Outrageous Impairment Loss Balance Sheet

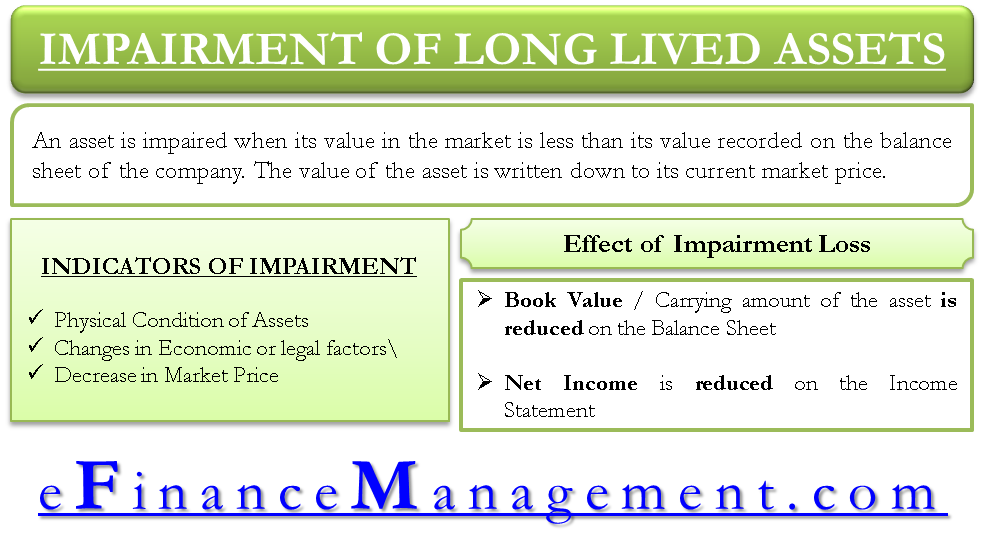

Impairment of is a reduction in the assets value due to obsolescence or damage to the asset.

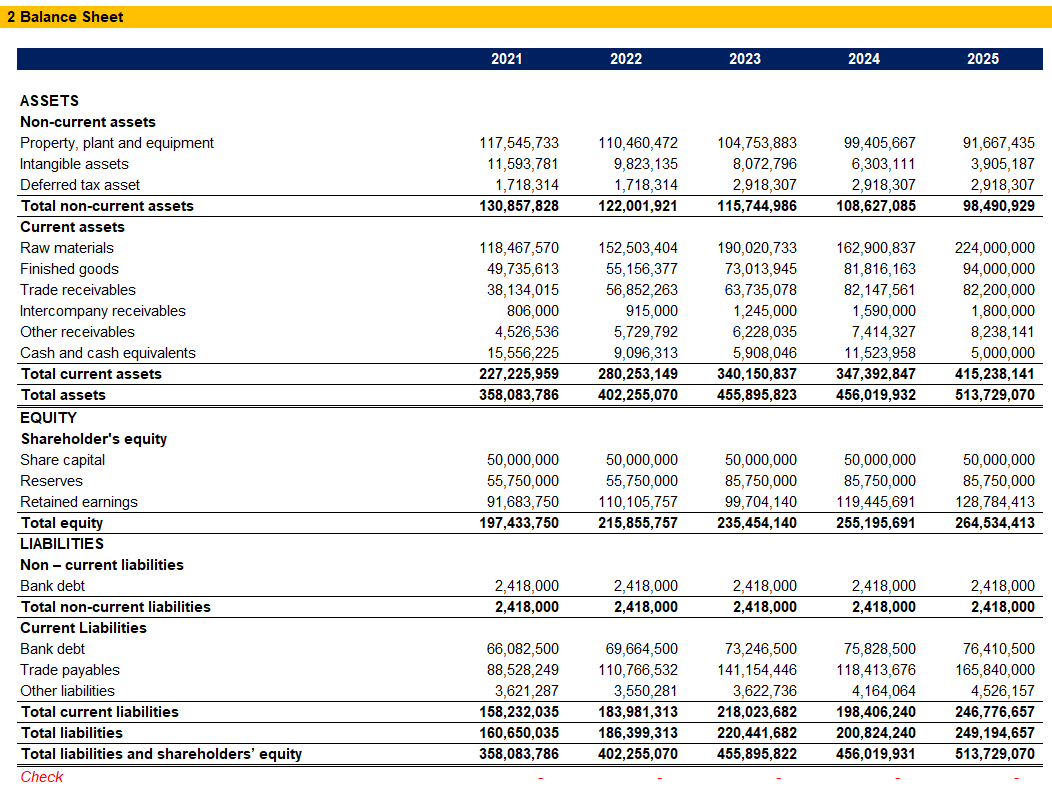

Impairment loss balance sheet. An impaired asset is an asset that has a market value less than the value listed on the companys balance sheet. An impairment loss can be recognized only if the historical cost carried on the balance sheet cannot be recovered and exceeds the fair value of the asset. Impairing an assets value produces a decline in the statement of changes in shareholders equity because higher expenses and lower income affect the retained earnings master account which is an equity statement.

