Fine Beautiful Four Financial Ratios

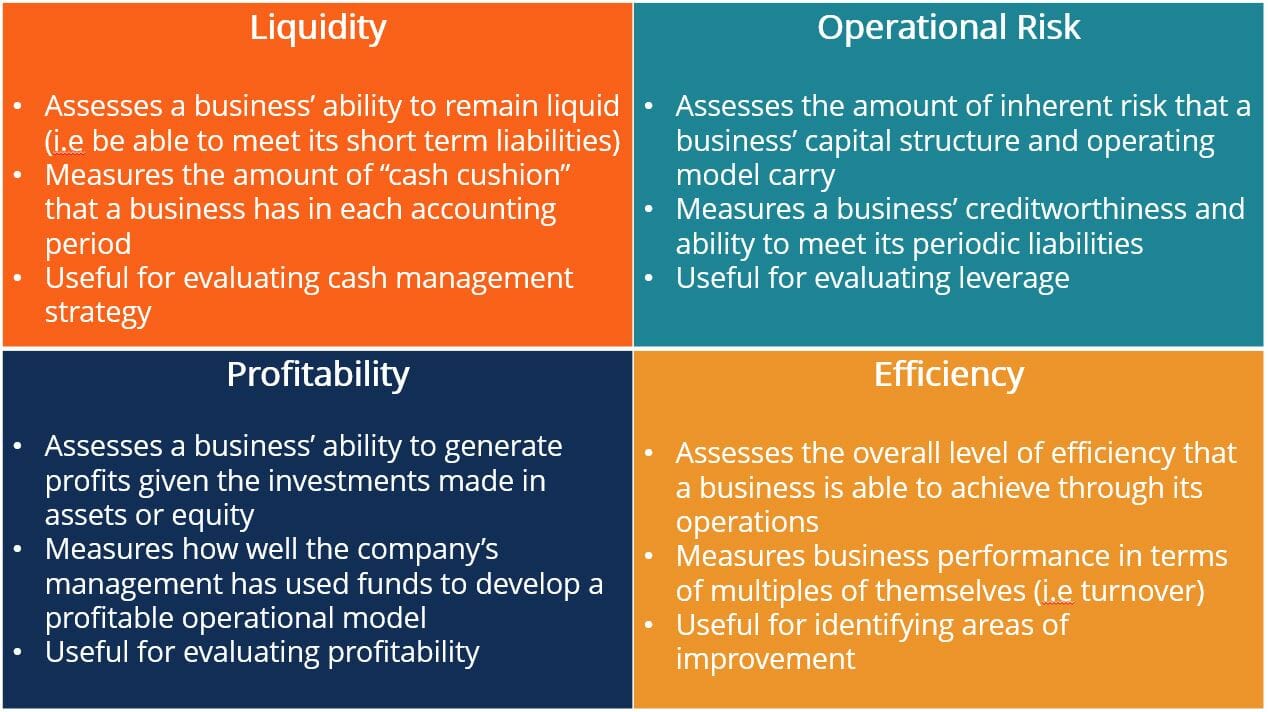

The following financial ratios are often labeled as liquidity ratios since they provide some indication of a companys ability to pay its obligations when they come due.

Four financial ratios. The fast ratio is a more conservative model of the present ratio. 4 Financial Performance Ratios Every Contractor Needs to Know. What are the four financial performance ratios.

