Divine Amortization Of Patent Cash Flow

Jindani SBUs answer was correct.

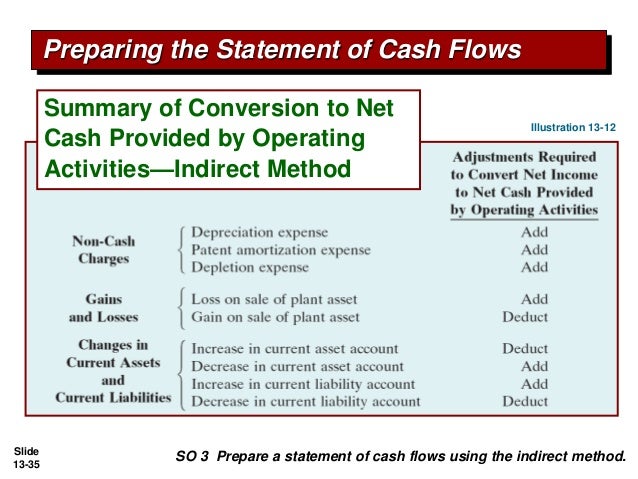

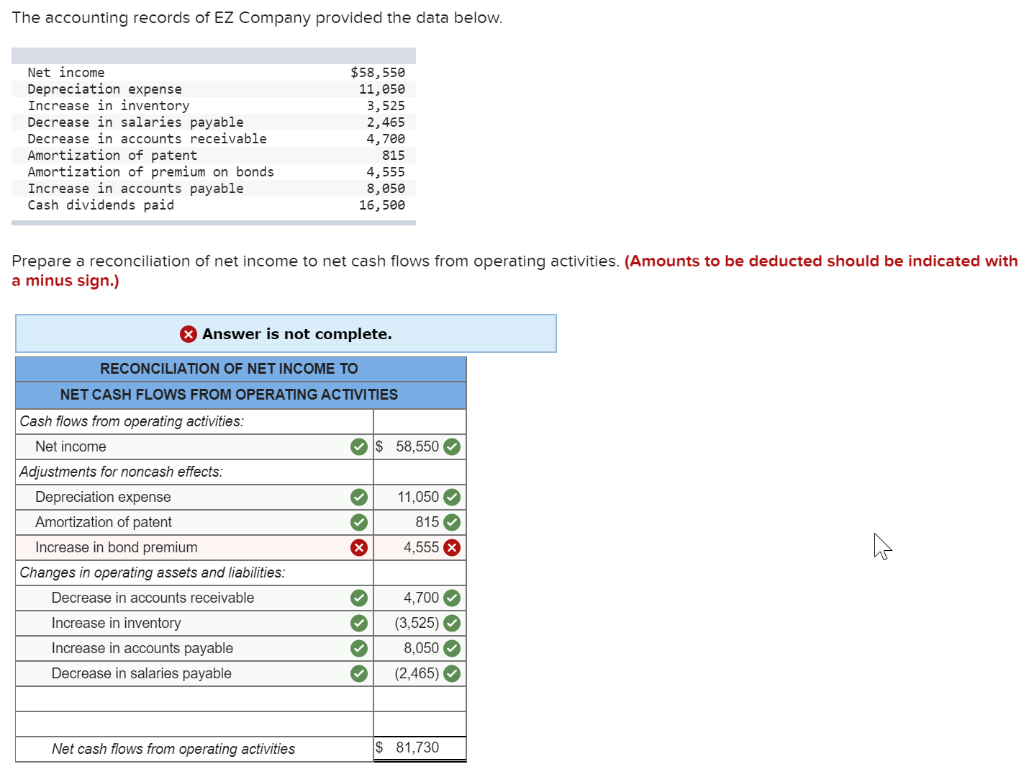

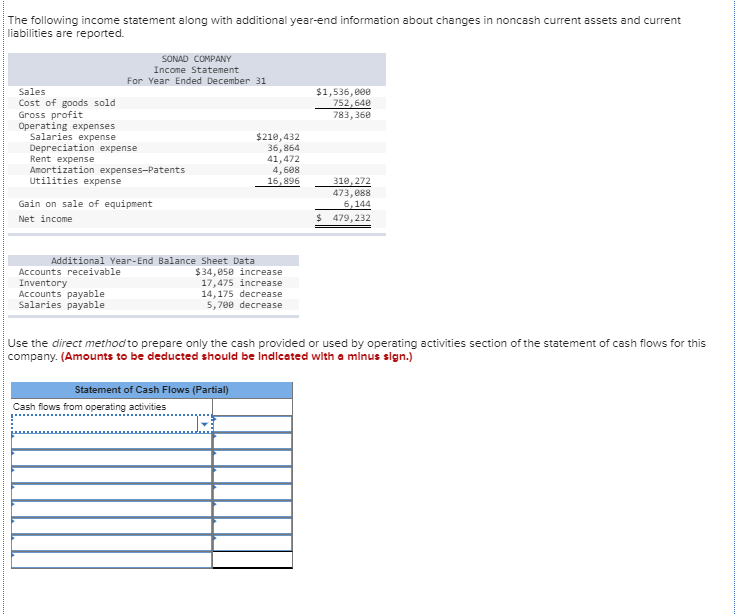

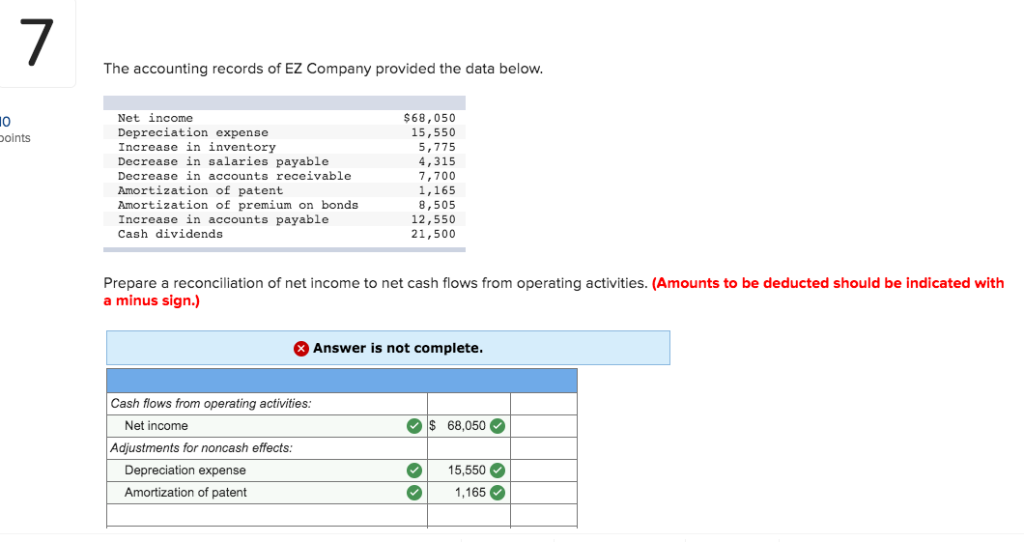

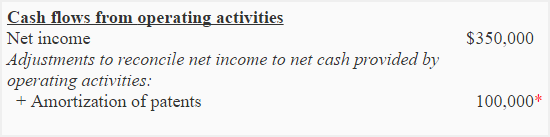

Amortization of patent cash flow. Amortization doesnt do anything to cash flow because its just recognizing the amortization expense on the books but there is no cash inflow or outflow for it. A decrease in cash flows from investing activities. How is the amortization of patents reported in a statement of cash flows that is prepared using the indirect method.

In a statement of cash flows indirect method the amortization ofpatents of a company with substantial operating profits should bepresented as an. Deduction from net incomed. Its presentation is given below.

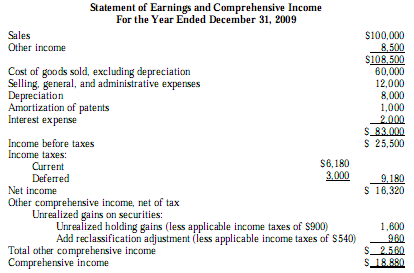

The cash flow statement is the bridge between the balance sheet and the income statement. Record the patent purchase into the general ledger. Amortization of intangible assets is a process by which the cost of such an asset is incrementally expensed or written off over time.

