Glory Cash Flow Statement And Fund Flow Statement Deferred Tax Calculation Example Excel

Red dollar amounts decrease cash.

Cash flow statement and fund flow statement deferred tax calculation example excel. Offsetting cash inflows and outflows in the statement of cash flows 51. Statement of Cash Flows For the Fiscal Year Ended Aug. It is also righteous to say that a fund flow statement is prepared to explain the.

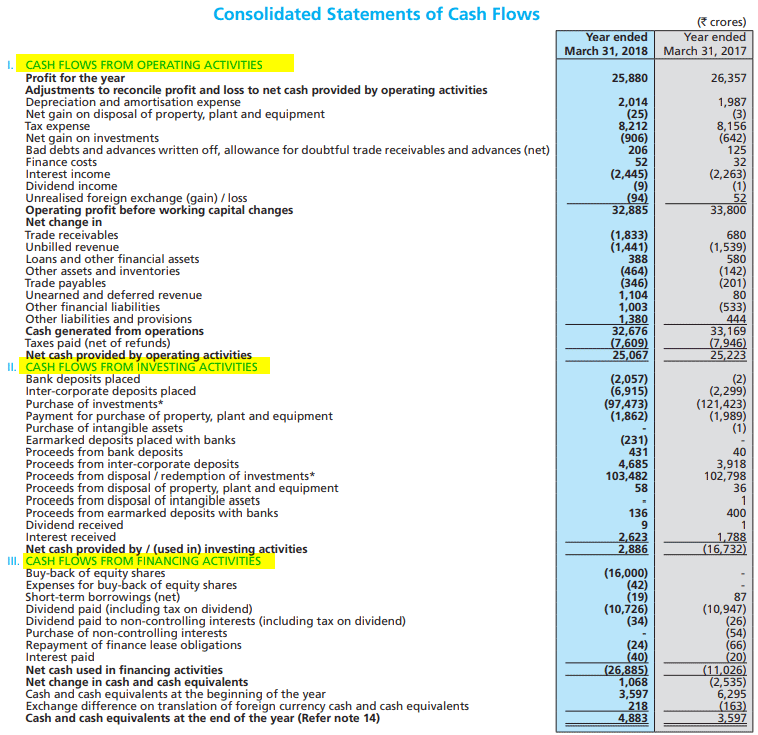

Depreciation and amortization Net cash from operating activities Deferred income taxes Cash flows from investing activities. A deferred tax asset arises when the carrying value of an asset is less than its tax base or carrying value of any liability is more than its tax base creating a deductible temporary difference. If I want to start a Cashflow of a particular year from PAT Whereas in the same I have a Deferred Tax Liability Could anyone help me how to go about it.

