Top Notch Ifrs For Non Profit Organizations

The implications for not-for-profit entities could range from changes in net debt as all leases are on balance sheet to increased stakeholder awareness of the change in income statement profile.

Ifrs for non profit organizations. Not-for-profit entities NFPs like SEC registrants and private companies are a core constituency of the FASB. Statement of Functional Expenses The statement of functional expenses shows how expenses are incurred for each functional area of the business. New Zealand Equivalents to International Reporting Standards NZ IFRS for for-profit entities based on the International Financial Reporting Standards IFRS issued by the International Accounting Standards Board IASB and PBE Standards for public benefit entities including both public sector entities and not-for-profit.

3353113 and is registered as an overseas company in England and Wales reg no. Functional areas typically include management and administration fund raising and programs. All of our financial people are volunteers apart from a paid bookkeeper and have a.

Content updated daily for nonprofit organization. On January 28 2021 The International Financial Reporting for Non-Profit Organisations IFR4NPO an initiative to develop the first internationally applicable financial reporting guidance for non-profit organizations published a consultation paper to give non-profit organizations the opportunity to contribute to the development of the guidance for their sector. CIPFA is proud to be working with Humentum on the International Financial Reporting for Non-Profit Organizations IFR4NPO project a five-year initiative designed to address these outstanding accounting issues through the development of the worlds first internationally applicable financial reporting guidance for the non-profit sector.

Sam Musoke presents the full session launching the IFR4NPO project as presented at the Humentum Annual Conference OpEx DC 2019International Financial Report. The International Financial Reporting Standards Foundation is a not-for-profit corporation incorporated in the State of Delaware United States of America with the Delaware Division of Companies file no. Accountants and finance staff with financial reporting responsibilities of not-for profit making entities such as faith based organizations and charity organizations operational managers of not-for profit entities auditors of not-for profit making entities that report under IFRS consultants compliance staff.

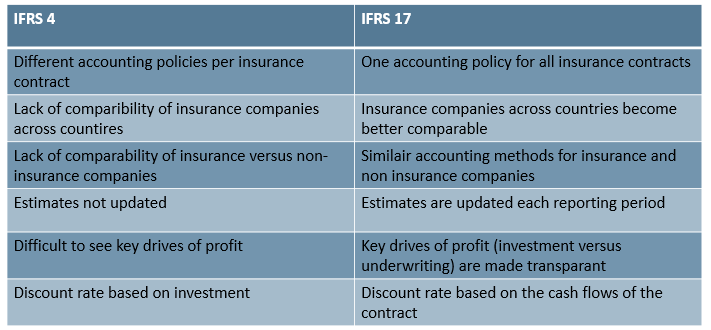

Does IFRS apply to US non-profit organizations. IFRS STANDARDS FOR NOT-FOR-PROFIT ENTITIES NFPs The focus of the IASB to date has been to develop standards for private sector for-profit entities. Ad This is the newest place to search delivering top results from across the web.

Content updated daily for nonprofit organization. Today rather than requiring American companies to adopt International Financial Reporting Standards IFRS convergence is being accomplished through the issuance of new standards by both the FASB and the IASB to minimize the differences between the two standards. The International Financial Reporting for Non Profit Organisations IFR4NPO initiative is a five-year project coordinated by Humentum and the Chartered Institute of Public Finance and Accountancy CIPFA to develop the first ever NPO international financial reporting guidance which can command support from the accounting community and NPOs as well as the funders and regulators of NPOs.