Peerless Formula For Comprehensive Income

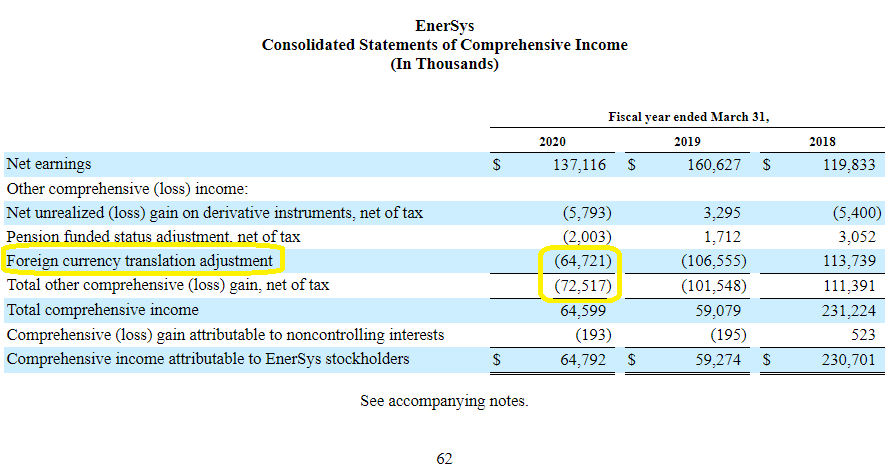

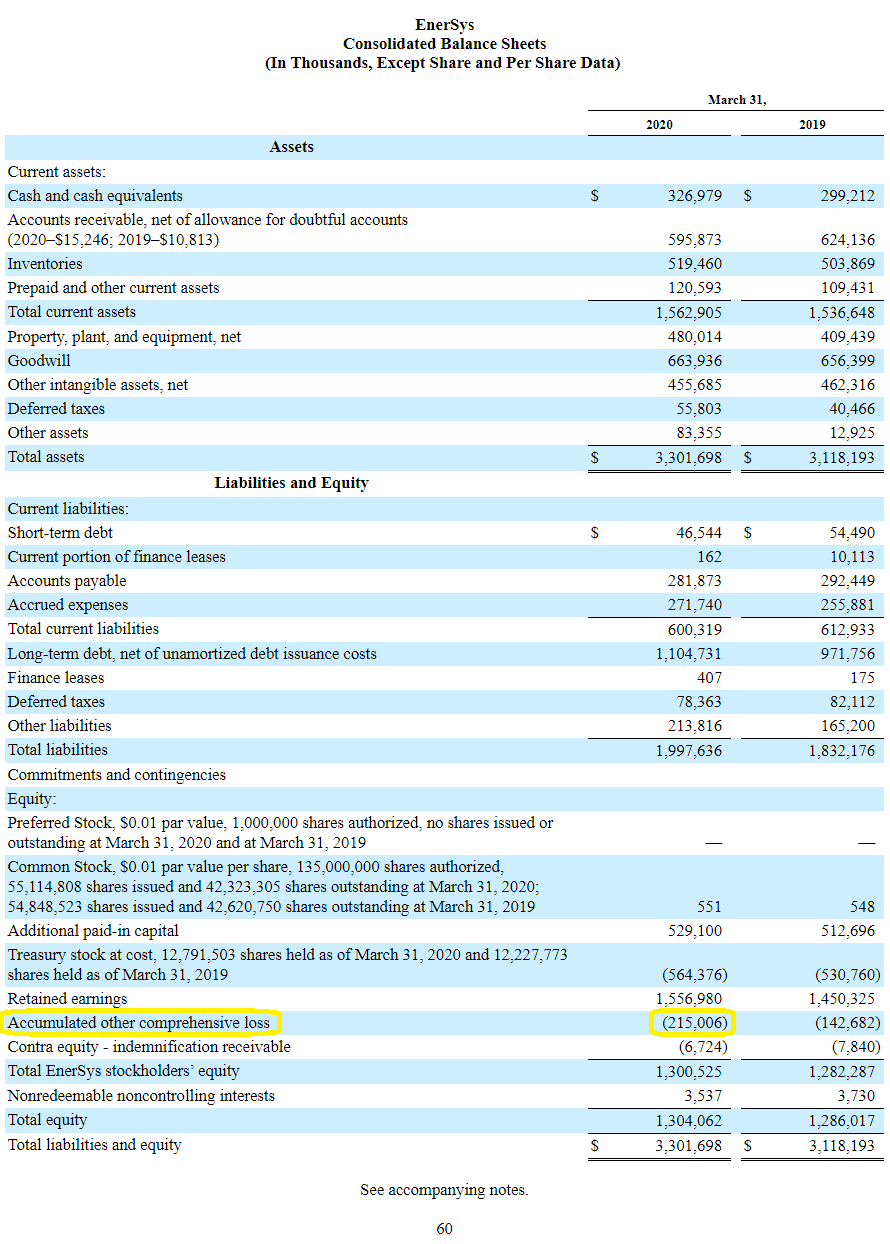

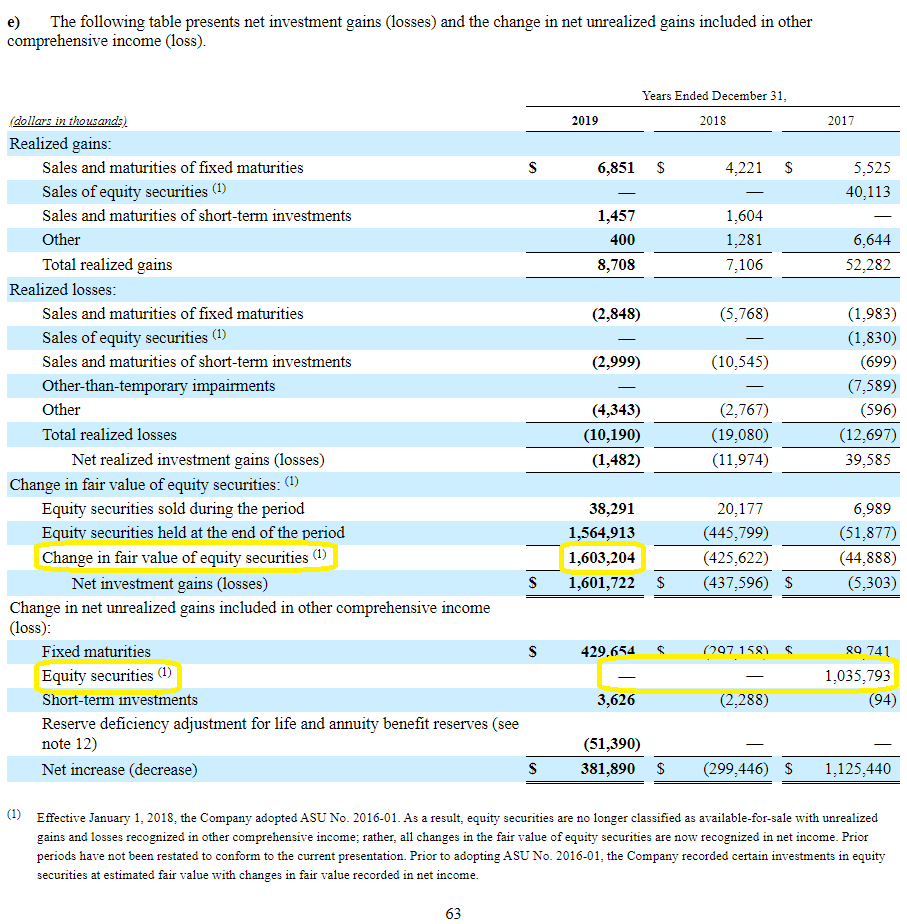

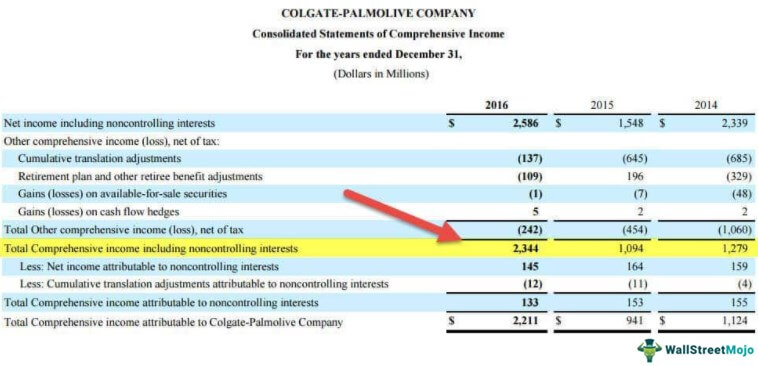

This number is then transferred to the balance sheet as accumulated other comprehensive income.

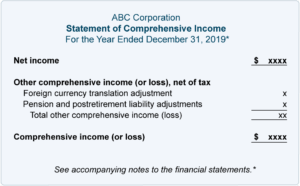

Formula for comprehensive income. Whereas other comprehensive income consists of all unrealized gains and losses on assets that are not reflected in the income statement. Profit or loss is determined once all