Neat Normalizing Financial Statements

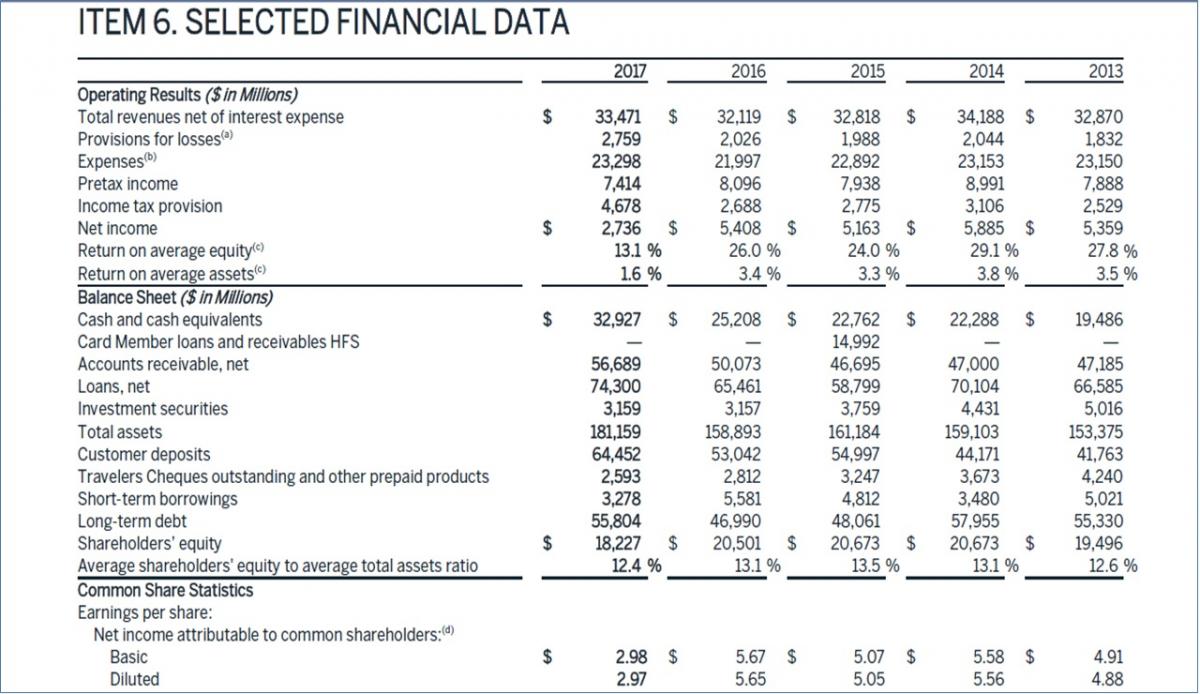

Normalization adjustments are intended to change certain financial data of a subject business to make the historical financial operations look like normal conditions so as to be on a consistent basis with comparable companies and what a prospective buyer might reasonably be expected to obtain from the company in the future using history as a guide.

Normalizing financial statements. The process is to remove non recurring expenses or revenue from a financial metric like the EBITDA Earnings before interst taxm depreciation and amortization. Normalizing unusual statements and their impact on the cash available for debt service allows you to analyze trends even when the information from your borrower includes anomalies. Normalizing Financial Statements for Business Valuation In order to assess the likely future performance of your business the financial statements must first be normalized to account for fluctuations in revenue gross profit percentages and expenses from year to year.

Normalization adjustments are meant to remove items appearing in the subject companys financial statements that are either unlikely to be repeated in the future or are unrelated to the companys business operations. Normalizing consists of adjusting revenues and expenses so that the financial statements reflect only what would be expected or normal for the business and the new owner. What is normalization.

Ad Find Financial Statements Form. It also allows the analyst to better measure true economic income assets and liabilities. Unusual nonrecurring or extraordinary items.

Normalizing adjustments are hypothetical and are not intended to present. Get detailed data on venture capital-backed private equity-backed and public companies. Once earnings have been normalized the resulting number represents the future earnings capacity that a buyer would expect from the business.

Normalizing consists of adjusting revenues and expenses so that the financial statements reflect only what would be expected or normal for the business and the new owner. Ad See detailed company financials including revenue and EBITDA estimates and statements. Objective The main objective for recasting or adjusting the financial statements of a closely held company can be stated as follows.

Normalized financial statements will allow the analyst to better compare the subject companys financial performance and position to similar companies or industry averages. Normalized financial statements will allow the analyst to better compare the subject companys financial performance and position to similar companies or industry averages. The first is that it allows the company to be compared to specific companies with a closely identical business model.

:max_bytes(150000):strip_icc()/dotdash_INV_final-How-to-Analyze-Netflixs-Income-Statement_Feb_2021-01-be96182dedd548c4a87f5167be805c64.jpg)

/dotdash_INV_final-How-to-Analyze-Netflixs-Income-Statement_Feb_2021-01-be96182dedd548c4a87f5167be805c64.jpg)