Glory Goodwill Impairment Journal Entry

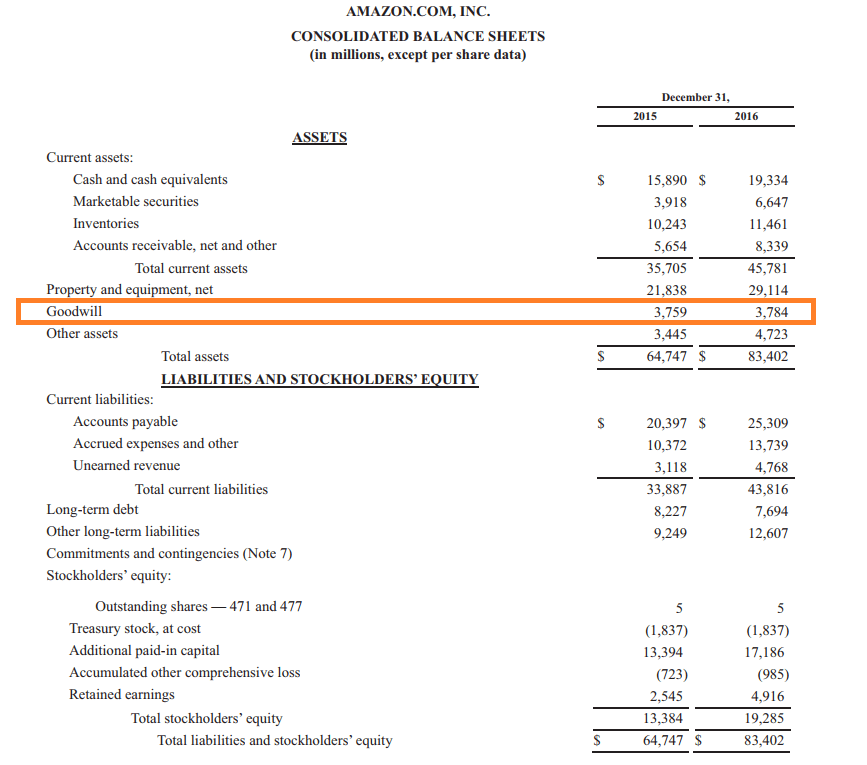

If the goodwill account needs to be impaired an entry is needed in the general journal.

Goodwill impairment journal entry. To be added as increase profit or damage especially as the produce of money lent. An impairment loss is recognized through a journal entry that debits Loss on Impairment debits the assets Accumulated Depreciation and credits the Asset to reflect its new lower value. Sometime vendor of company will demand excess value business than market value difference will be goodwill.

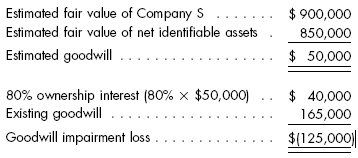

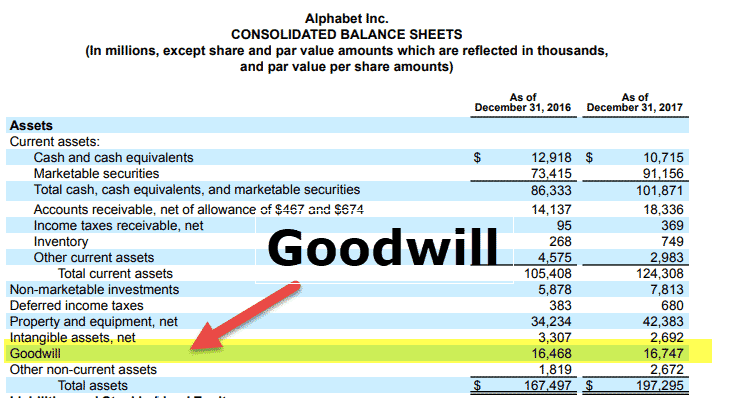

900000 400000 500000. Goodwill will have to be checked every year for impairment and if there is any change it is recorded in the Income Statement. O Goodwill emerges during consolidation elimination entry so impairment loss is done on consolidation adjustment entry Journal entry o Dr Impairment loss o Cr Goodwill Journal entry impairment losses that are in prior periods o Dr Retained earnings opening balance o Cr Goodwill.

