Matchless Llc Balance Sheet Equity Section

If you were to dispose of all the assets through a sale and pay off liabilities the money left over would be available for distribution to.

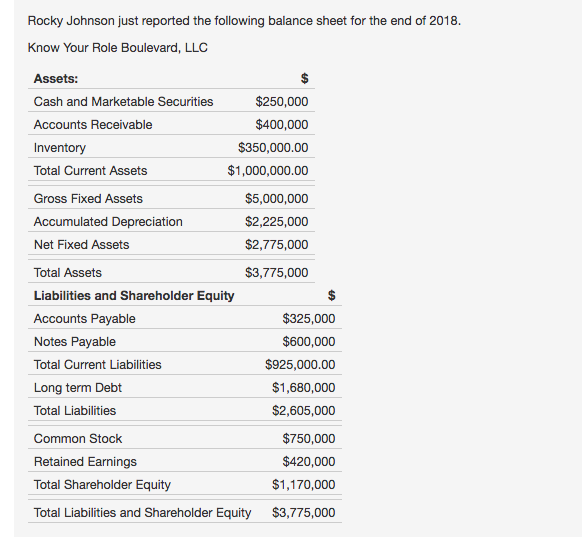

Llc balance sheet equity section. But what if the underlying entity is an LLC. Assets Liabilities Equity. Balance sheet is a representation of the financial position of an organization for specified date.

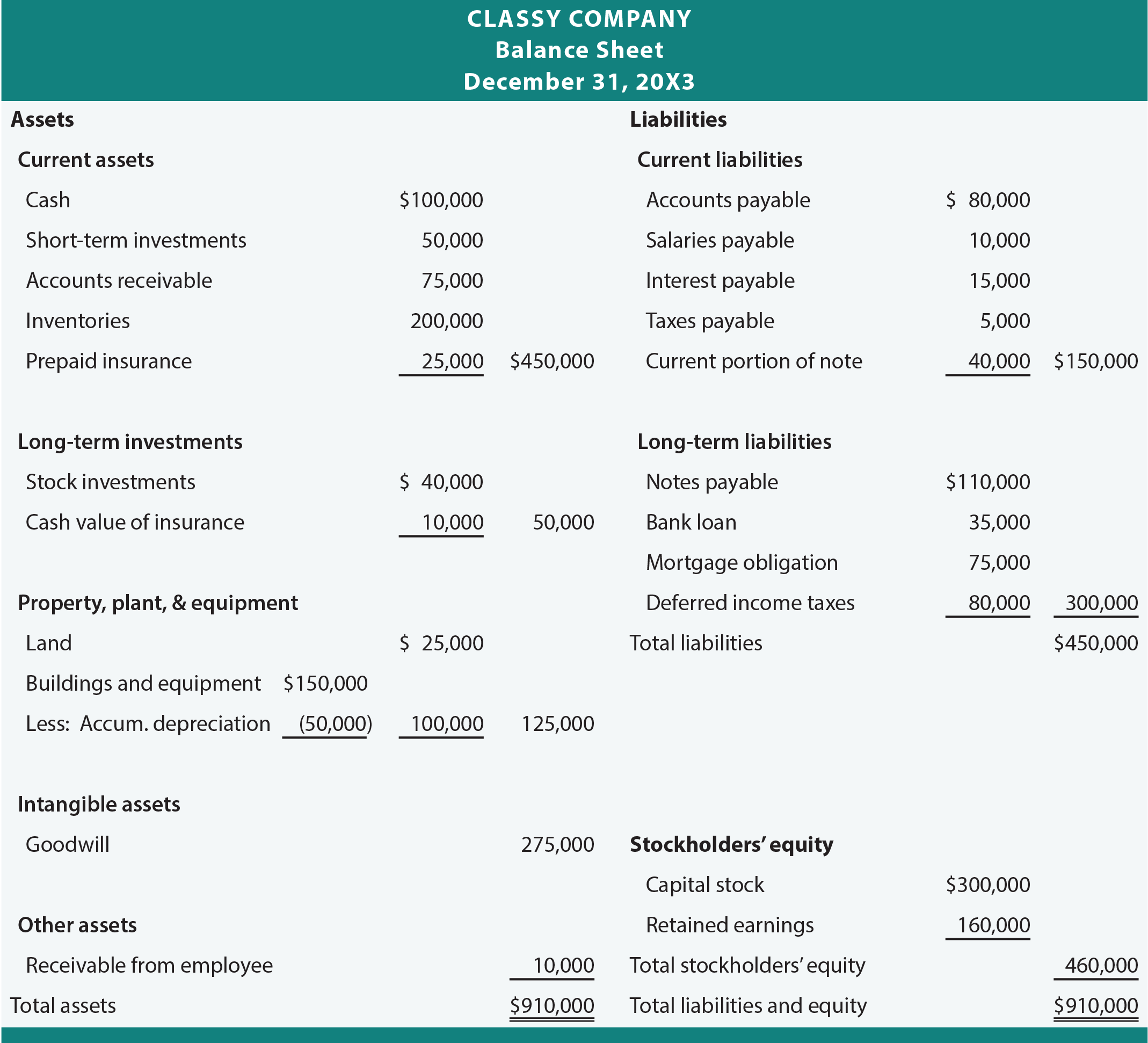

Customer lists contracts and the business name are all considered Section 197 intangibles and must be amortized over the course of 180 months 15 years beginning with the date you placed the assets in service. Repayment of Debt Wages Advertising Travel. The term Equity should not be confused with the actual titling within the equity section of a balance sheet.

