Looking Good Asc 740 Accounting For Income Taxes

Using the electronic feedback form on the FASB.

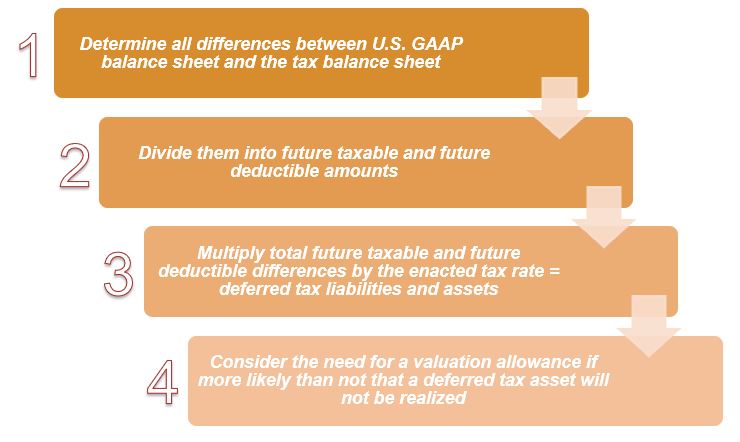

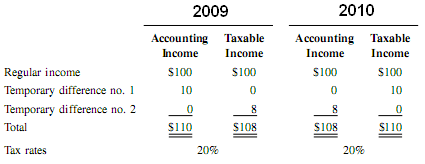

Asc 740 accounting for income taxes. This April 2021 edition incorporates. ASC 740-10 notes the following. The asset and liability method places emphasis on the valuation of current and deferred tax assets and liabilities.

As a result of the implementation the Company recognized approximately a 200 million increase in the liability for unrecognized tax benefits. This KPMG handbook is designed to assist you in understanding the application of ASC 740 and other pertinent sections of the FASB standard. Our publication summarizes the guidance in Accounting Standards Codification 740 on accounting for and reporting on the effects of income taxes that result from an entitys activities during the current and preceding years and provides EY s interpretative guidance including guidance on how to.

Some of these differences may create practical issues for dual reporters. ASU 2019-12 includes eight simplifications to ASC 740 which are outlined in the alert. A reconciliation of the beginning and ending amount of unrecognized tax benefits follows.

GAAP specifically ASC Topic 740 Income Taxes requires income taxes to be accounted for by the assetliability method. This Subtopic also provides accounting guidance for the related income tax effects of individual tax positions that. Understand the fundamentals for how US GAAP requires companies to book income tax expense under ASC 740.

Some GAAP differences are long-standing but other nuances are emerging as the accounting issues around US tax reform are resolved. While the scope of ASC 740 appears to be self-explanatory the unique characteristics of different tax regimes across the United States and the world can make it difficult to determine whether a particular tax is based on income. Individuals can submit comments in one of three ways.

The Boards asset and liability approach to accounting for income taxes for annual periods is a discrete approach that requires all tax accounts to be re-measured each annual reporting date APB Opinion 28 as amended by SFAS 109 ASC 740-270 rejects the discrete approach to interim reporting whereby the results of operations. If income taxes paid by the entity are attributable to the entity the transaction should be accounted for consistent with the guidance for uncertainty in income taxes in Topic 740. The tax or benefit related to ordinary income or loss shall be computed at an estimated annual effective tax rate and the tax or benefit related to all other items shall be individually computed and recognized when the items occur.