First Class Hmrc Statement Of Earnings For Mortgage

The address is on the form.

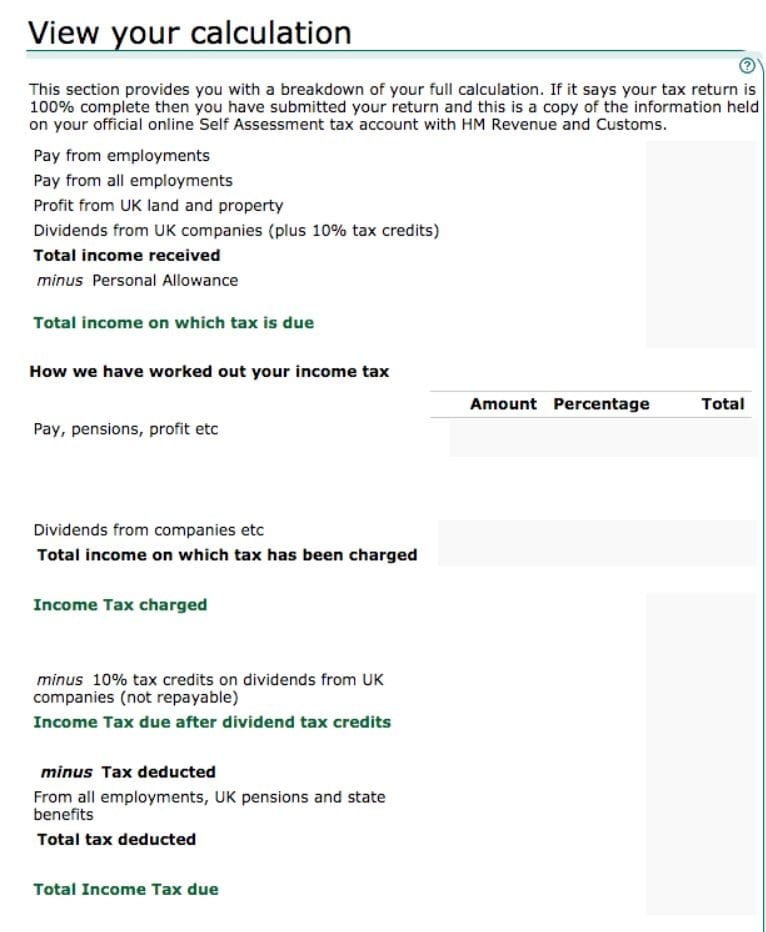

Hmrc statement of earnings for mortgage. 2019-20 - Claim 25 as normal claim 75 as a tax adjustment at basic rate. Verification of income for clients. Statement of earnings doesnt have to come from the local tax office.

The majority of lenders will also want to see the net income shown on the payslips earnings from self-employment to marry up with the figures on the corresponding bank account for at least the last 3 months. So the mortgage company have asked for a statement off earnings from the HMRC to show she has been paying TAX. Published 1 April 2013.

Based on 25 of the annual average of any variable income eg. Student Finance today told me to send my dads statement of earnings from HMRC to them I have already sent them his P60. The lenders will also need a tax year overview which you can print from your HMRC online account.

Tax-free allowances on property and trading income. Published 4 July 2014 Last updated 5. And interest dividend and retirement statements from banks and investment firms Forms 1099 you have several.

This has become particularly difficult since the Financial Conduct Authority introduced rules in 2014 requiring lenders to make sure borrowers could afford their repayments now and in the future. You will have to look on a tax coding. If we do not need to see your deposit we wont ask to see any bank statements.

How to get your employment history. You will have to phone your HMRC centre We cant tell you what that is. Work bonuses and 100 of any guaranteed income.