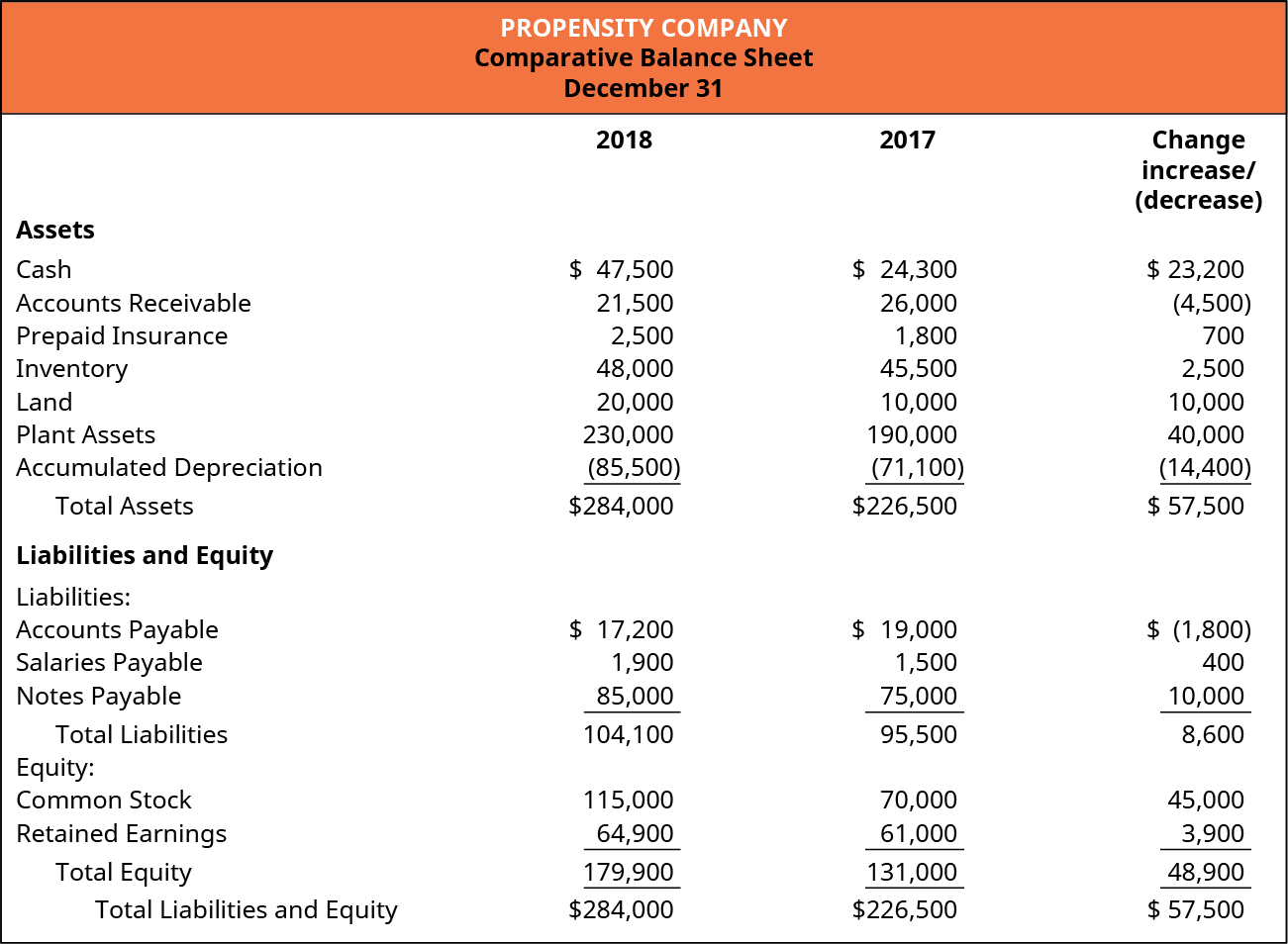

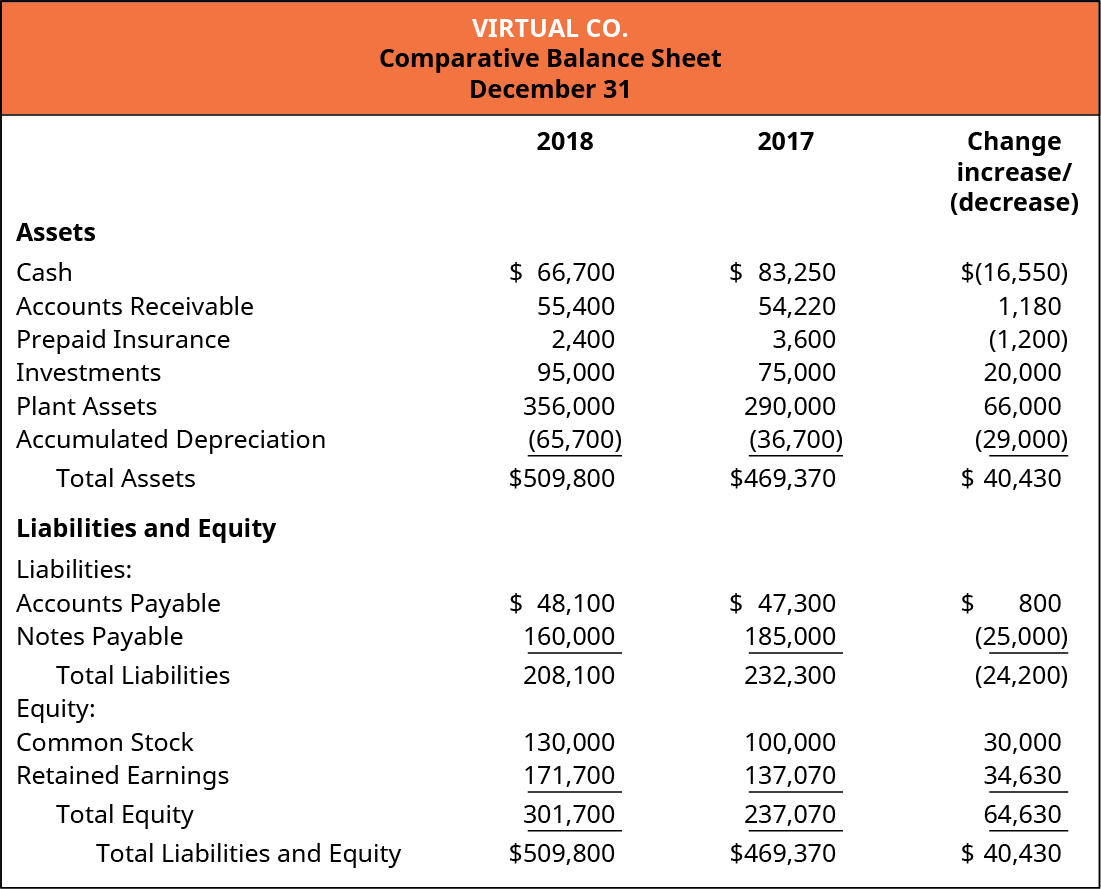

The 10000 should be disclosed as a noncash investing and financing activity. In order to prepare the cash flow statement we adjust the profit before tax with working capital adjustments and operating expenses and accrual is an operating expense payable. A Cash Flow Statement also called the Statement of Cash Flows shows how much cash is generated and used during a given time period.

The time interval period of time covered in the SCF is shown in its heading. However the cash flow statement. The cash flow statement is required for a complete set of financial statements.

Effect on the statement of cash flow. The cash method is a. The statement is consist of three components naming.

In the indirect method the accounting line items such as net income depreciation etc. Along with balance sheets and income statements its one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. A cash flow statement tells you how much cash is entering and leaving your business.

While Accrual accounting is a good measure of the OVERALL HEALTH of a business its shortcoming is that it makes it hard to figure out how much cash really came in and went out of a business. The cash flow is recorded in a specific report model which is term as statement of cash flow. Accrued revenues and accrued expenses themselves have no impact on cash flow because neither cash nor cash equivalents have exchanged hands.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)