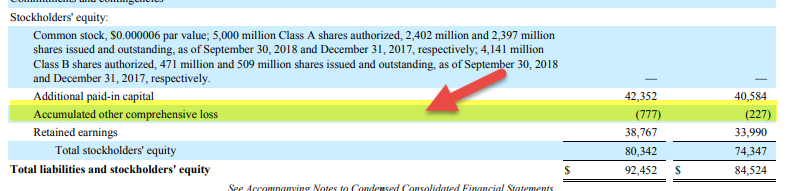

Out Of This World Fair Value Through Other Comprehensive Income

If such financial assets are designated in accordance with IFRS 9 Financial Instruments IFRS 9 at inception as Fair Value Through Other Comprehensive Income FVTOCI then the gains and losses are recognised in OCI and accumulated in OCE.

Fair value through other comprehensive income. Or fair value through profit or loss FVTPL. Hold the financial asset for the longer term. Investments of more than 50.

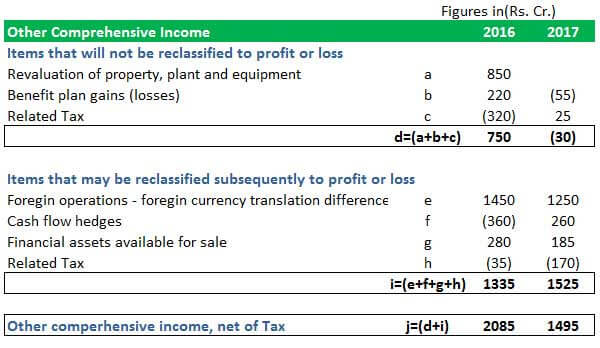

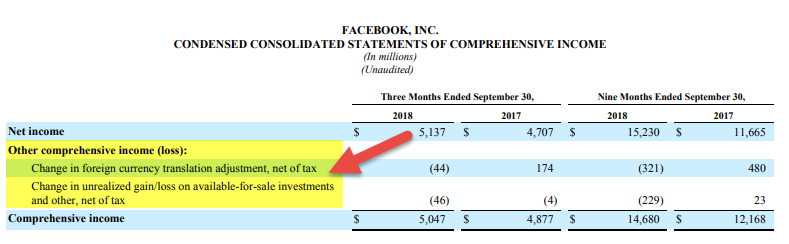

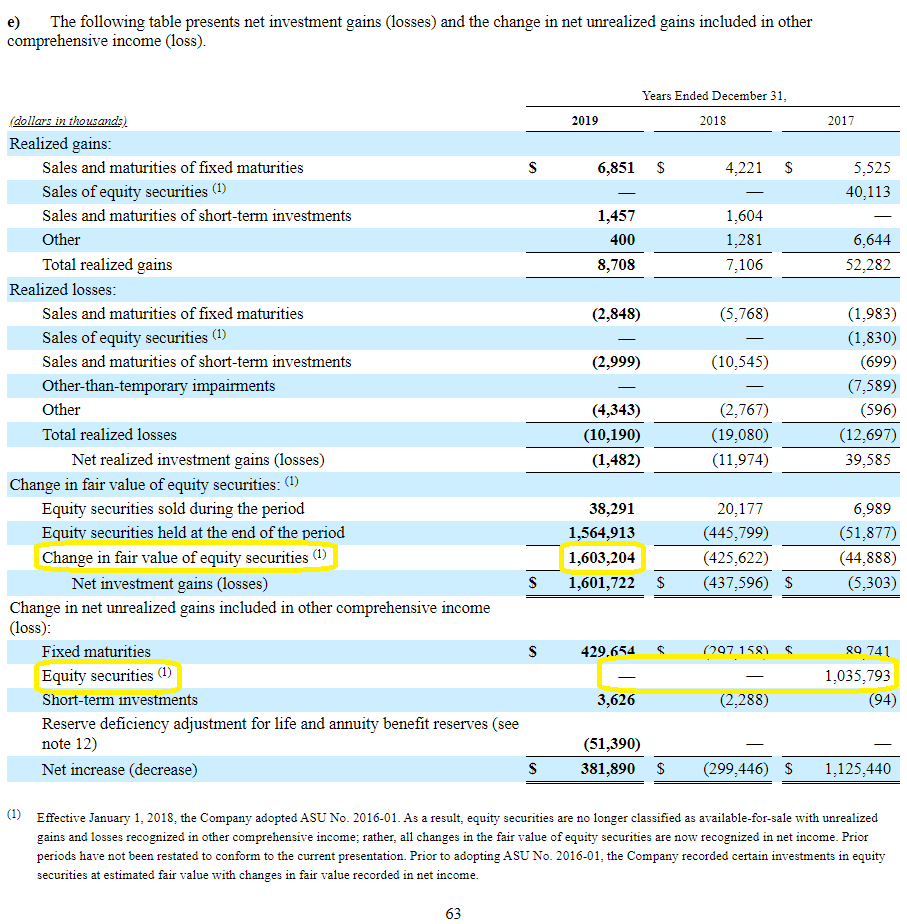

Fair value with value changes recognised in other comprehensive income. Fair Value through Other Comprehensive Income FV-OCI When investments are disposed previously unrealized holding gains or losses need to be transferred out of OCIAOCI Under FV-OCI with recycling unrealized holding gains or losses are transferred ie. For fair value hedges of an equity instrument accounted for at fair value through other comprehensive income FVOCI under IFRS 9 gainslosses of equity instruments are never recycled to PL changes in the fair value of the hedging instrument are also recorded in OCI without recycling to PL.

On December 31 2018 the fair value of the instrument was P5500000. Financial assets at fair value through other comprehensive income classification is part of the decision model for the classification and measurement of financial assets that started in the IFRS 9 Framework for financial assets. Nontrading investments of less than 20.