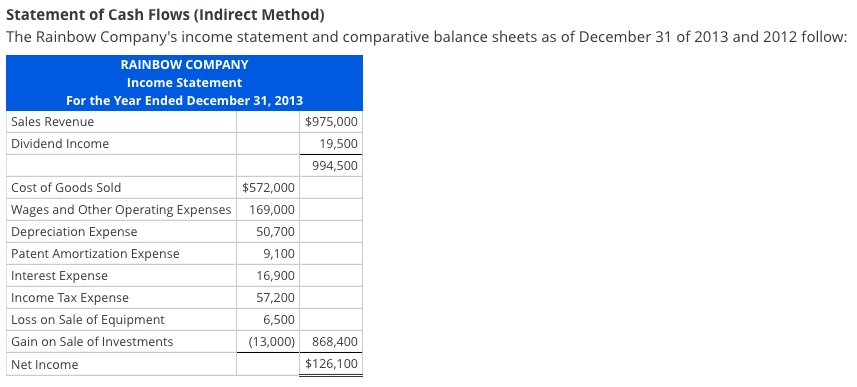

EE 16-2 Nadal Corporations accumulated depreciationfurniture account increased by 17720 while 3800 of patent amortization was recognized between balance sheet datesThere were no purchases or sales of depreciable or intangible assets during the year. A patent is a type of intangible asset that gives a business the legal right to make and sell a product exclusively for a fixed period of time. A deduction from net income in arriving at cash flows.

The three sections of the cash flow statement are cash flow from operations cash flow from investing and. Therefore like all non-cash expenses it will be added to the net income when drafting an indirect cash flow statement. In addition the income statement showed a loss of 5200 from the sale of land.

Cash flow from financing activitiesc. A decrease in cash flows from investing activities. The amortization of a patent is not a cash-flow transaction and therefore it should not be included in the statement of cash flows.