Recommendation Ias Investment In Subsidiary

In any case IAS 27 does not require preparing separate financial statements.

Ias investment in subsidiary. Holds an initial investment in a subsidiary investee. Enjoy Free Price Alerts Market Analysis Tools. Accordingly the Committee concluded that in applying paragraph 51 of IAS 12 the entity uses the distributed tax rate to measure the deferred tax liability related to its investment in the subsidiary.

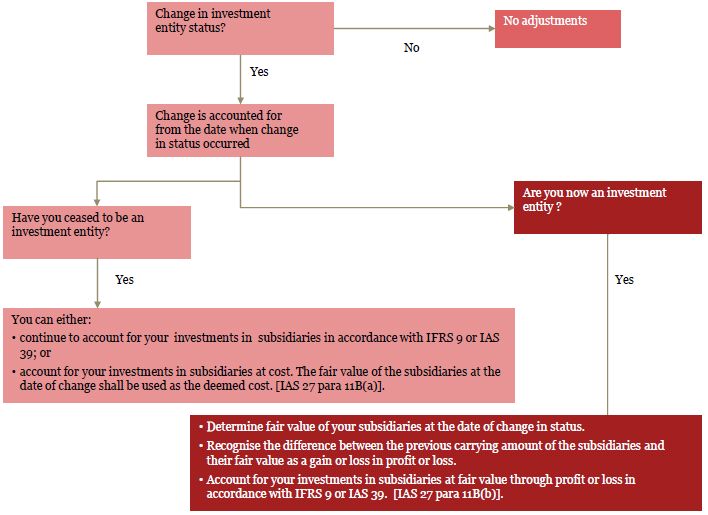

The accounting depends on whether control is retained or lost. 37 The fair value of any investment retained in the former subsidiary at the date when control is lost shall be regarded as the fair value on initial recognition of a financial asset in accordance with IAS 39 Financial Instruments. Investment in subsidiaries joint ventures and associates Accounted for either.

Elects to account for its investments in subsidiaries at cost applying paragraph 10 of IAS 27. Investment in the subsidiary through distributions of profits by the subsidiary which would be taxed at the distributed tax rate. An intercompany loan is outside IFRS 9s scope and within IAS 27s scope only if it meets the definition of an equity instrument for the subsidiary for example it is a capital contribution.

If an investment becomes a subsidiary the entity follows the guidance in IFRS 3 Business Combinations and IFRS 10 If any retained investment is held as a financial asset the entity applies IFRS 9 Financial Instruments and recognise in profit or loss the difference. Investment in such subsidiaries shall be classified as held for trading and accounted for in accordance with IAS 39 Financial instruments. Investments in subsidiaries joint ventures and associates classified as held for sale.

Holds an initial investment in another entity investee. The exposure draft addressed the concern that retrospectively determining cost in accordance with IAS 27 on first-time adoption of International Financial Reporting Standards IFRSs cannot in. The entity is required to apply the same accounting for each category of investments.

In the fact pattern described in the request the entity preparing separate financial statements. IAS 2735 Partial disposal of an investment in a subsidiary. This is accounted for as an equity transaction with owners and gain or loss is not recognised.