Spectacular Goodwill Debit Or Credit In Trial Balance

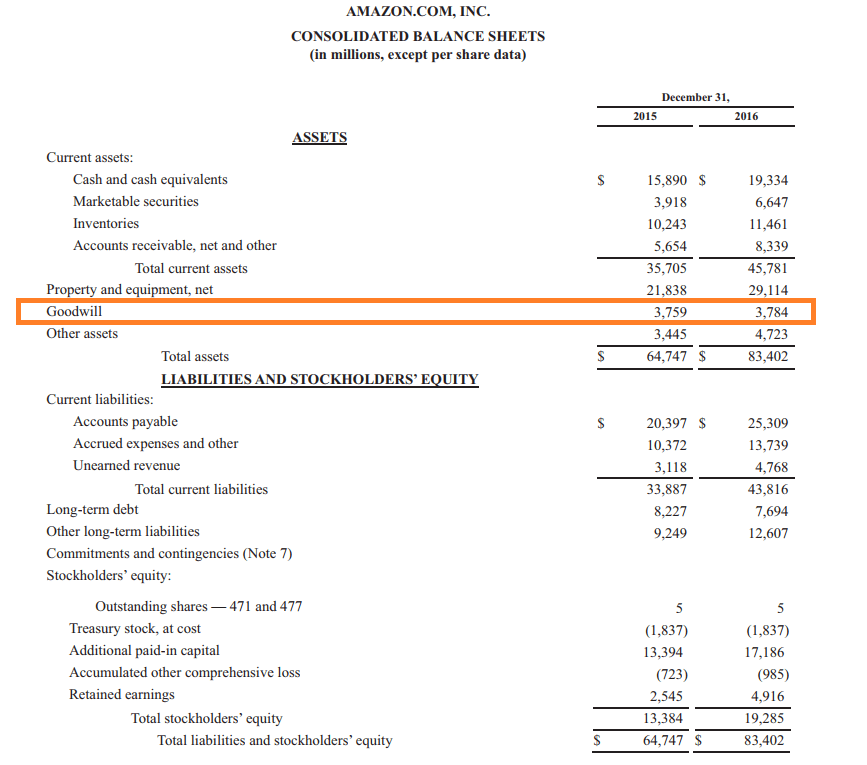

Since goodwill is an intangible asset it is recorded on the balance sheet as a noncurrent asset.

