Fantastic Qbi Safe Harbor Statement

This election will print with the government copy and will appear after the 1065 return.

Qbi safe harbor statement. Taxpayers may still treat rental real estate that doesnt meet the requirements of the safe harbor as a trade or business for purposes of the QBI deduction if it is a section 162 trade or business. On release 201802070 2018-27 an option was added for this election. IRS is not allowing taxpayers who use the QBI business income deduction to efile the 2020 tax return due to an apparent requirement to physically sign a Section 199A Rental Real Estate Safe Harbor Statement under penalty of perjury.

Qbi Rental Real Estate Safe Harbor Statement. Is there a standard statement for 199A QBI Safe Harbor Rule to be attached to the tax return available. After making the appropriate selection go to view mode of the return and review statement QBI Safe Harbor.

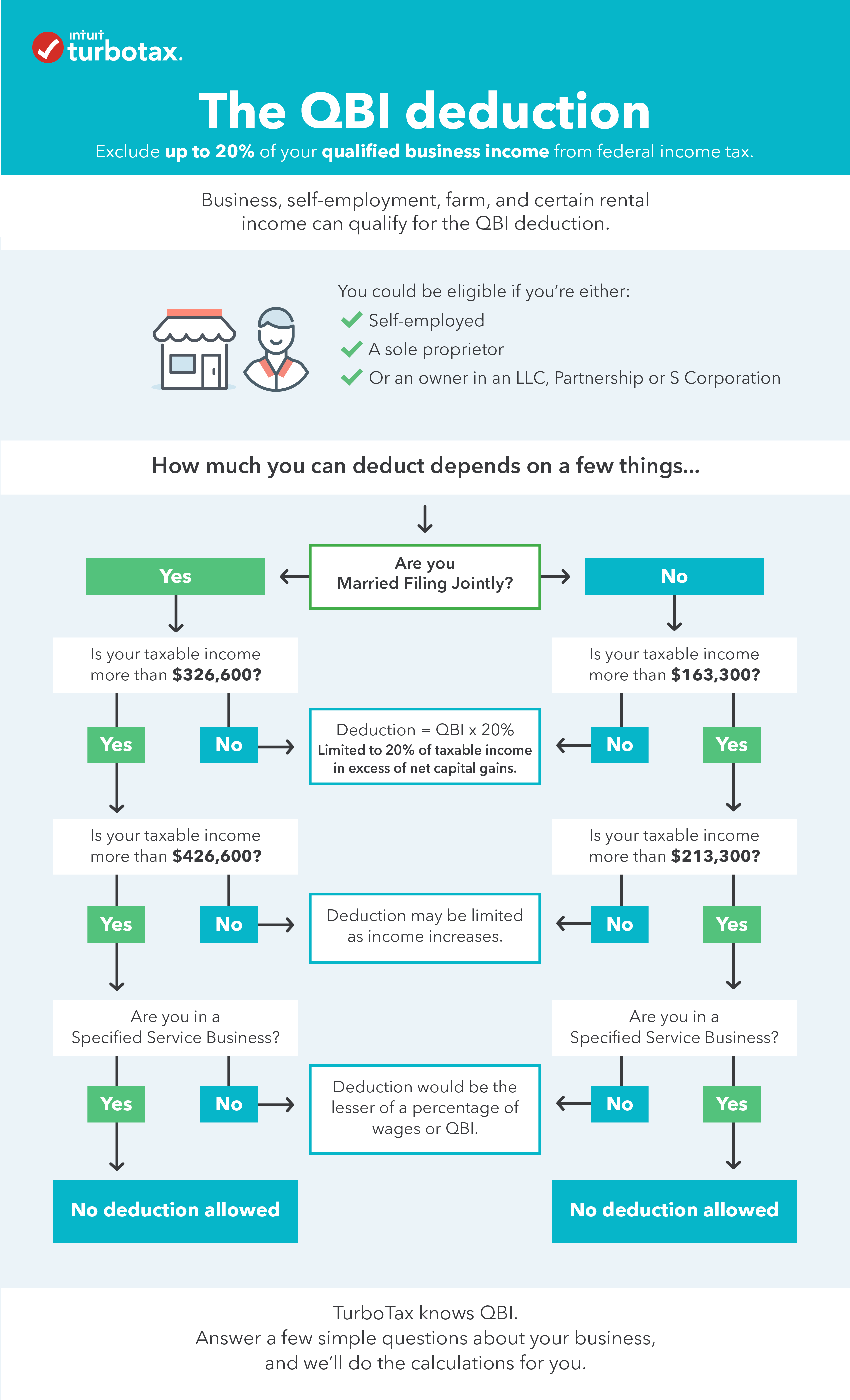

The safe harbor is just that. The IRS proposed a safe harbor earlier this year that would give owners or certain real estate interests the opportunity for a qualified business income QBI deduction. For more information on the safe harbor see Notice 2019-07 PDF.

This election will print with the government copy and will appear after the 1065 return. Simply stated this safe harbor rule makes the QBID available for rental real estate enterprises in which 250 or more hours of services are provided each year. This statement is required to be signed and then attached as a PDF to the e-filed return.

The IRS published Notice 2019-7 in January 2019. Go to Interview Form QBI-1 - Qualified Business Income Section 199A. It is not required to meet the safe harbor requirements to claim QBI as.

Taxpayers whose real estate business does not meet the safe harbor may still. The rental or licensing of tangible or intangible property to a related trade or business quali es if. See below Key Takeaways.