Peerless Financial Statements Not Prepared On A Going Concern Basis

Paragraph 14 of IAS 10 states that an entity shall not prepare its financial statements on a going concern basis if management determines after.

Financial statements not prepared on a going concern basis. IFRS does not provide guidance on the liquidation basis of accounting. Financial statements that fact shall be stated. If management concludes that the entity is not a going concern the financial statements should not be prepared on a going concern basis in which case IAS 1 requires a series of disclosures.

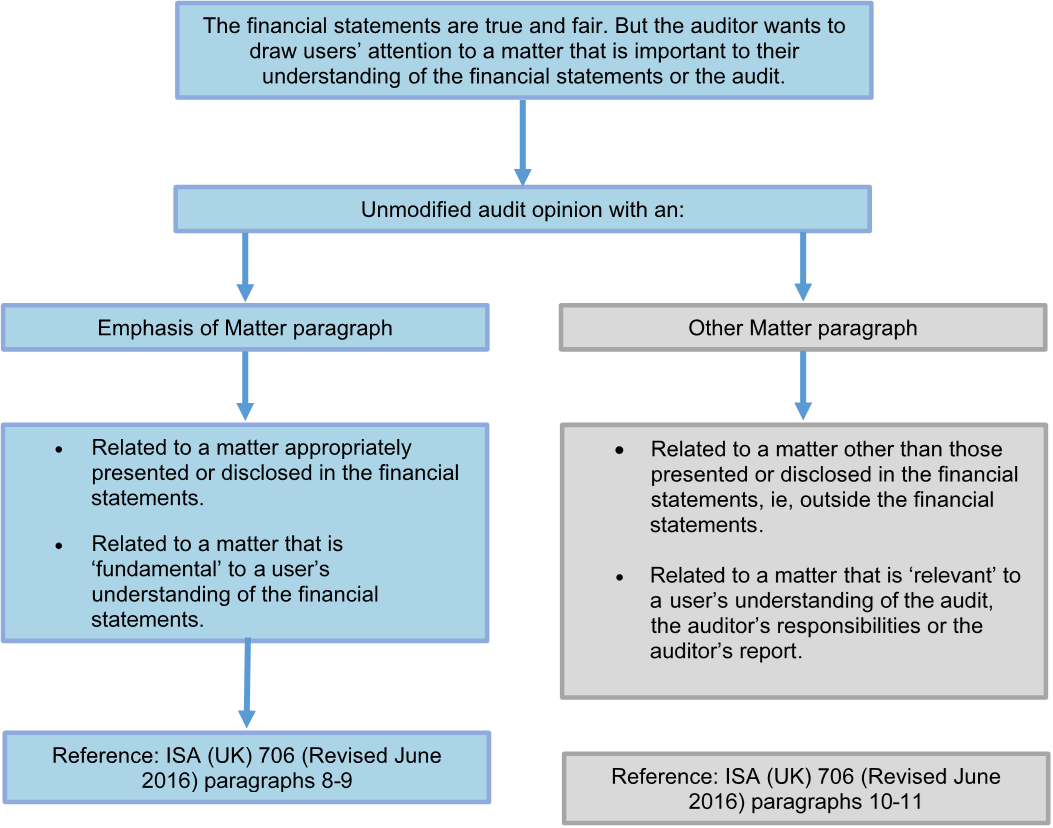

This guide is designed to explain the main changes that are needed to the audit report of a company where the financial statements are prepared on a basis other than going concern. When an entity does not prepare its financial statements on a going concern basis IFRS requires that the entity disclose the basis of preparation used. When an entity does not prepare financial statements on a going concern basis it shall disclose that fact together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern IAS 125.

