Amazing Treatment Of Depreciation In Cash Flow Statement

The straight-line method of depreciation will result in depreciation of 1000 per month 120000 divided by 120 months.

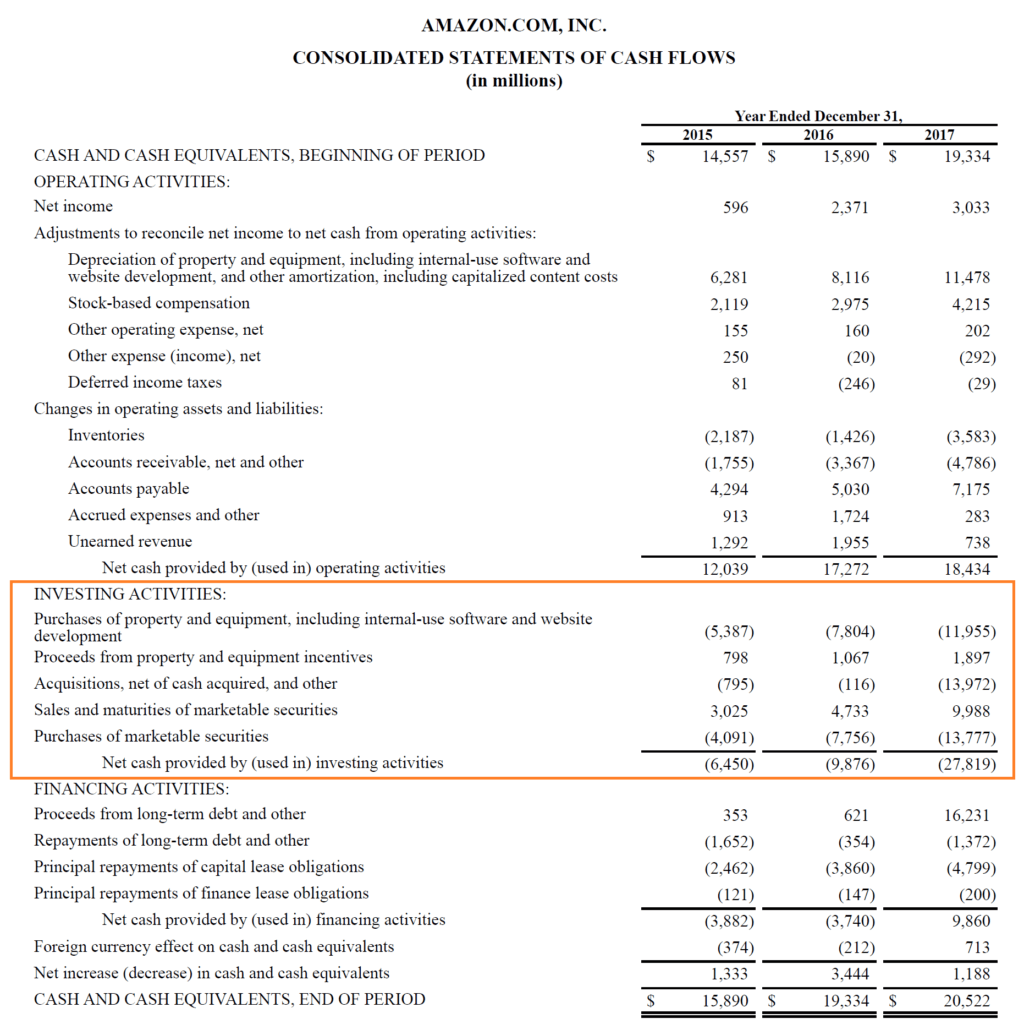

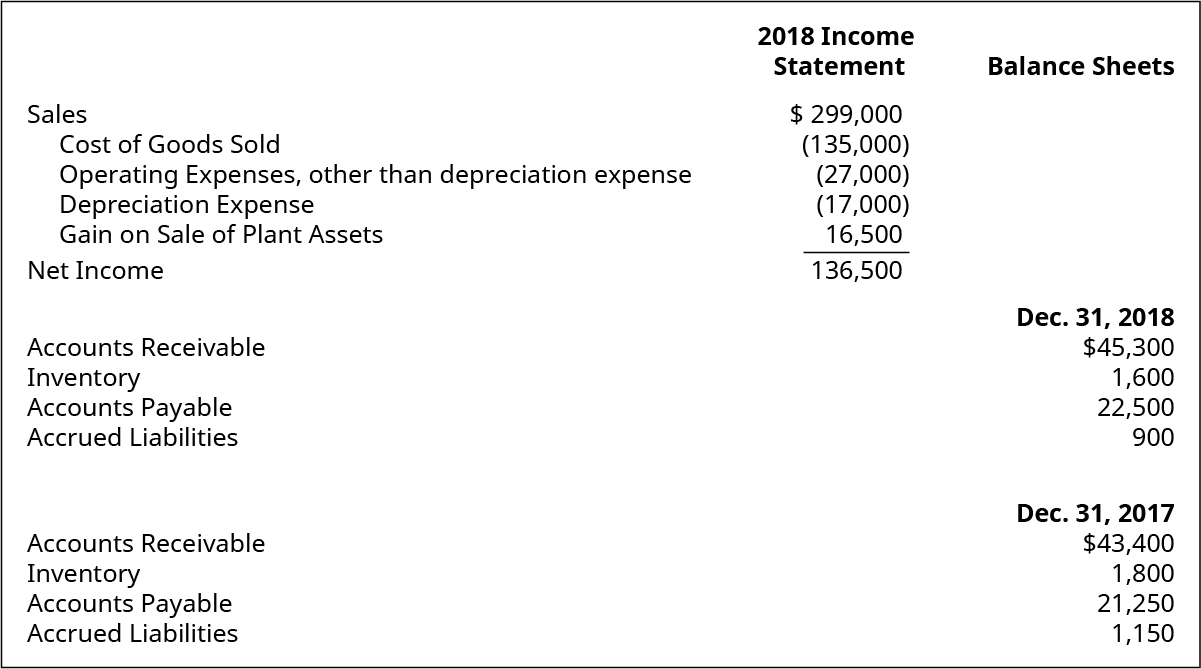

Treatment of depreciation in cash flow statement. Your balance sheet now reads machining equipment 50000 depreciation 5000 for a net asset value of 45000. Reduces profit but does not impact cash flow it is a non-cash expense. The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in.

Fixed assets are recorded at original acquisition costs in the balance sheet and accumulated depreciation shown below the. However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters. Cash dividend payments -2500 Proceeds from issuance of note payable 13000 Proceeds from issuance of stock 4000 Cash flows from financing activities 14500 Net Cash Flow -10000.

Cash paid for fixed assets -46000 Cash flow from financing activities. If its a provision for doubtful debts or for depreciation then no they wont appear as line items in the statement of cash flows. The monthly journal entry to record