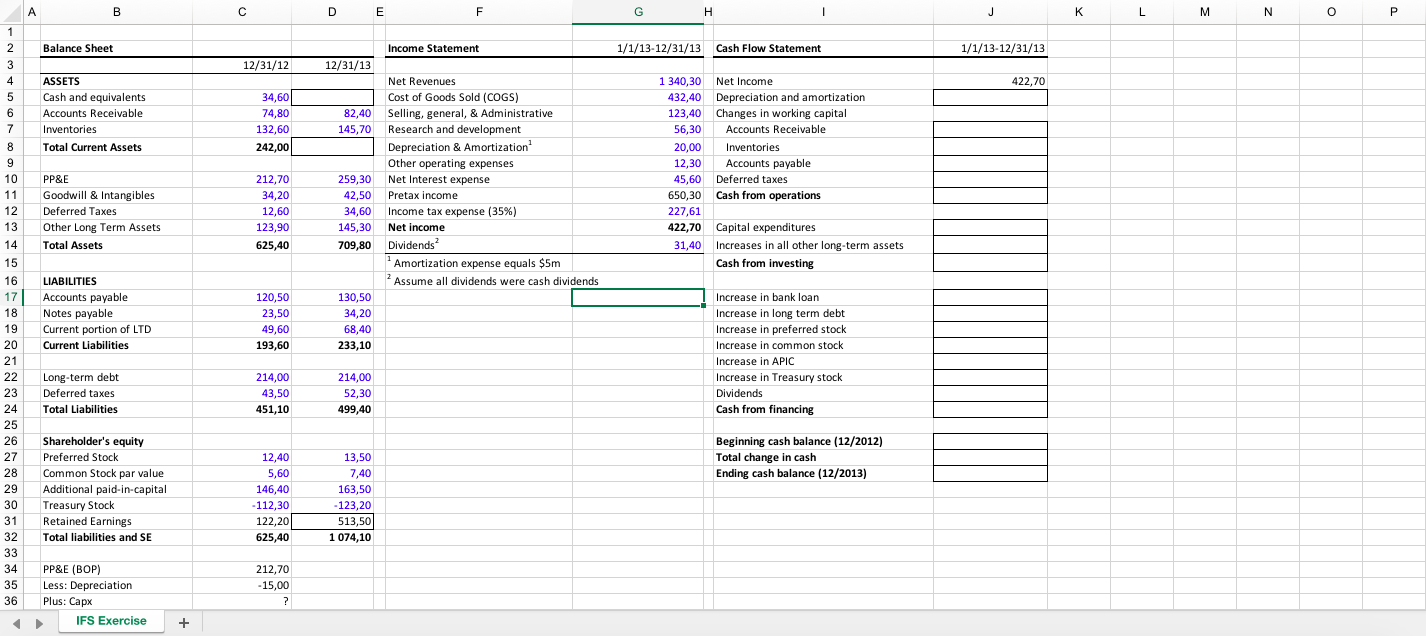

CASH FLOWS FROM OPERATING ACTIVITIES. Put both statement of cash flows in the same presentation currency next to each other and sum up. However taxable profits are rarely the same as financial accounting profits which gives rise to deferred taxes in financial statements.

Financial Modeling of Deferred Tax. Assuming only noncash items are Depreciation. Increase in Deferred Tax Assets Impact on Statement of Cash Flow SOCF In the operations section of the statement of cash flow we record the cash expenses and income.

A detailed calculation of this amount is included below the cash flow statement on the Direct sheet and at the top of the cash flow statement on the Indirect sheet. Similarly deferred tax is a non-cash item and shall be treated accordingly in the operating activities section of the cash flow statement. 40183756400 Increase Decrease in Deferred Outflows of.

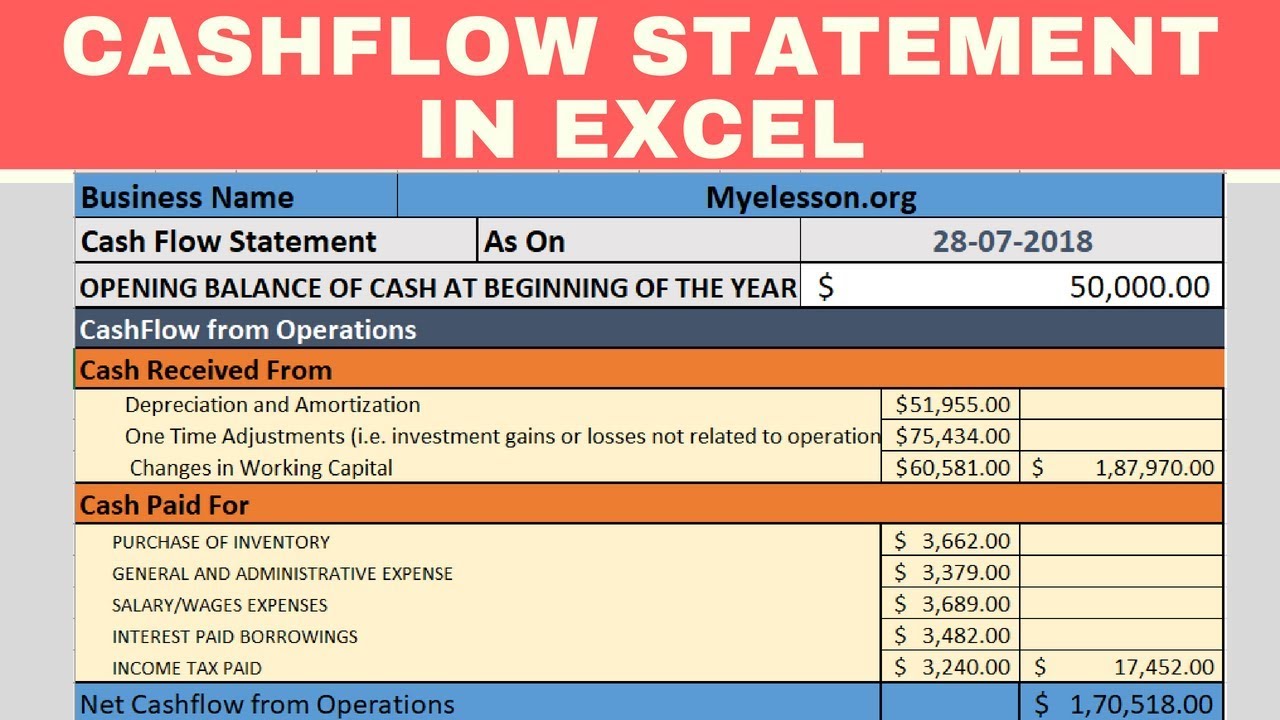

We begin by forecasting cash flows from operating activities before moving on to forecasting cash flows from investing and financing activities. It is one of the three major financial statements next. The cash flow statement records the cash-ins and cash-outs of a business in a certain period.