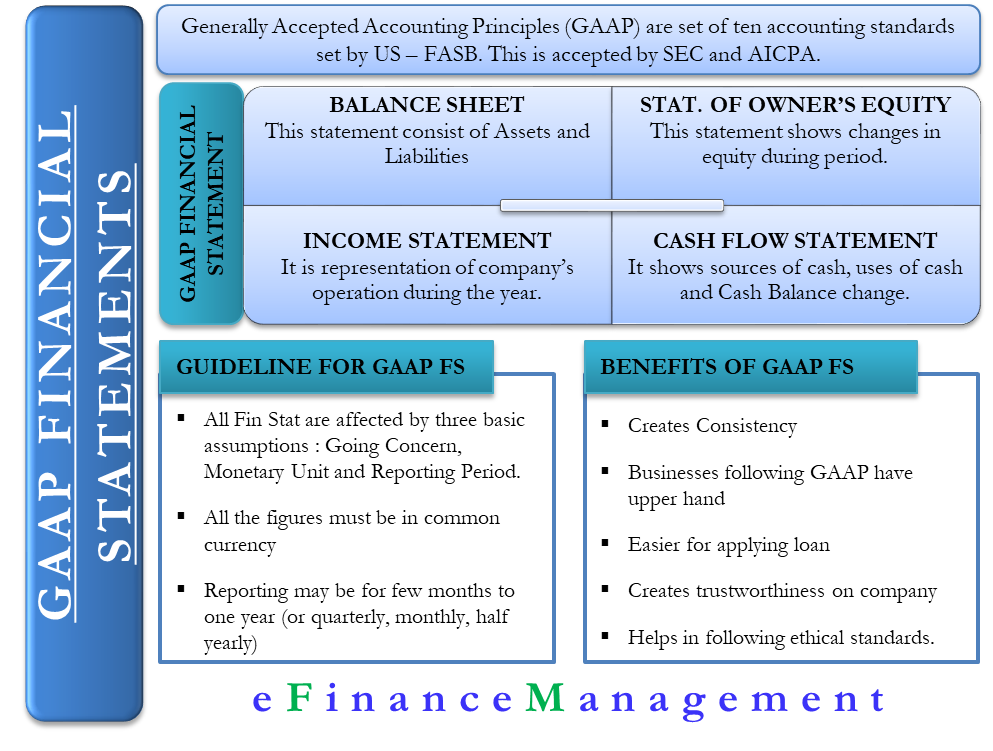

The problem is that IAS 1 does not tell us how to prepare the financial statements when going concern does not apply. When preparing financial statements management shall make an assessment of an entitys ability to continue as a going concern. A number of respondents said that preparing financial statements for prior periods on a non-going concern basis could be impractical requires undue cost or effort and might not provide useful information to users of the financial statements.

