Stunning Closing Entries For Retained Earnings

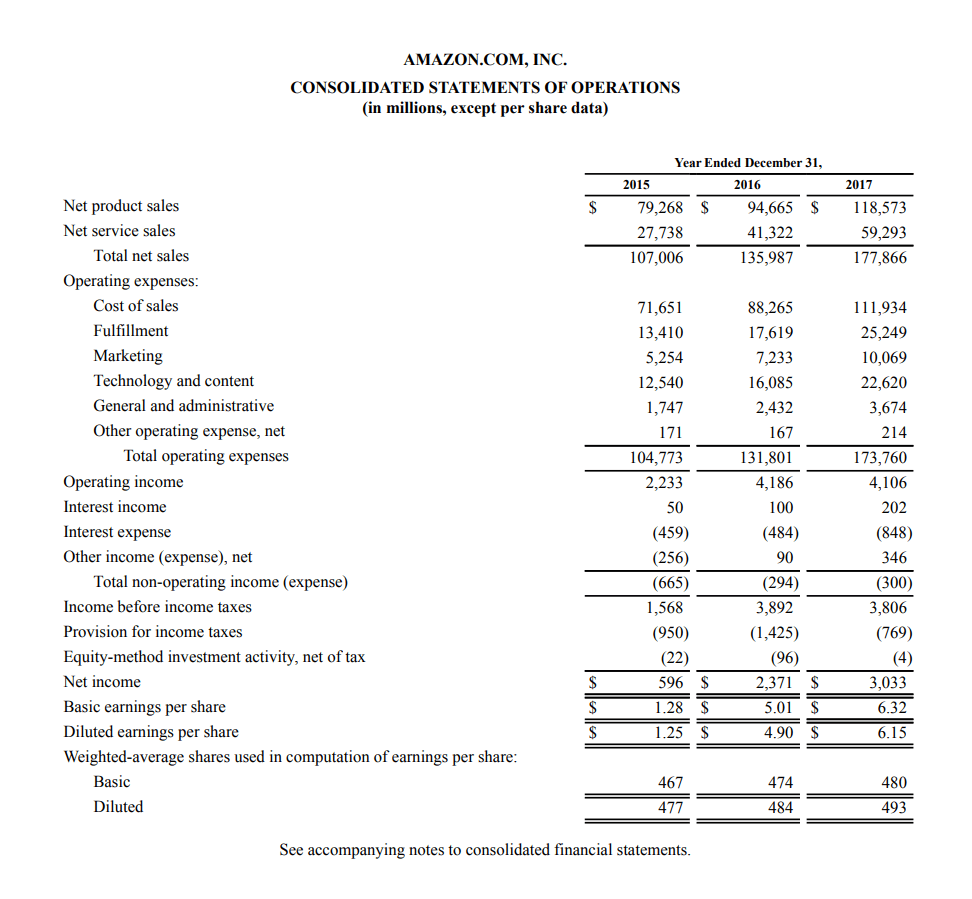

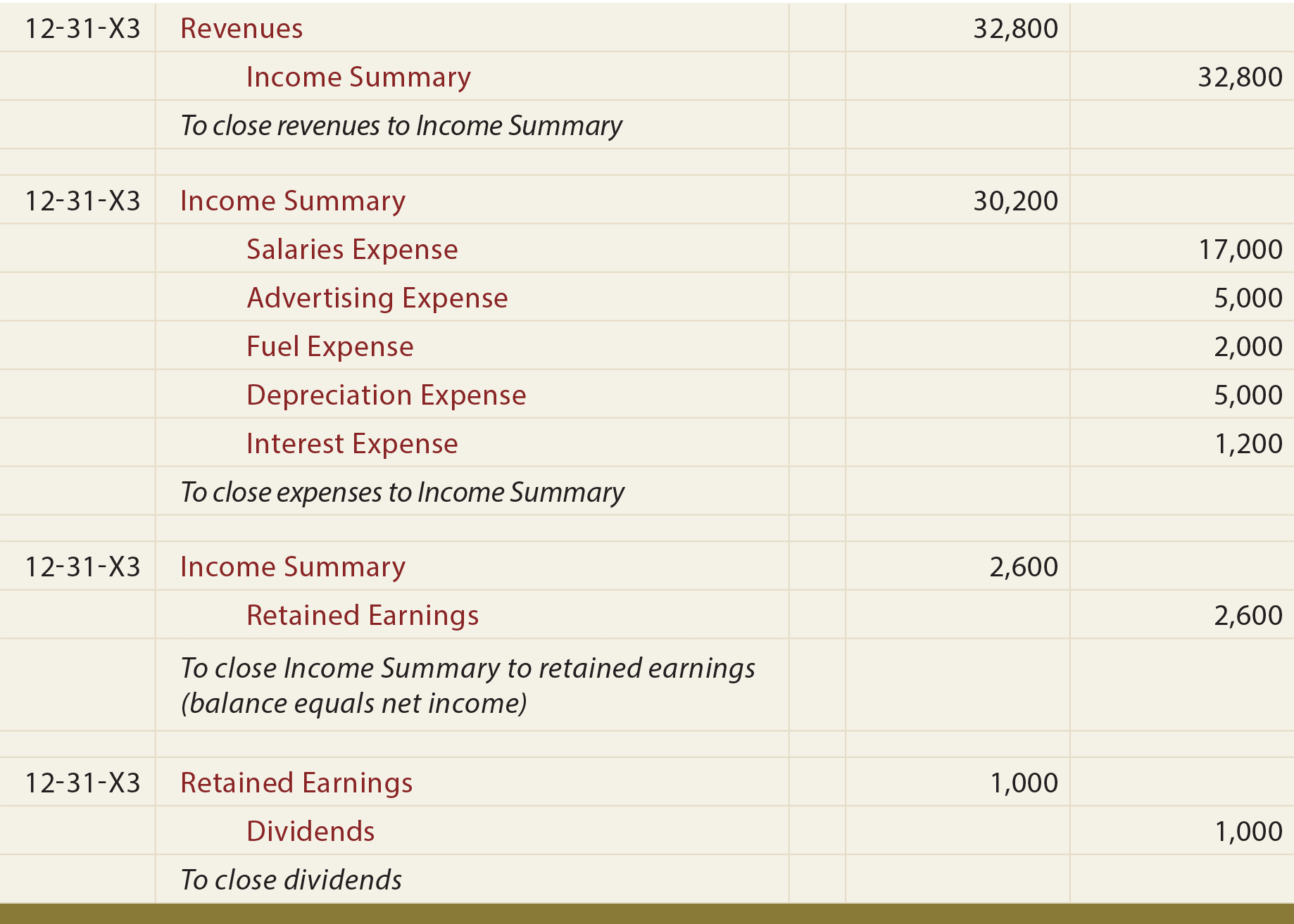

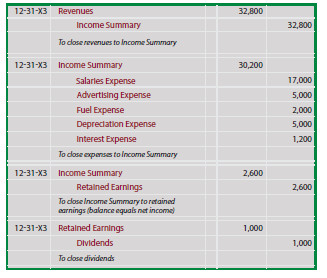

For example a closing entry is to transfer all revenue and expense account totals at the end of an accounting period to an income summary account which effectively results in the net income or loss for the period being the account balance in the income summary account.

Closing entries for retained earnings. Beginning RE of 5000 when the reporting period started. Your entry is a Math computation. The purpose of the income summary account is simply to keep the permanent owners capital or retained earnings account uncluttered.

This is Not what happens. Retained earnings is an account used to represent the accumulated earnings that the business has chosen to reinvest into its operations rather than distribute to its shareholders as dividends. Retained earnings represent the amount your business owns after paying expenses and dividends for a specific time period.