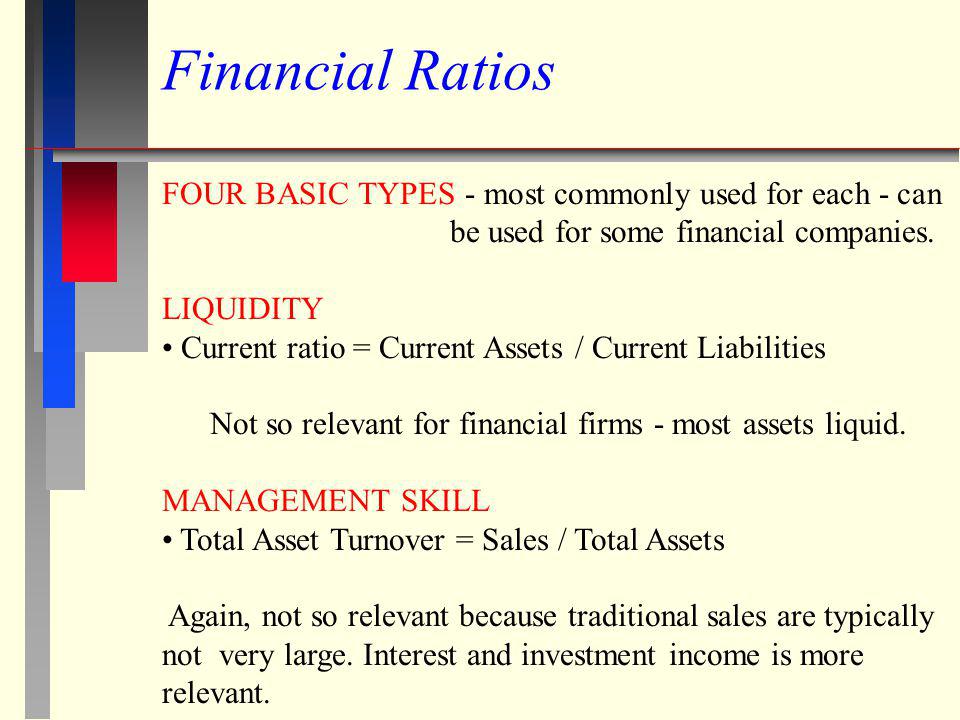

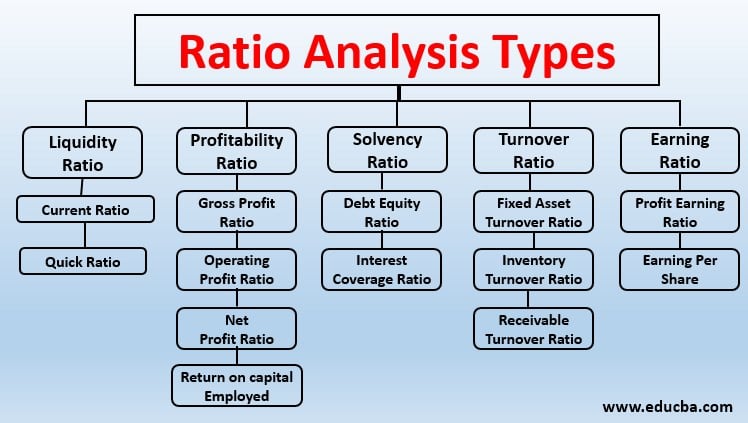

BUS 110 - Introduction to Business Chapter 14 - Financial Ratios 1. This article throws light upon the four main types of financial ratios. The two basic liquidity ratios are the current ratio and the quick ratio.

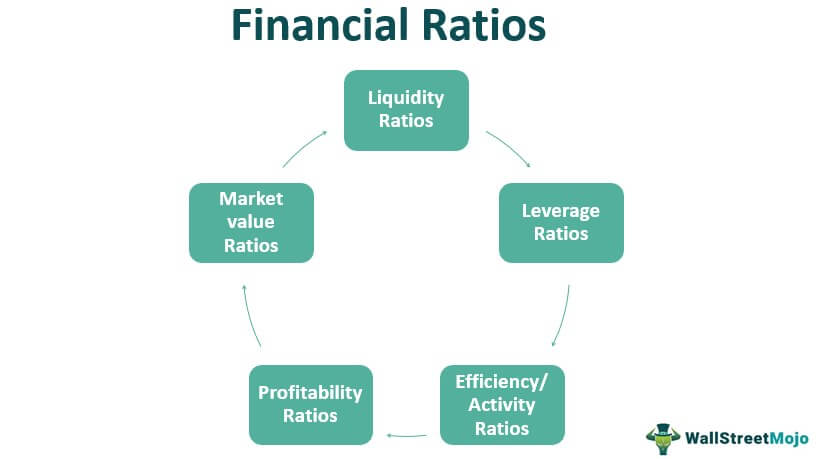

So what are some of the most important financial ratios. Liquidity ratios are used to estimate a companys ability to pay its short-term debts. There are generally five types of financial ratio.

The financial ratios that give you an idea of the leverage inherent in the business such as the debt-to-equity ratio or other ratios that allow you to see a companys capital structure along with the potential benefits and risks of such a capital structure and how it compares to those of competitors in the same sector or industry are what I call leverage financial ratios. Anyone hoping to do well in the construction business needs those skills and more to pull it off. Some of these ratios include earnings ratio asset turnover ratio inventory turnover ratio working capital ratio interest coverage ratio peg ratio growth ratio accounts receivable turnover dividend yield gross profit margin dividend payout ratio and valuation ratios.

Important liquidity ratios are the current quick and cash ratios. The first four of the above ratios inform us about a companys speed in. List of financial ratios Weve covered a lot of financial ratios on Study Finance too many to list all on one page.

A financial ratio is a metric usually given by two values taken from a companys financial statements that compared give five main types of insights for an organization. In general financial ratios can be broken down into four main categories. Specifically we will discuss the following.