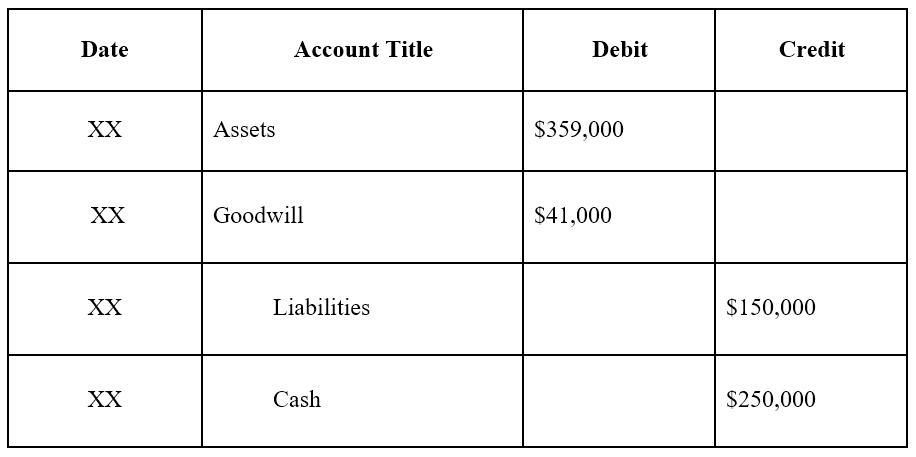

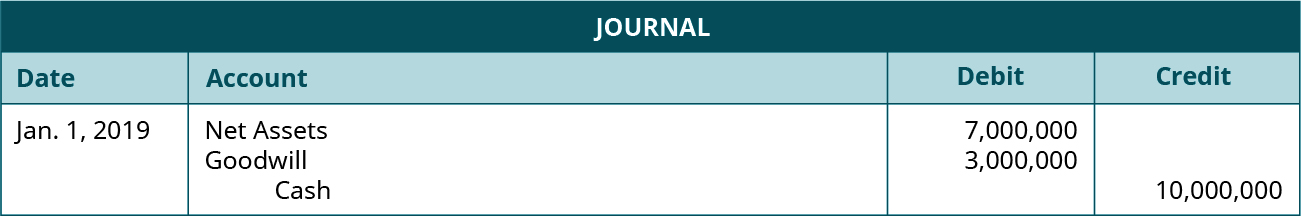

As mentioned above the higher the assets net realizable value and its value in use. This transaction does two things. The journal entry is generally posted as follows.

It generally is recorded in the journal books of account only when some consideration in money or money worth is paid for it. In the group statement of financial position the accumulated profits will be reduced 30. Find out impairment loss if.

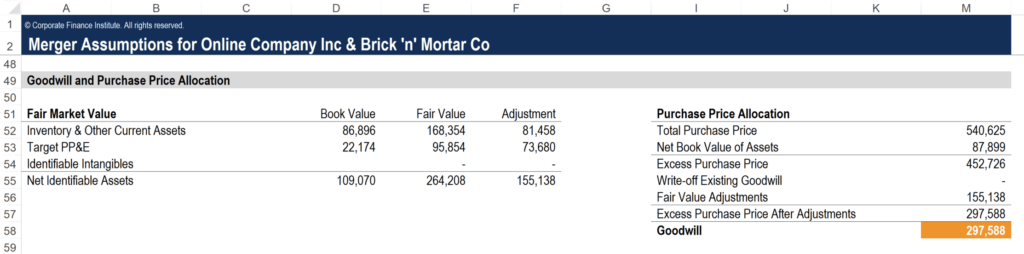

Goodwill payment fair value of net assets. Exhibit 4 reflects what happens when Entity A calculates its goodwill impairment charge and deferred tax impact simultaneously. The journal entry for goodwill impairment is as follows.

Following are the main journal entries of Goodwill. IAS 3696 To test for impairment goodwill must be allocated to each of the acquirers cash-generating units or groups of cash-generating units that are expected to benefit from the synergies of the combination irrespective of whether other assets or liabilities of the acquiree are assigned to those units or groups of units. Fair value of net assets fair value of assets fair value of liabilities.