Formidable Bank Efficiency Ratio Comparison

Goldman Sachs Bank USA.

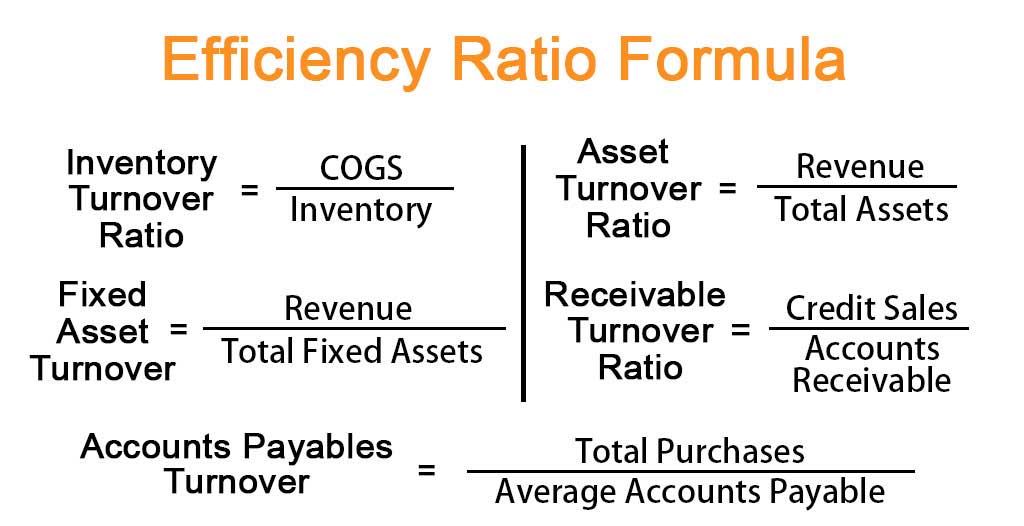

Bank efficiency ratio comparison. Find Content Updated Daily for bank accounts comparison. Efficiency ratios are metrics that are used in analyzing a companys ability to effectively employ its resources such as capital and assets to produce income. Home Federal Bank of Hollywood.

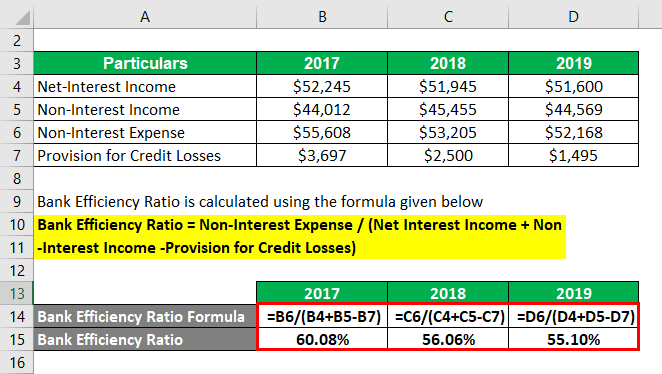

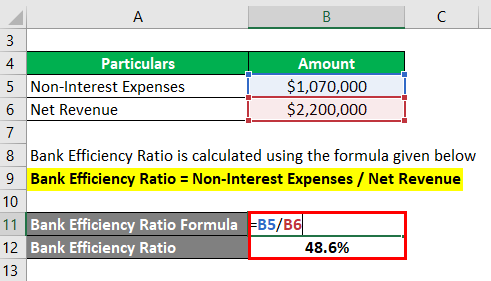

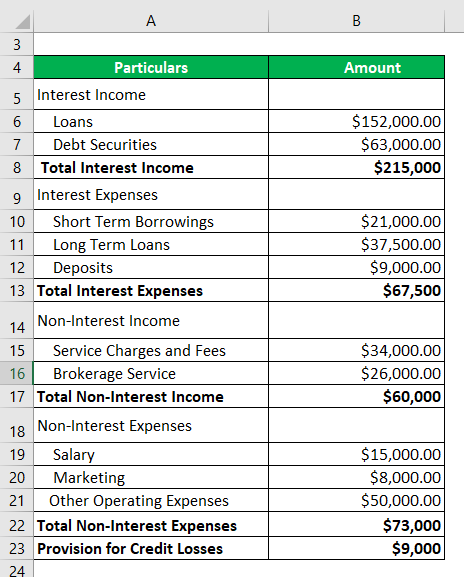

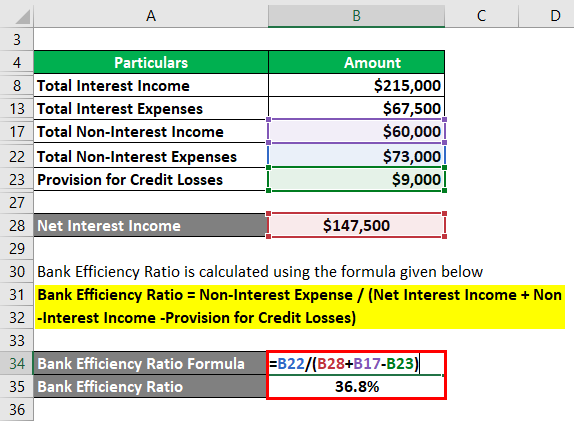

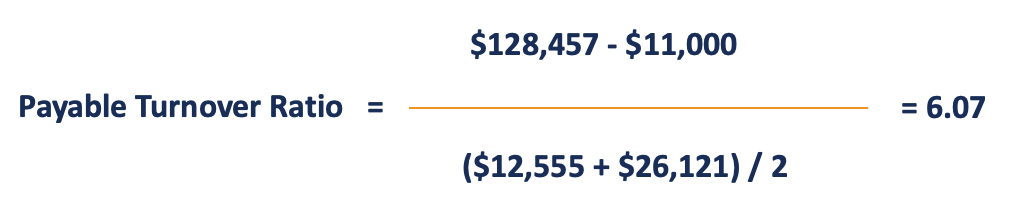

The formula for the efficiency ratio is. Banking Financial Ratios. Three types of operating ratios may be used in analyzing the performance of banks.

In theory an optimal efficiency ratio is 50 which would mean 1 of expenses results in 2 of revenue. Compared to Banks with ROA average Banks with ROA average have Lower share of assets in Corporate Wholesale Banking. It is to be further noted that the variation among Islamic banks in respect of efficiency is more standard deviation 154.

For example for banks in the Federal Reserves Twelfth District the aggregate efficiency ratio of 56 percent is nearly 55 percentage points lower than the aggregate efficiency ratio for all banks nationwide. Efficiency ratios have spiked in. Operating asset ratios operating income ratios and operating equity ratios.

Bank Topline reports 50 in expenses and 125 in revenue in its most recent quarter. To determine efficiency divide the number of company-wide bank employees by the total number of investment banking employees at the same point in time expressed as a. The efficiency ratio assesses the efficiency of a banks operation by dividing non-interest expenses by revenue.

Of 71 while those clocking a higher PB ratio of 277 reflect a much higher mean ROA at 144. Riverside Bank of Dublin. U Loans to banks and customers stood at 2335bn which has ticked up marginally half on half but is still 14 lower than what it was at the end of 2009.