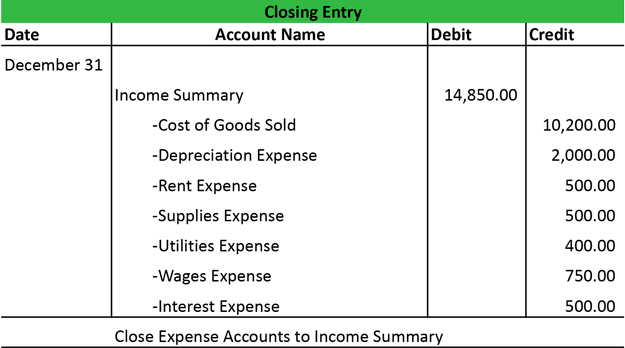

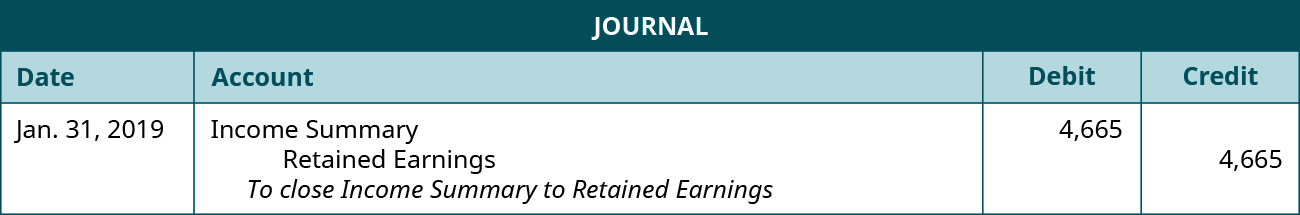

These journal entries condense your accounts so you can determine your retained earnings or the amount your business has after paying expenses and dividends. The purpose of closing entries is to merge your accounts so you can determine your retained earnings. Closing Entry 3 for Bob To close the income summary account to the retained earnings account Bob needs to debit the retained earnings and credit the income summary.

Dr Retained earnings Cr Sales. Therefore this entry will ensure that the balance has been transferred on the balance sheet. 2000 in dividends paid out during the period.

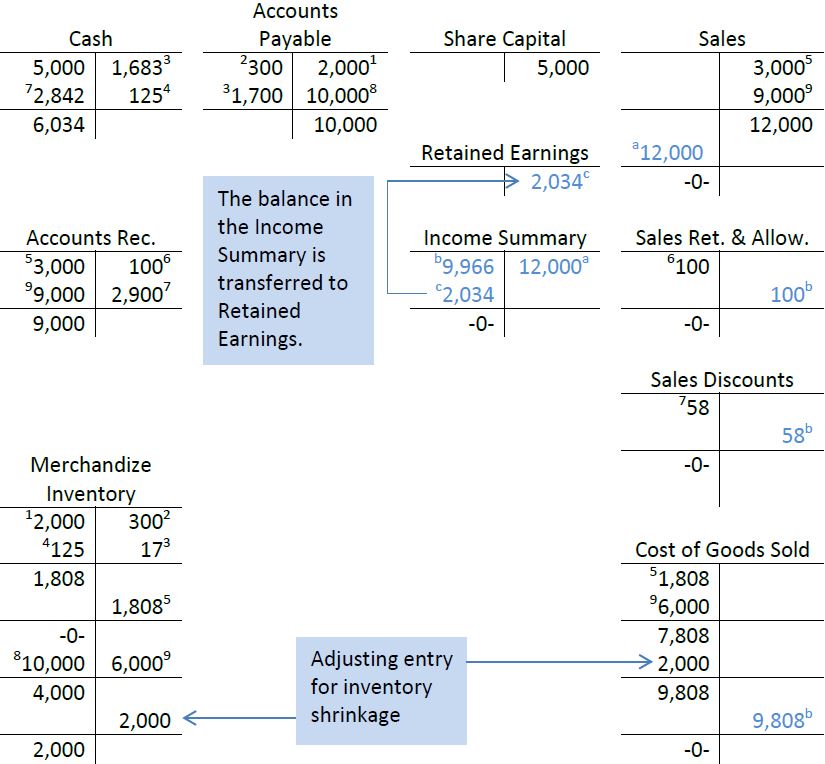

In some cases however a company will need to retain enough cash to pay the final expenses associated with its physical location. To do this their balances are emptied into the income summary account. It enables you to determine net income or retained earnings for the current accounting period and it.

Accountants will debit the expense account and credit cash. For any year end run the Balance Sheet as of the Next Day. Then you shift the balance in the income summary account to the retained earnings account.