Fabulous Uses Of Trial Balance

Trial Balance aside from general ledger accounts is also useful to check the accuracy of special-purpose accounting books.

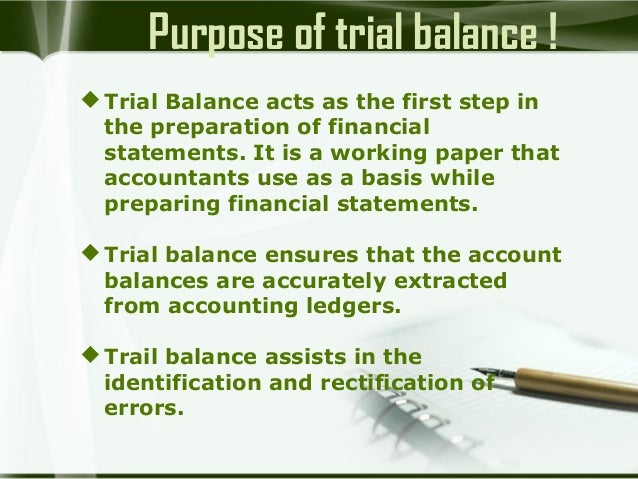

Uses of trial balance. The purpose of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced. Since it is anyhow prepared for a purpose it is put to some other uses like being used in the preparation of final accounts etc. Ad Get Your Trial Balance Template Download Print in Minutes.

To Detect and Correct Errors. Introduction to Unadjusted Trial Balance. Also one of the important purposes of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced.

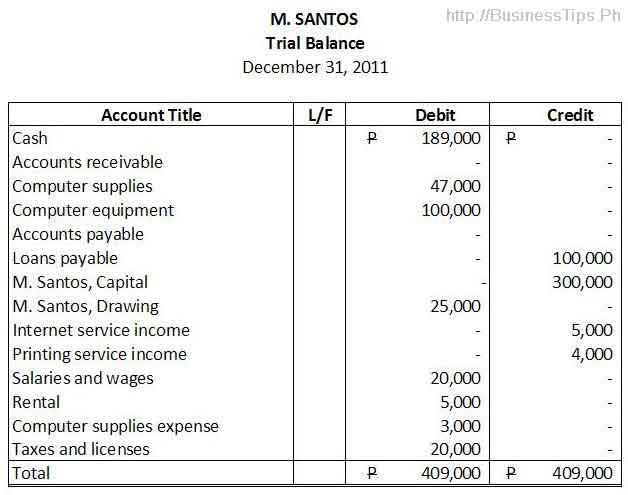

It helps to confirm that all debits are equal to credits and also to identify errors if any. If all the transactions for an accounting period are accurately recorded the sum of the debit balances of the trial balance should be equal to the sum of the credit balances. The trial balance is used to verify the actual amount entered on the right side of the current account while migrating the figures from various ledger books like purchase books sales books cash books etc.

An unadjusted trial balance is a list of all the general ledger balances without making any adjustment entries. A trial balance can be used as a decision tool to ensure the mathematical accuracy of the journal entries and ledger balances. Uses Of Trial Balance A trial balance is useful in preparing financial statements.

Ad Get Your Trial Balance Template Download Print in Minutes. Only the closing balances of the accounts are shown in trial balance. This is the only main purpose of the Trial Balance.

Your trial balance is an accounting report that contains your general ledger account balances in debit and credit columns. It contains debit column for debit balance of accounts and credit column for credit balances of accounts. Trial Balance - Purpose A trial balance is prepared to check the mathematicalarithmetic accuracy of accounting.