Cool Statement Of Management Responsibility For Annual Income Tax Return 2019

2307 in DVD-R with sworn declaration per Revenue Regulation No.

Statement of management responsibility for annual income tax return 2019. Employers Responsibility to Report Employees Yearly Earnings AIS Employers are required by law S68 2 of the Income Tax Act to prepare Form IR8A and Appendix 8A Appendix 8B or Form IR8S where applicable for employees who are employed in Singapore by 1 Mar each year. Employers do not need to submit the hardcopy forms to IRAS. Securities and Exchange Commission.

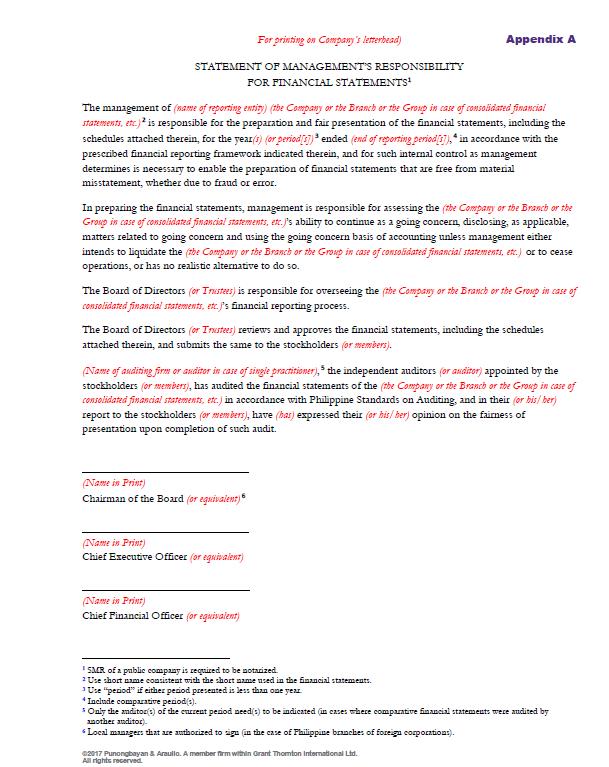

20 Revised Statement of Managements Responsibility on January 26 2017. The SMR was revised in line with the adoption of the new and revised auditor reporting standards which are. What is the best thing to do to protect yourself your family and businesses from outside and unfriendly forces.

Selling your Property for En Bloc Sales Lower Property Tax Rates for Owner-Occupied Residential Properties. Bureau of Internal Revenue BIR may refuse filing unaudited financial statements as an attachment to the income tax return ITR if it would not comply and may impose penalties upon failure to file or late filing or worst if a taxpayer will fraudulently fail to file BIR may assess based on presumptive fraud within the period of ten 10 years from discovery. B All taxpayers required to file annual income tax return under the National Internal Revenue Code as amended shall be required to submit a statement of managements responsibility.

Management is likewise responsible for all information and representations contained in the financial statements. To find out how much you owe or to verify your payment history you can view your tax account. In this regard the Management affirms that the attached audited financial statements for the period ended December 31 2014 and the accompanying Annual Income Tax.

On January 30 2017 the Securities and Exchange Commission SEC issued a Notice stating that the SEC en Banc resolved to issue Financial Reporting Bulletin FRB No. Management is likewise responsible for all information and representations contained in the financial statements accompanying the Annual Income Tax Return or Annual Information Return covering the same reporting period Furthermore the Management is responsible for all information and representations contained in all the other tax returns filed for the reporting including but not. 2022 Property Tax Bills.

Management is likewise responsible for all information and representations. Management is likewise responsible for all information and representations contained in the financial. STATEMENT OF MANAGEMENTS RESPONSIBILITY FOR ANNUAL INCOME TAX RETURN The Management of name of taxpayer is responsible for all the information and representations contained in the Annual Income Tax Return for the year ended date.

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)