Stunning T4rsp Statement Of Rrsp Income

Annuitant and beneficiary is one and the same person Form 8891 and the general instructions for.

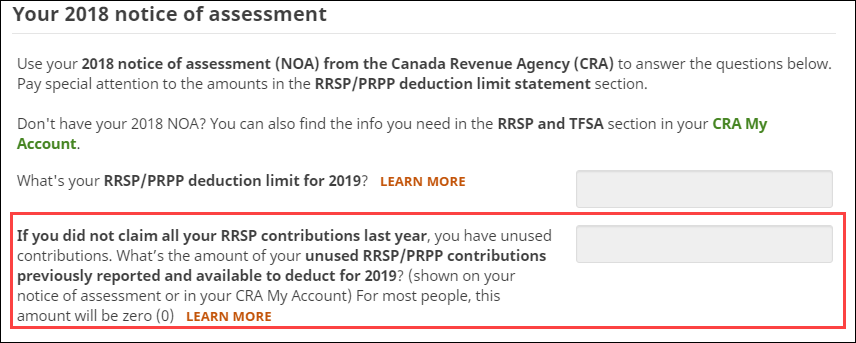

T4rsp statement of rrsp income. Reported including RRSP contribution receipts Canadian tax slips T4RSP T4RIF or NR4 and periodic or annual statements issued by the custodian of the RRSPRRIF. When you withdraw money from an RRSP the administrator of the RRSP has to fill out a T4RSP slip to indicate the amount of the withdrawal and the income tax that you paid on that amount. The amount entered as Annuity If 65 or older or due to death of spouse qualifies for the eligible pension income amount in the calculation of non-refundable tax credits while the amount entered as.

Statement of RRSP income. If your spouse also contributes to an RRSP you will file two IRS Forms 8891 along with your 1040. When you withdraw money from an RRSP the administrator of the RRSP has to fill out a T4RSP slip to indicate the amount of the withdrawal and the income tax that you paid on that amount.

Filling out a T4RSP slip The costs associated with redeeming units of a mutual fund are RRSP expenses. Statement of Investment Income Reports. Youll receive a T4RSP.

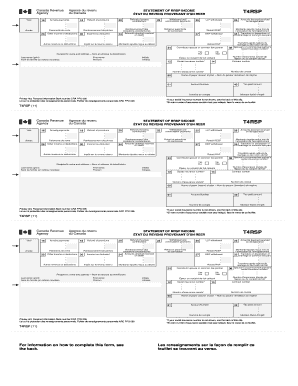

STATEMENT OF RRSP INCOME T4RSP 11 T4RSP Year 20 Refund of excess contributions 22 Withdrawal and commutation payments 25 LLP withdrawal 28 Other income or deductions 30 Income tax deducted 26 Amounts deemed received on deregistration 16 Annuity payments T4RSP 1 18 Refund of premiums 34 Amounts deemed received on death 27 HBP withdrawal Agence du revenu du Canada. A T4RSP slip also shows the amount you took out from an RRSP under the Home Buyers Plan andor the Lifelong Learning Plan as well as any amount transferred from an RRSP to a spouse or common-law partner due to a marriage or partnership breakdown. If the proceeds of the RRSP are reduced by such redemption fees the amount to be reported on the T4RSP slip is the net amount paid out of the RRSP.

Fill out boxes 16. If you make a withdrawal from your RRSP you will receive a T4RSP. T4RSP Statement of RRSP Income Notice to the reader All information returns should be filed electronically to avoid the delays that may occur in processing paper returns.

An investor or have an RRSP T4RSP. If youre a resident of Québec youll receive a Relevé 2 RL-2 slip instead. The slip will have the amount you withdrew in box 27 or box 25.