Sensational Balance Sheet Uses And Purposes

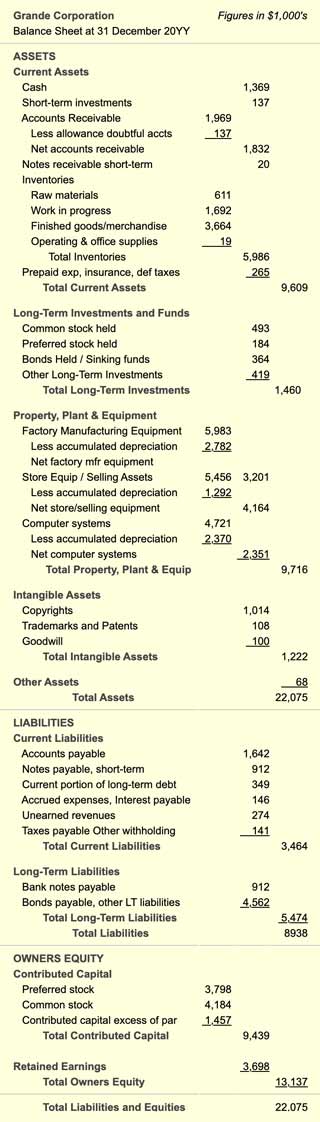

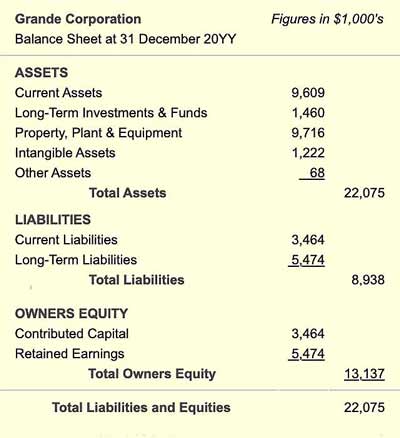

The trial balance is recorded under debit and credit columns while a balance sheet ideally displays total assets liabilities and stockholders equity.

Balance sheet uses and purposes. A balance sheet is a financial statement that shows what the business is worth at a given point in time. Obligations at a particular date to the owner as well as to the outsiders. A balance sheet report is a type of financial statement that is used to calculate the holdings of a business and its owners.

The functions of a Balance Sheet are. Therefore if the debit total and credit total on a trial. The Importance of a Balance Sheet in Your Business Plan.

Below are some of the uses and importance of a balance sheet. The balance sheet is an indispensable tool for businesses of all sizes. The purpose of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced.

A trial balance lists the ending balance in each general ledger accountThe total dollar amount of the debits and credits in each accounting entry are supposed to match. It is vital to include a balance sheet within any business plan as it is a really important part of the financials. A balance sheet is a snapshot of a particular point in time normally at specific points through the year and at the end of the tax year.

An asset is anything that has value such as equipment real estate or cash in your bank account. At a glance the balance sheet provides a snapshot of the companys financial health. Uses of the Balance Sheet.

A balance sheet provides both investors and creditors with a snapshot as to how effectively a companys management uses its resources. The purpose of the balance sheet is to reveal the financial status of a business as of a specific point in time. A balance sheet shows your businesss assets liabilities and shareholder equity at a specific moment.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)