the expenses of the company. Comprehensive Income Formula Use the following comprehensive income formula.

The net income is transferred down to the CI statement and adjusted for the non-owner transactions we listed above to compute the total CI for the period. Realized holding gains and losses on available-for-sale securities. Besides using the basic formula of determining.

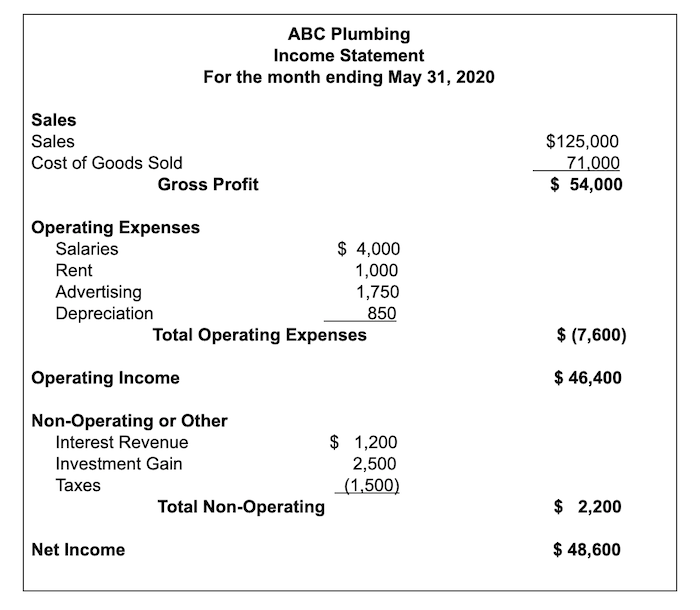

Which of the following is least likely an item that is treated as other comprehensive income. Comprehensive Income Gross Profit Margin Operating Expenses - Other Income items - Discontinued Operations add if savings subtract if loss. A single statement or.

It is a more robust document that often is used by large corporations with investments in multiple countries. Comprehensive income for a corporation is the combination of the following amounts which occurred during a specified period of time such as a year quarter month etc. In addition using the basic formula of determining comprehensive income provides an easy to understand snapshot of how the company has fared since the last analysis.