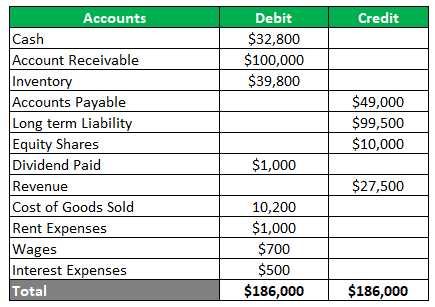

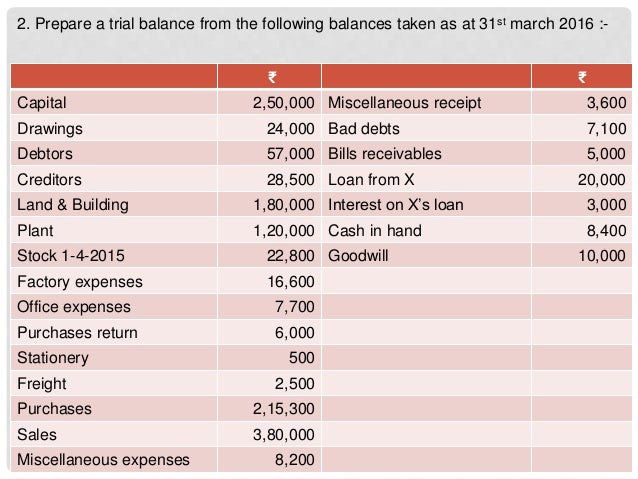

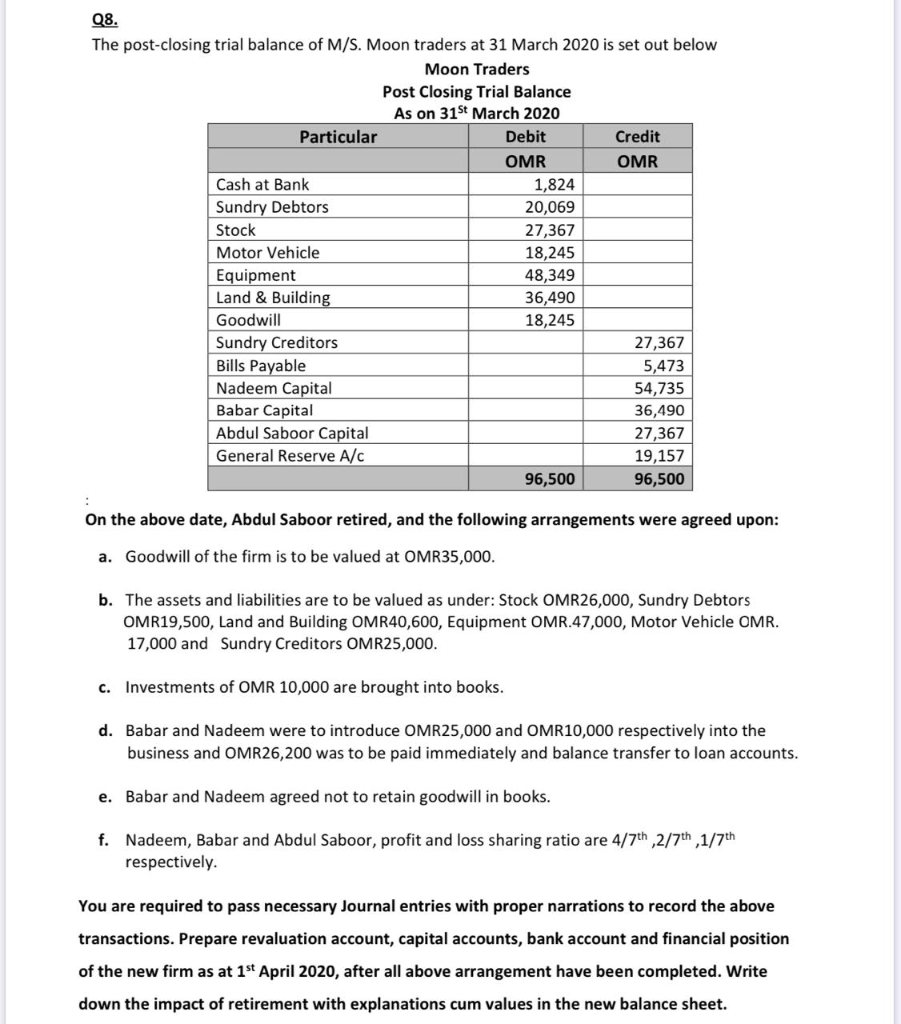

Goodwill debit or credit in trial balance. It will decrease in the amount of cash. It is a statement prepared at a certain period to check the arithmetic accuracy of the accounts ie whether they are mathematically correct and balanced. The debit should have been to the utilities expense account but the trial balance will still show that the total amount of debits equals the total number of credits.

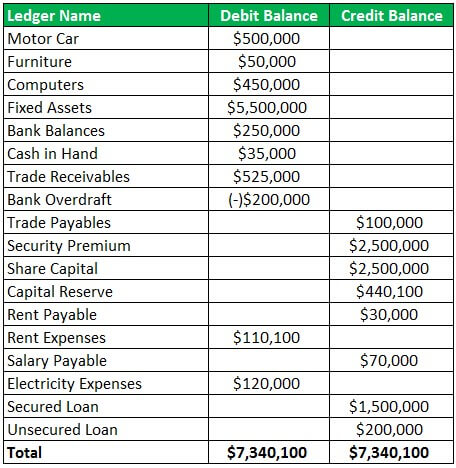

Trial Balance is a simple listing of Nominal Accounts with Debit Balances posted into Debit and Credit Balances posted into Credit Columns. Cash will go from our business. Goodwill is a type of an intangible fixed asset which is shown in the balance sheet under the fixed assets.

Goodwill as the name suggests is the the reputation which the firm enjoys in the market which attracts customers towards itIt is basically because of the good will of the organisation to provide quality product or services. It contains a list of all the general ledger accounts. A debit balance is a net amount often calculated as debit.

So increase in asset of our business will be debit. Trail Balance is a statement showing the balances or total of debits and credits of all the accounts in the ledger with to verify the arithmetical accuracy of posting into the ledger accounts. Then its continuously carried over into the next period.

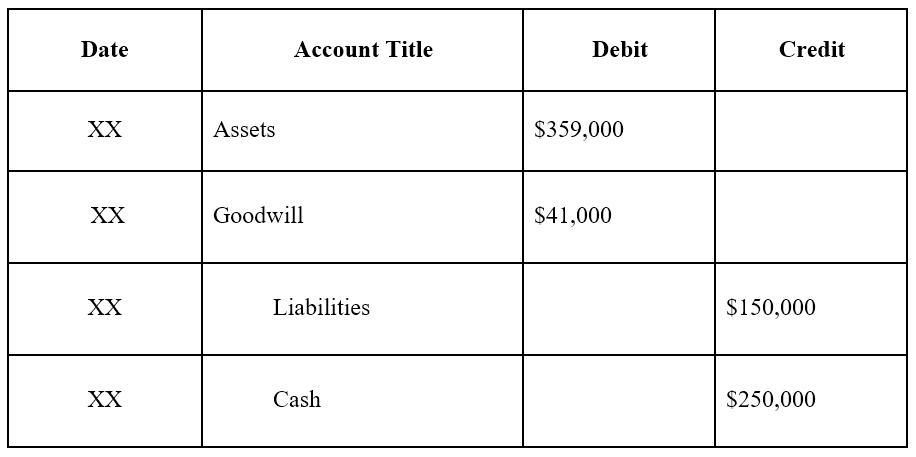

The debit side and the credit side must balance meaning the value of the debits should equal the value of the credits. For example ABC has bought XYZ company. Debit Profit or loss or Capital Account.

There have been at least three methods for finding it in recent decades. How Goodwill Is Treated in the Financial Statements. Any other acquisitions will be added to the balance carried over.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)