Great Types Of Assets Liabilities And Equity

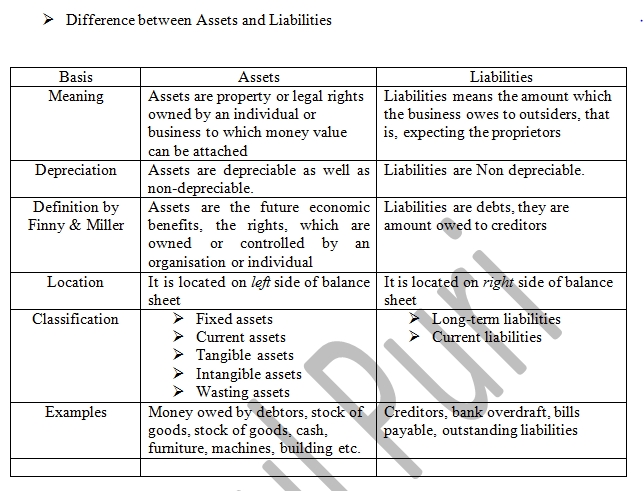

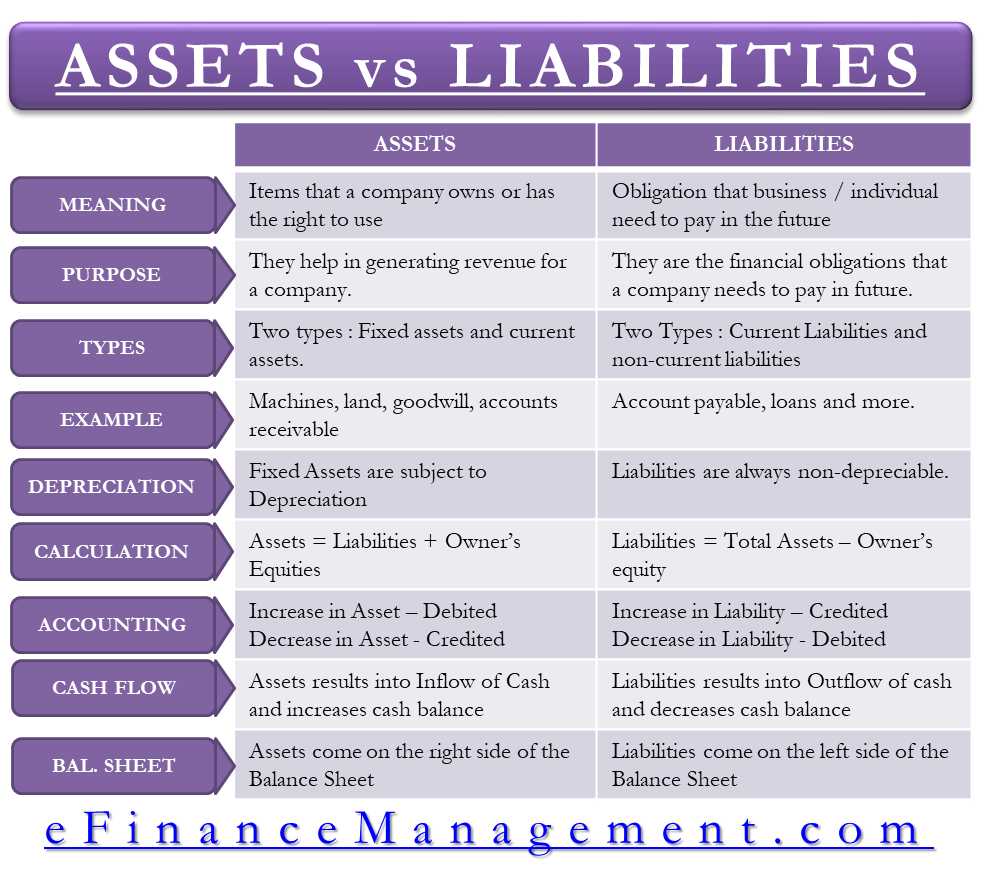

Something we owe to a non-owner.