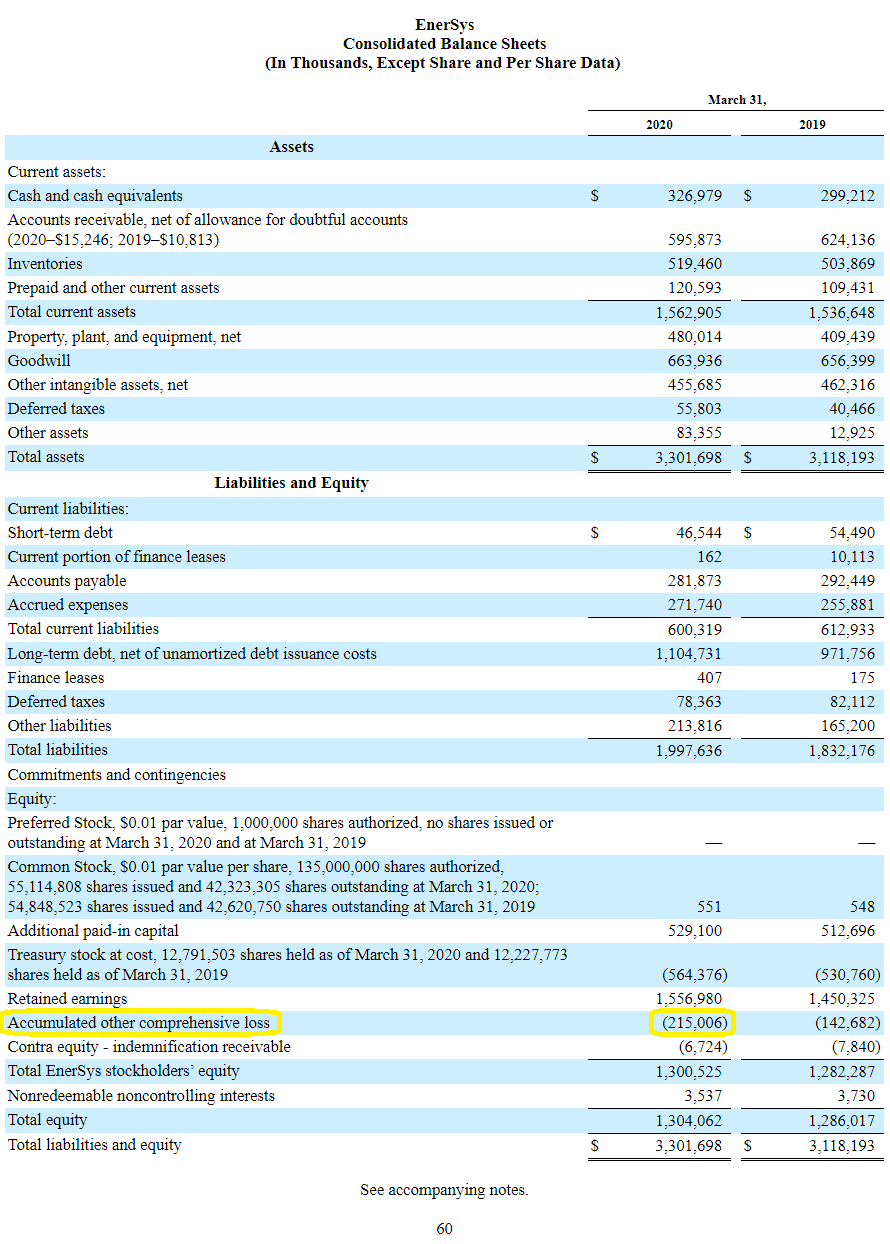

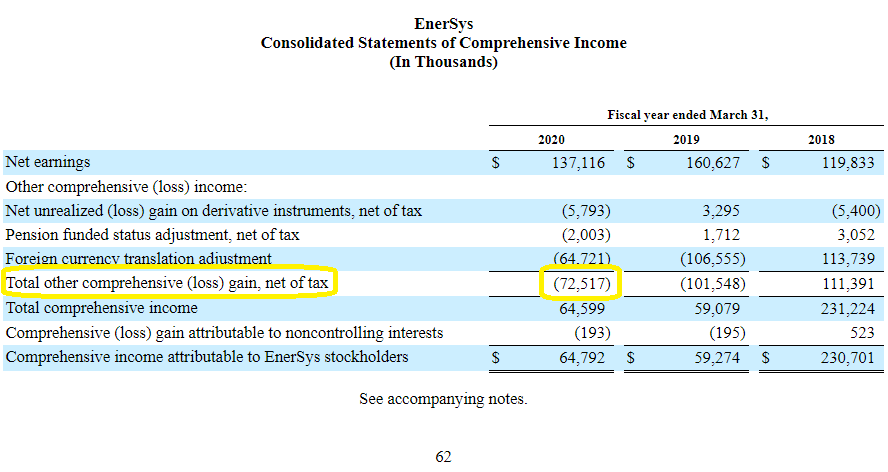

These changes are recognized initially in other comprehensive income OCI. The accounting treatment of comprehensive income is. The transaction cost incurred amounted to P700000.

Investments of between 20 and 50. Or fair value through profit or loss An entity applies the impairment requirements in IFRS 955 to financial assets that are measured at amortised cost in accordance with IFRS 9412 and to financial assets that are measured at fair value through other comprehensive income in accordance with IFRS 9412A. Interest income is recorded in statement of profit or loss using the effective interest rate.

In business accounting other comprehensive income OCI includes revenues expenses gains and losses that have yet to be realized. All equity investments in scope of IFRS 9 are to be measured at fair value in the statement of financial position with value changes recognised in profit or loss except for those equity investments for which the entity has elected to present value changes in other comprehensive income. Equity investments irrevocably accounted for at fair value through other comprehensive income are.