the depreciation will be a debit of 1000 to the income statement account Depreciation Expense and a credit of 1000 to the balance sheet contra asset account Accumulated Depreciation.

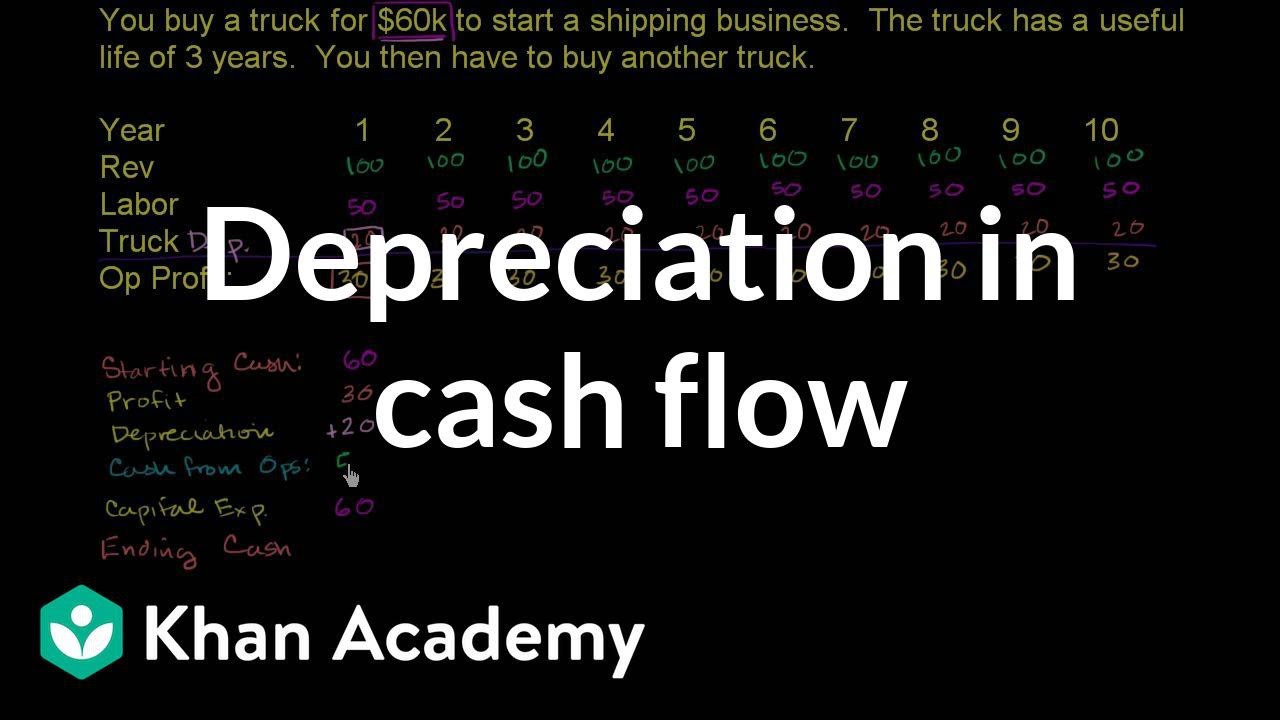

A Brief Overview of Depreciation. On a statement of cash flows depreciation is treated as an adjustment to income because depreciation. Question about this is an expense has already been deducted to eliminate it.

With the help of useful life of asset and the appropriate rate the depreciation needs to be calculated each year and is debited to Income Statement like any other operating expenses. Depreciation is found on the income statement balance sheet and cash flow statement. Depreciation can only be presented in cash flow statement when it is prepared using indirect method.

Now the original purchase of the asset would have resulted in a cash outflow which means that overall the positive impact of depreciation on cash flow is cancelled out by the original payment. Depreciation can be somewhat arbitrary which causes the value of. A is a direct source of funds.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)