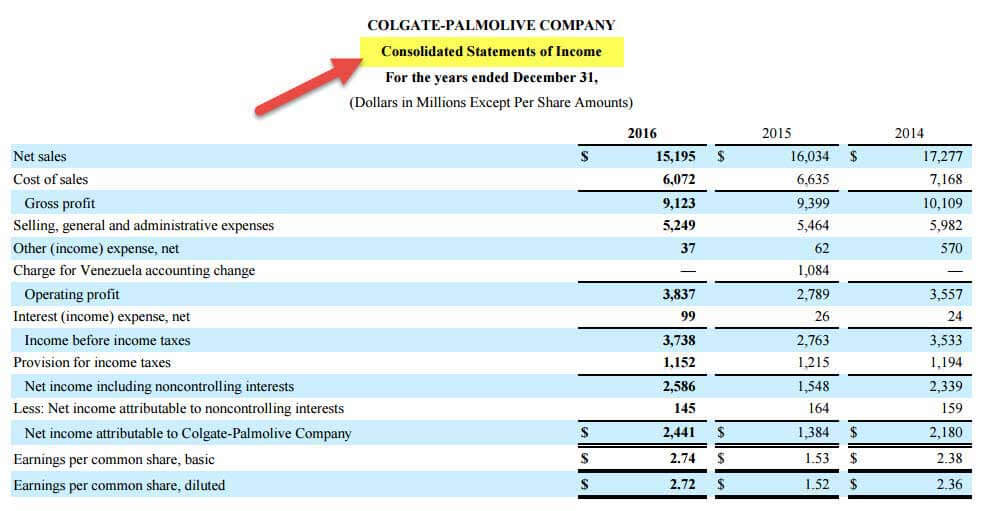

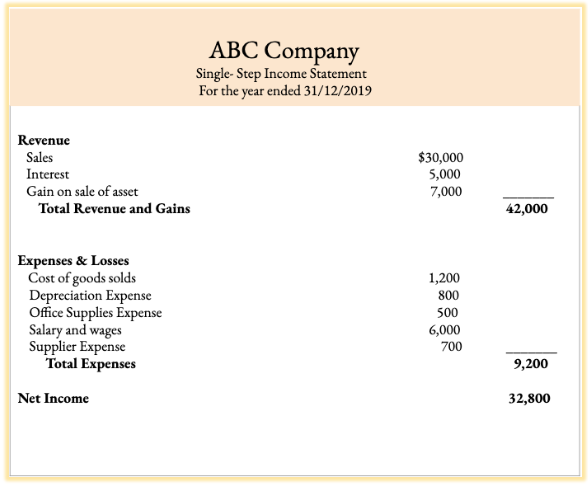

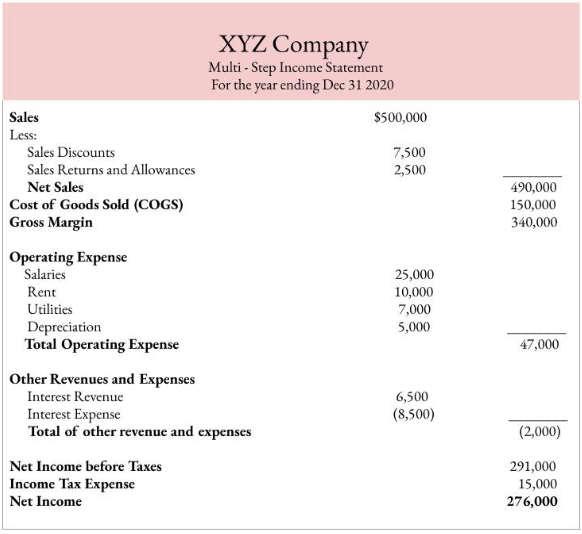

Net income or net earnings from the companys income statement. Entities may present all items together in. It provides an overview of revenues and expenses including taxes and interest.

Since comprehensive income is simply comparing the book value per share at the end of the last period to the book value at the end of the current period the approach makes it. The accounting treatment of comprehensive income is. In business accounting other comprehensive income OCI includes revenues expenses gains and losses that have yet to be realized.