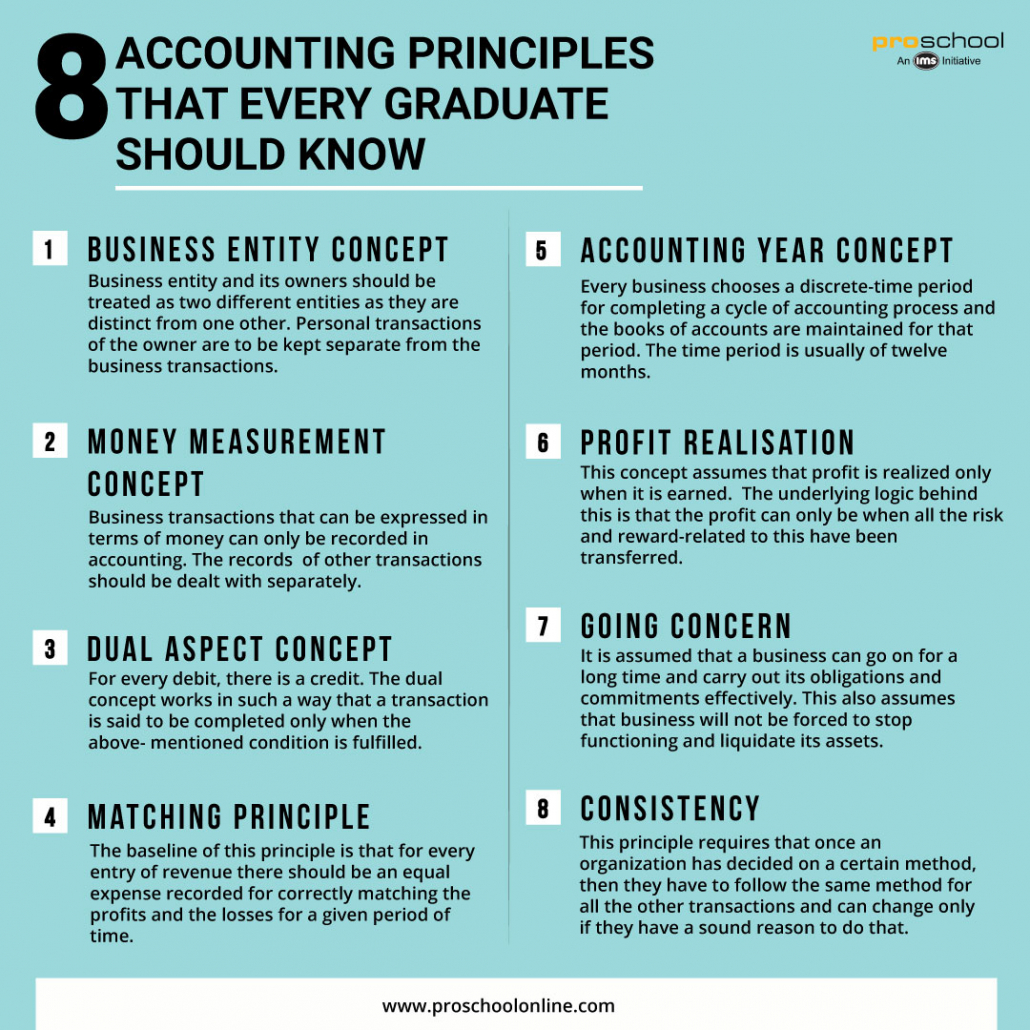

An entity shall not prepare its financial statements on a going concern basis if management determines after the balance sheet date that it either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so. An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so. An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so.

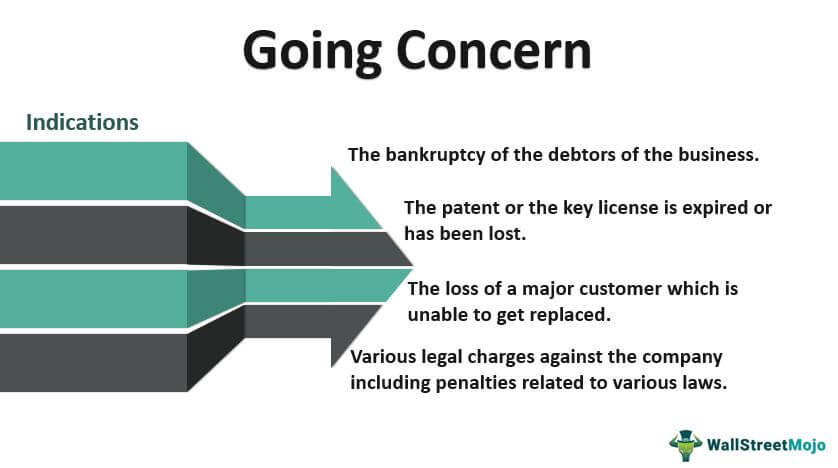

If management has significant concerns about the entitys ability to continue as a going concern the uncertainties must be disclosed. If the financial statements have been prepared on a going concern basis but in the auditors judgment the use of the going concern assumption in the financial statements is inappropriate ISA UK 570 requires the auditor to express an adverse opinion. Under GAAP an entity applies the going concern basis of.

An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so. An entity shall not prepare its financial statements on a going concern basis if management determines after the reporting period either that it intends to liquidate the entity or to cease trading or that it has no realistic alternative but to do so FRS 102 paragraph 327A only refers to the entity entering liquidation or ceasing to trade. When an entity does not prepare financial statements on a going concern basis it shall disclose that fact together with the.