Unbelievable Comprehensive Income Format

It is a broader measure of return earned during period and can be defined as follows.

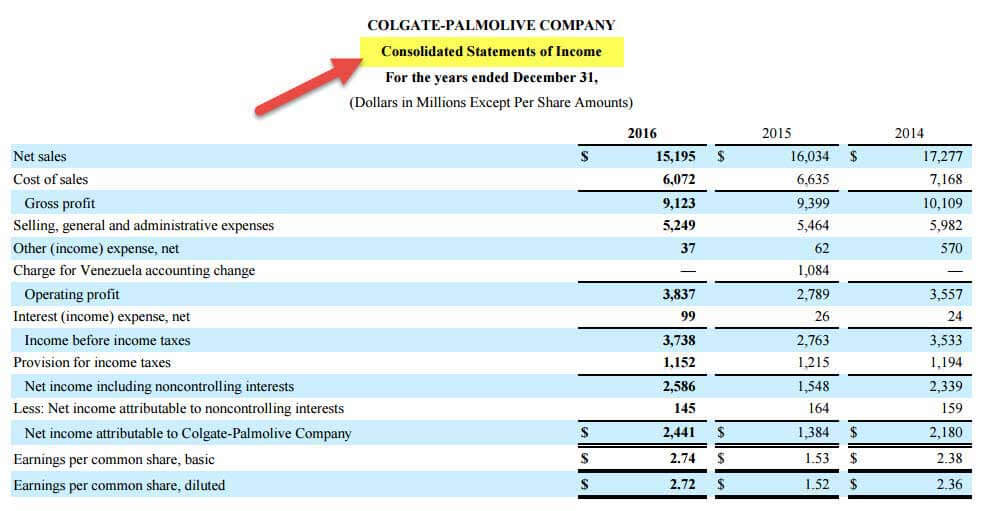

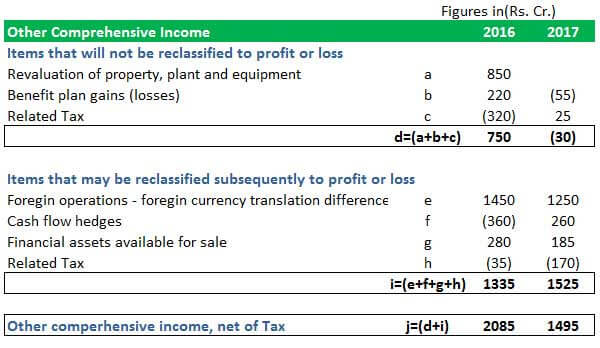

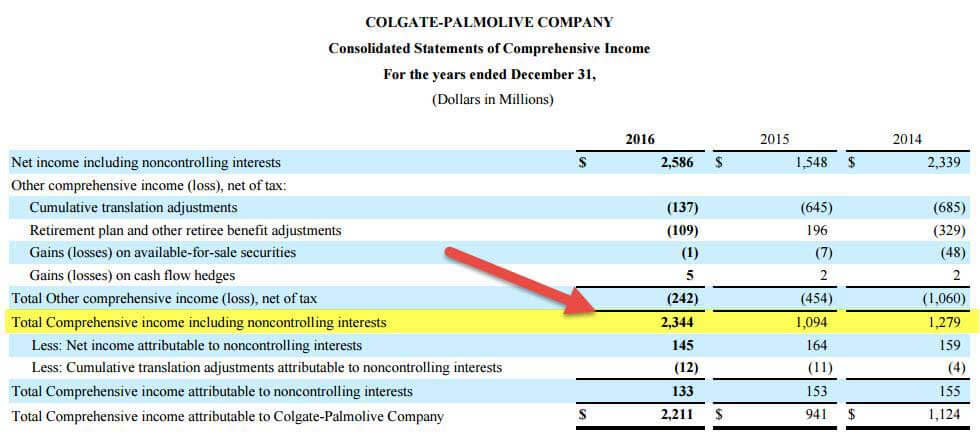

Comprehensive income format. Since net income only accounts for revenues and expenses that actually occurred during the period external users dont get a complete view of the company activities behind the scenes. Colgate SEC Filings As seen from the above statement we have to consider two primary components. In business accounting other comprehensive income OCI includes revenues expenses gains and losses that have yet to be realized and are excluded from net income on an income statement.