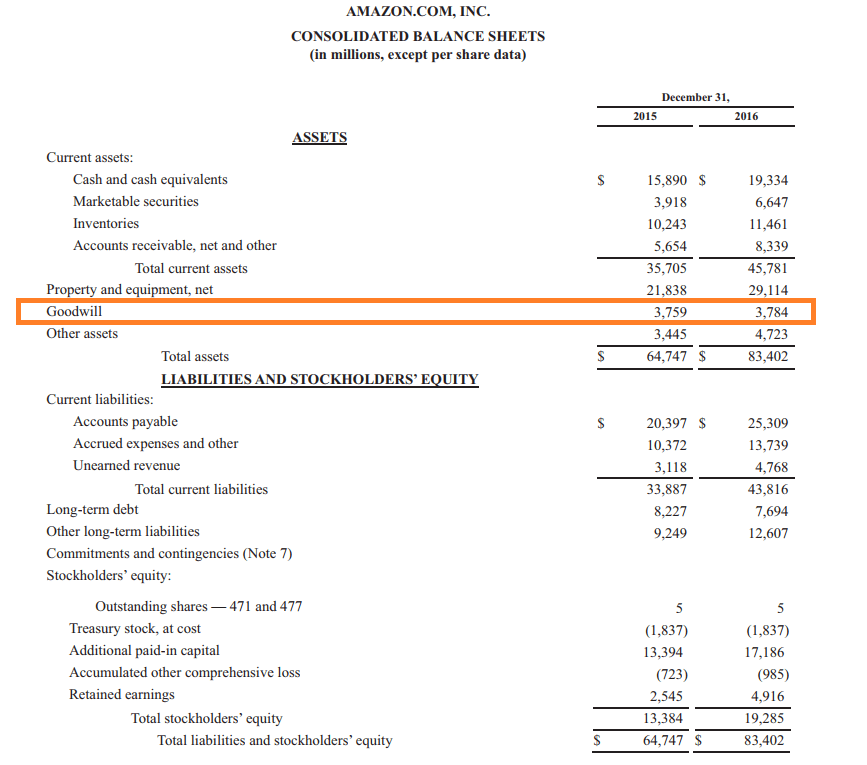

When an asset is deemed to be impaired it will need to be written down on the. Ad Find How To Balance Sheet. I first against any goodwill allocated to the CGU.

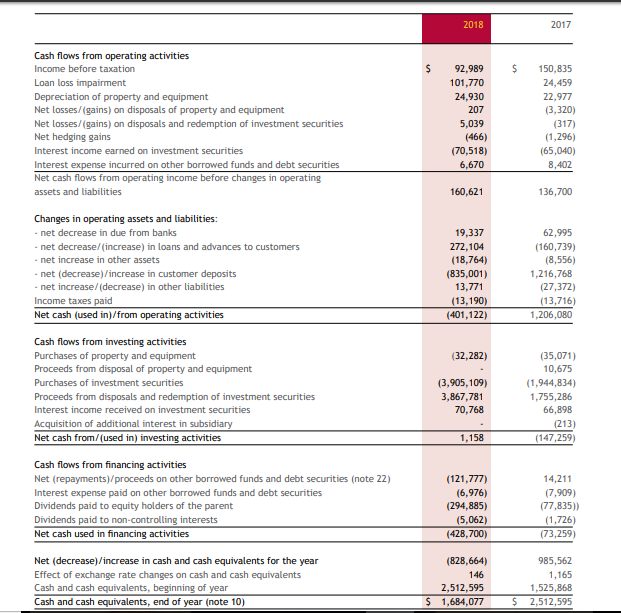

If an asset is impaired the impairment loss is recognized in the income statement just like any other operating expense. The impairment test is required when there are some indications or reasonable assumption that the recoverable amount of an asset declines rapidly. The loss will reduce income in the income statement and reduce total assets on the balance sheet.

Ii then against the other assets of the CGU on a pro rata basis. For land this means that the eventual market price of the land at sale is expected to be lower than. IAS 36 stipulates that in the case assets are impaired companies must estimate the recoverable amount of the asset and record this value in the financial statements during the period the impairment loss arises.

Impairment affecting balance sheet. Applying IAS 36 Impairment Published 10 December 2019 last updated 10 December 2019 4 section 8 explains that any impairment loss must be allocated to the assets in the CGU in a specific order. With impairment loss being recognized the net profit is impacted negatively.

A loss on impairment is recognized as a debit to Loss on Impairment the difference between the new fair market value and current book value of the asset and a credit to the assetThe loss will reduce income in the income statement and reduce total assets on the balance sheet. Asset impairment occurs when the carrying amount of an asset exceeds its recoverable amount. The asset is written down by the amount equal to the impairment loss which is recognized in the income statement.

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)