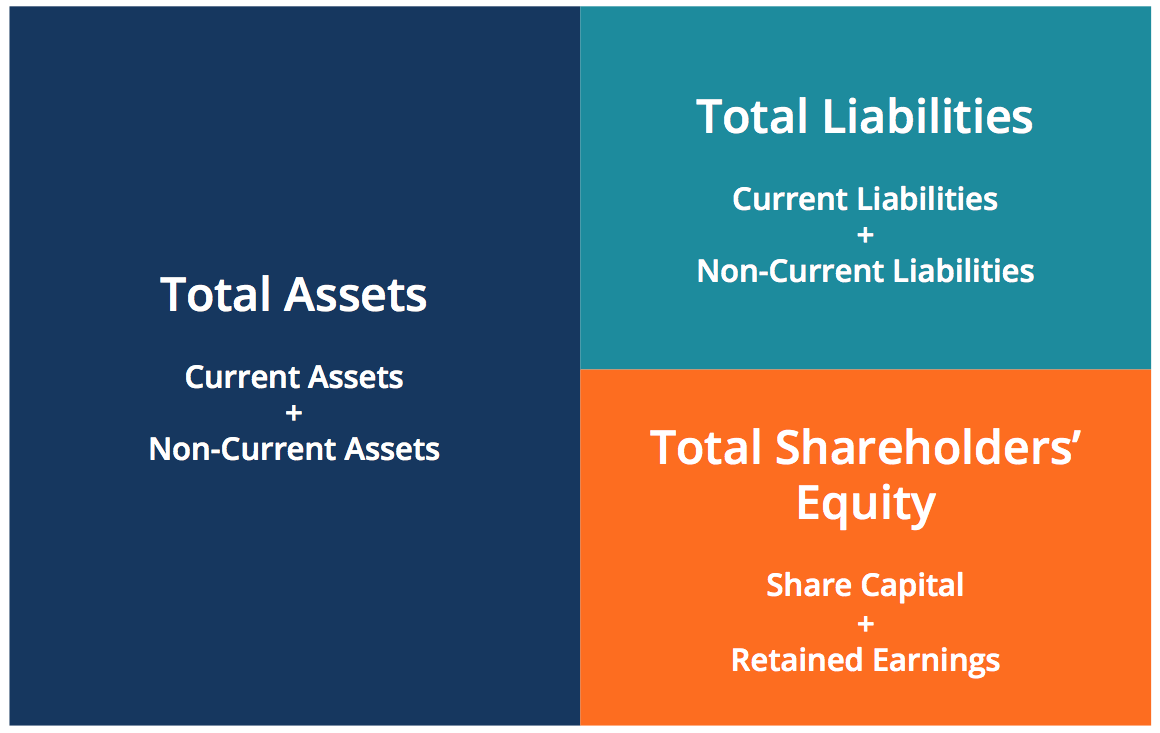

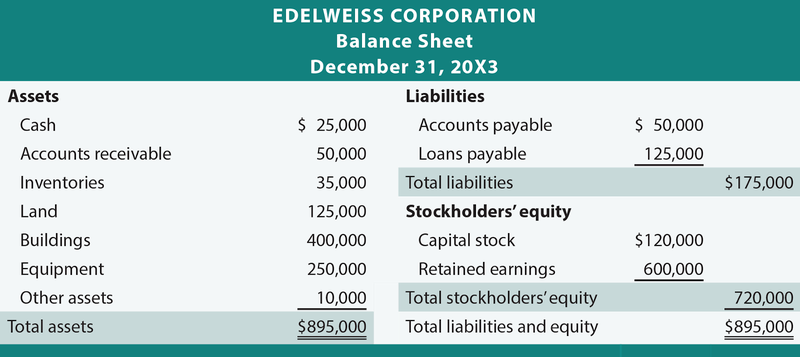

Types of assets liabilities and equity. In this case the equity would be 10. There are three parts to the balance sheet. But thats not the only kind of equity.

Assets are any items of value that your business owns. Something we owe to the owners or the value of the investment to the owner. This is probably where you come in as an investor.

Bob Iger Teaches Business Strategy and Leadership. A companys total liabilities are the combined debts and obligations owed to other parties. Examples of assets include cash accounts receivable inventory prepaid insurance investments land buildings equipment and goodwill.

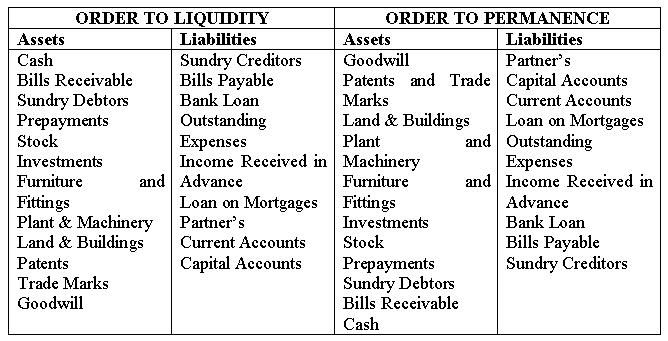

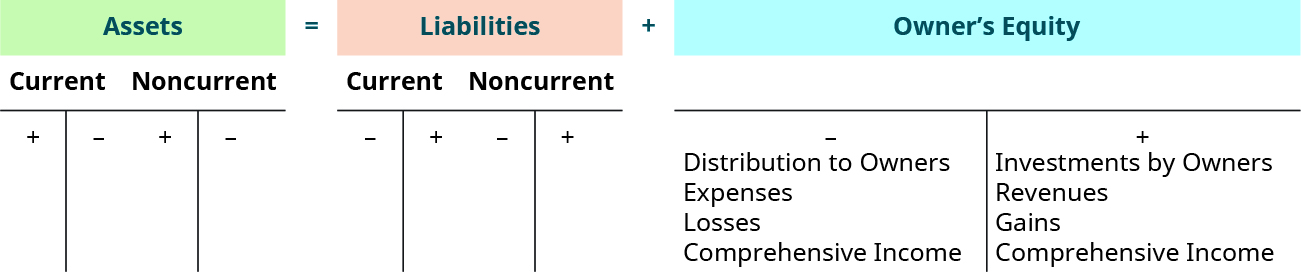

Do not include leased items in your assets. Long-term debt credit card debt machinery depreciation sales tax and income tax are all types of liabilities. Equity - Retained Earnings Equity - doesnt close Equity - closes Some equity accounts like Common Stock are carried forward from year to year.

For instance lets say a lemonade stand has 25 in assets and 15 in liabilities. Equity is the companys claim to business assets or property. The term liability signifies all types of account payables.

How much of a company someone owns in the form of shares. Assets Liabilities Equity. Total assets Liabilities accounts payable Owners equity.

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)