Simple Retained Earnings Formula Balance Sheet

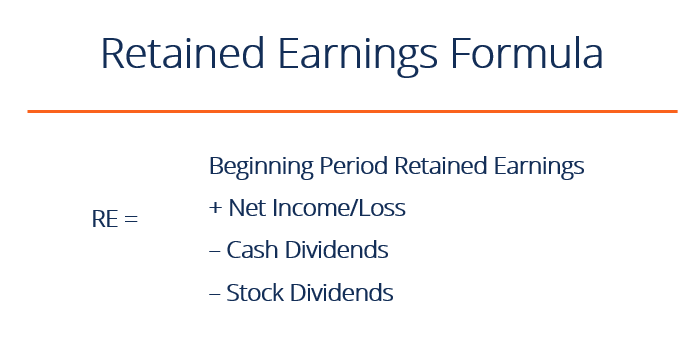

Retained Earnings End RE Beginning Net Income Dividends.

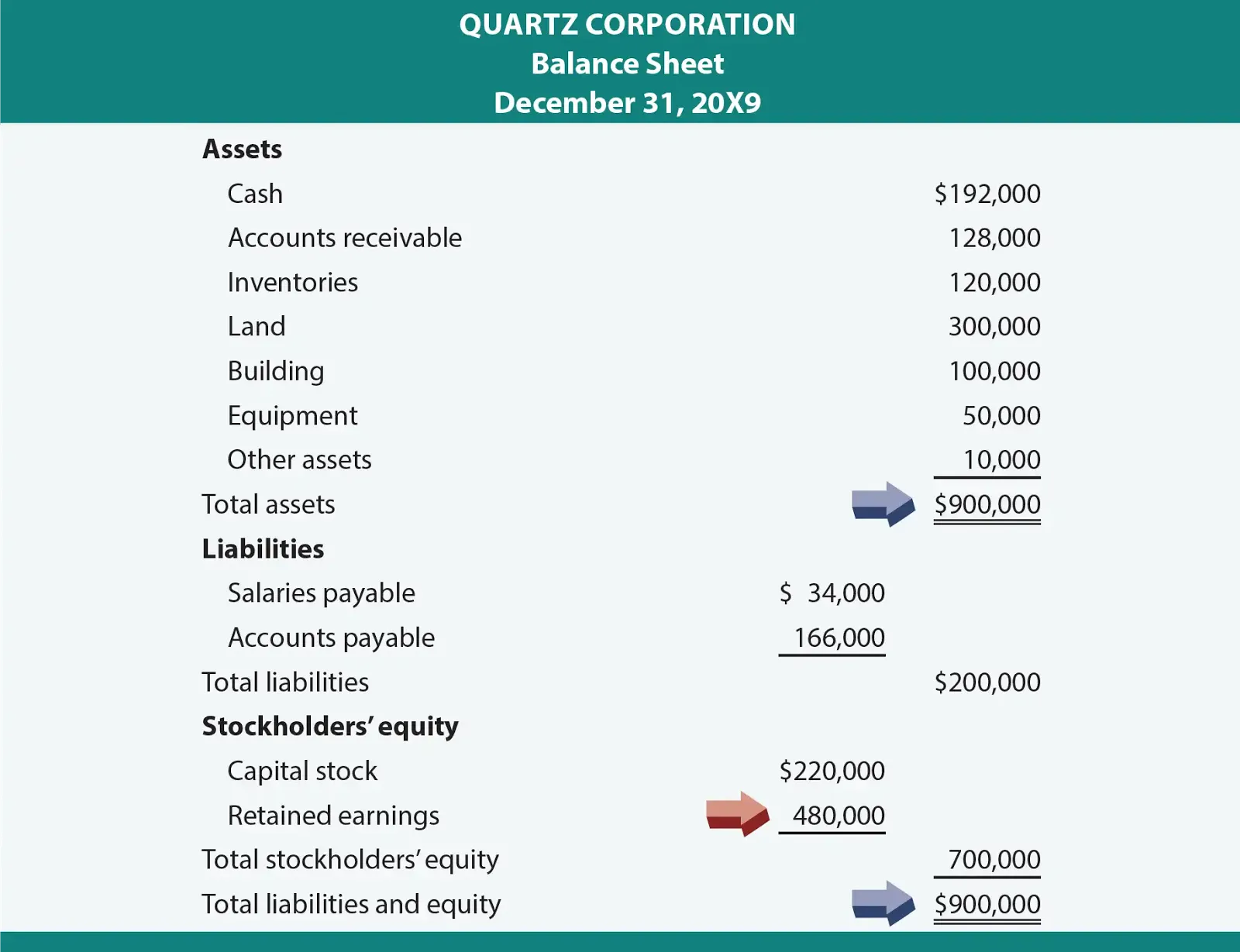

Retained earnings formula balance sheet. Calculation of retained earnings. It is shown as the part of owners equity in the liability side of the balance. When all the financial statements are prepared at the end of the period a journal entry is made to move the amount on the RE account to the RE.

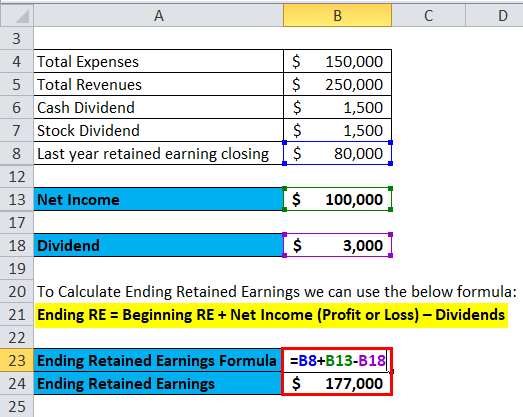

To calculate RE the beginning RE balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted. The formula for Retained Earnings posted on a balance sheet is. The formula for retained earnings is RE 1 RE 0 NI D RE 1 net income at the end of the reporting period.

This is when expenses exceed revenues. The formula for Retained Earnings posted on a balance sheet is. How to calculate retained earnings The retained earnings formula is fairly straightforward.

Retained earnings are calculated by adding the current years net profit if its a net loss then subtracting the current period net loss to or from the previous years retained earnings which is the current years retained earnings at the beginning and then subtracting dividends paid in the current year from the same. Instead it is retained for investments in working capital andor fixed assets as well as to pay down any liabilities outstanding. Warren Buffet recommended creating at least 1 in market value.

Retained Earnings are reported on the balance sheet under the shareholders equity section at the end of each accounting period. Calculating retained earnings from the balance sheet is a two-step process. Retained earnings can be negative if the company experienced a loss.

When earnings are retained rather than paid out as dividends they need to be accounted for on the balance sheet. The period beginning retained earnings is a cumulative balance of all the retained earnings. How do you calculate retained earnings on a balance sheet.