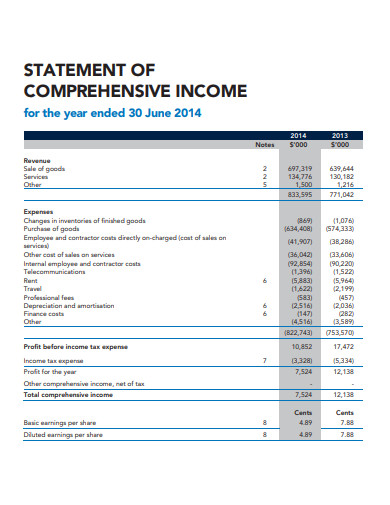

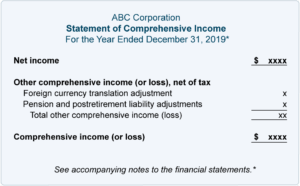

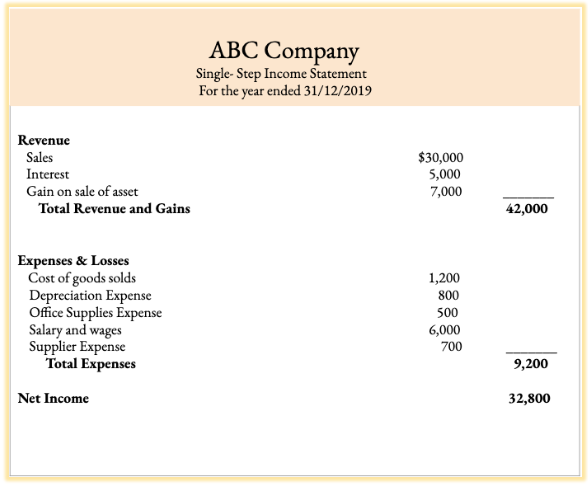

Comprehensive Income Net Income Other Comprehensive Income OCI. One is operation profit and the second one is non-operation profit. Net income or net loss the details of which are reported on the corporations income statement plus Other comprehensive income.

Total comprehensive income is therefore equal to net income other comprehensive income 50 million 25 million 75 million. It usually includes the net income and unrealized income such as unrealized gains or losses on the unoriginal financial instruments. This is simply translated into the accounting of comprehensive income within the familiar to most report on profit and loss.

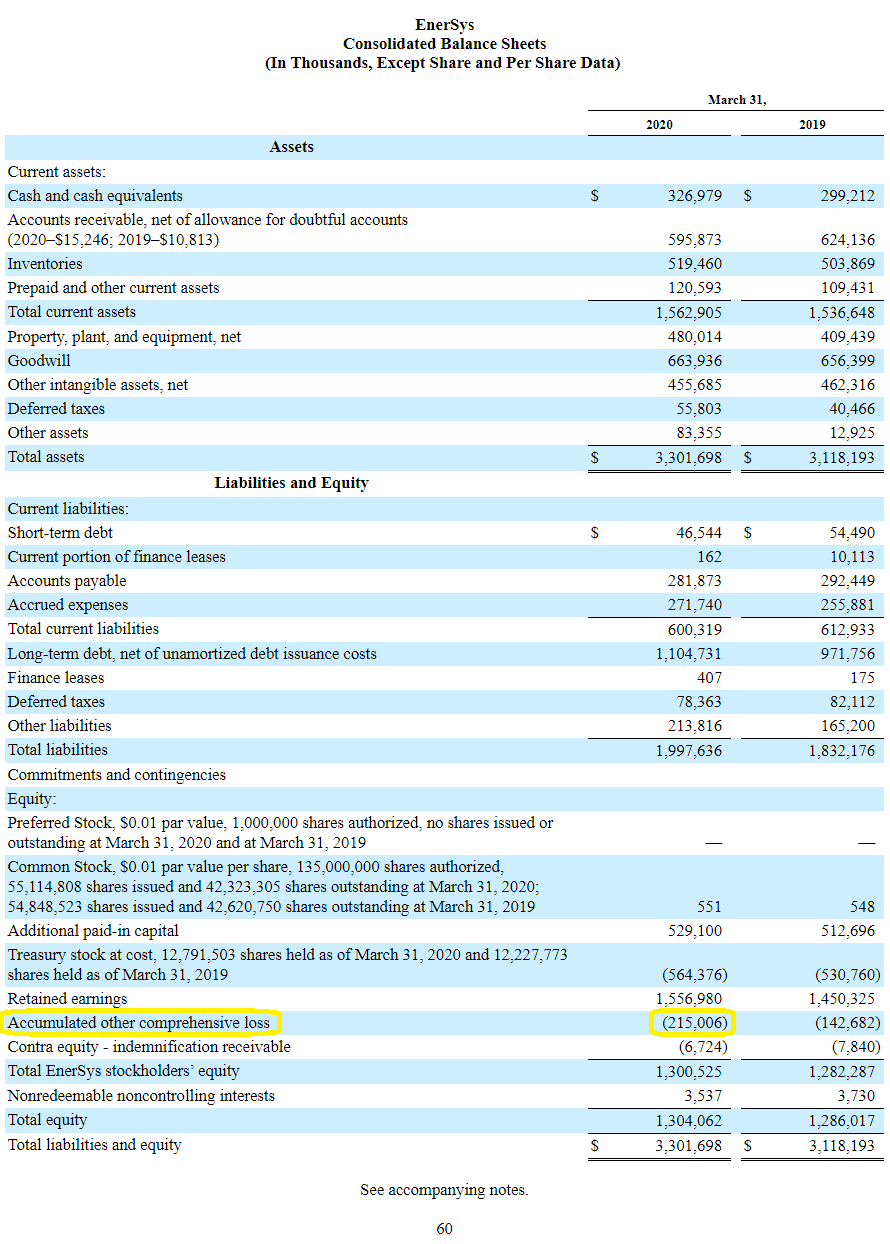

These amounts cannot be included on a companys income statement because the investments are still in play. Comprehensive income sums up all changes in the shareholders equity for a period except those arising from transactions with owners. The net income is the result obtained by preparing an income statement.

A variation that occurs in a companys net assets from non-owner sources during a specific period is known as a comprehensive income. Comprehensive income is made up of a companys overall sales revenue net income and figures for other comprehensive income which are combined to form comprehensive income. The Basics of Comprehensive Income OCI and AOCI The differences between comprehensive income OCI and AOCI are subtle yet critically important.

Heres What Well Cover. Comprehensive income for a corporation is the combination of the following amounts which occurred during a specified period of time such as a year quarter month etc. The second format of Statement of Comprehensive Income is the multiple-step of the income statement.