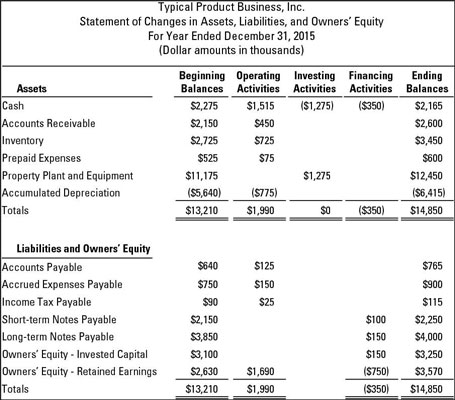

CASH FLOWS FROM FINANCING ACTIVITIES. This would be recorded as an intangible asset balance sheet account. Equity sections differ slightly between private companies limited liability companies LLCs and corporations.

If a business owns 10. I would present on the Balance Sheet Equity. CASH FLOWS FROM INVESTING ACTIVITIES.

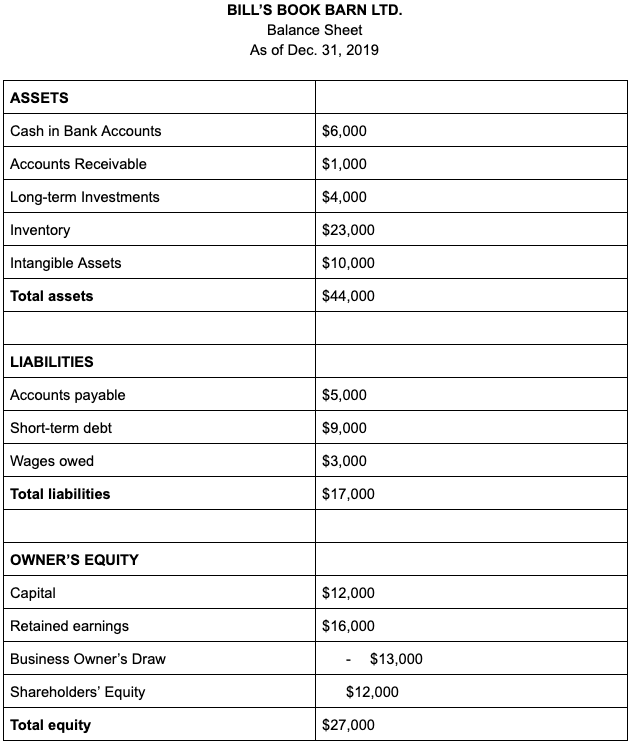

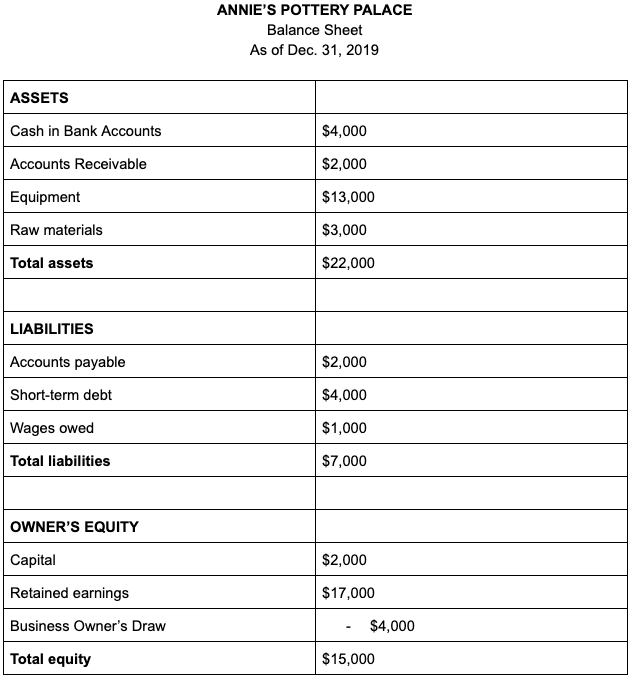

Assets - Liabilities Owners Equity So the simple answer of how to calculate owners equity on a balance sheet is to subtract a business liabilities from its assets. It is not an account. Owners equity sections can be divided into two main sub-divisions.

Once you have put money into the LLC your capital contribution and the contributions of other members are shown in the LLCs balance sheet as an equity ownership account. The amount may be reported as a single amount described as owners capital. It has liabilities and assets sides.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)