Wonderful Maruti Suzuki Ratio Analysis

Basic EPS Rs 14530.

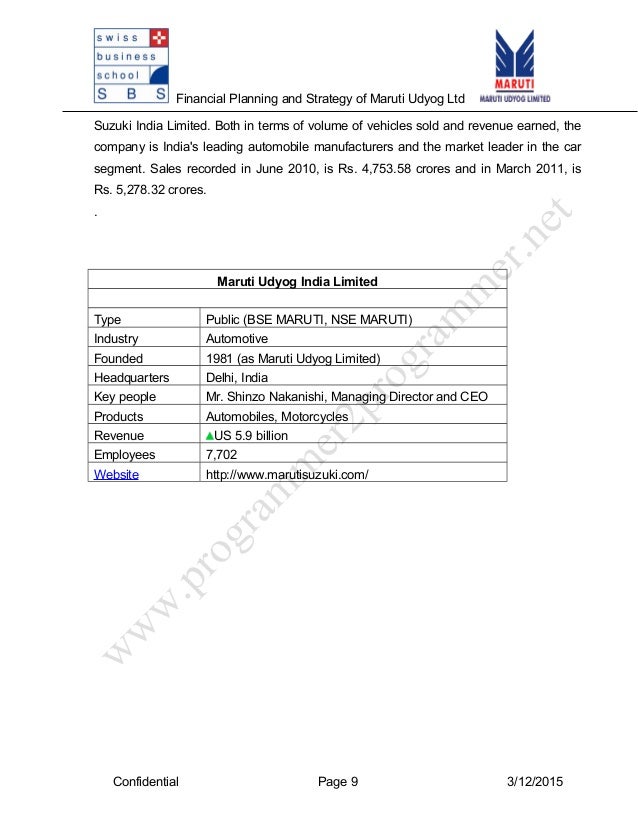

Maruti suzuki ratio analysis. According to these financial ratios Maruti Suzuki India Limiteds valuation is way above the market valuation of its sector. It is the tool to communicate with creditors debtorssuppliers and all those who are directly or indirectly associated with an organizationHere in this project report we have discussed about various components of balance sheet and their significanceWe have done in depth analysis of ratios. The near term growth outlook still remains gloomy for the entire industry and.

The study has identified that liquidity. 0071940001 is submitted in the partial fulfilment of the. Financial Charges Coverage Ratio.

Until recently 1828 of the company was owned by the Indian government and 542 by Suzuki of Japan. From the above table it is understood that the fixed asset turnover ratio of Maruti Suzuki has reached highest level in March 2017 since last 5 years as the net sales increased and the efficiency of utilisation of fixed asset has reached to highest rate. Per Share Ratios.

Financial Charges Coverage Ratio Post Tax. F A STUDY ON LEVERAGE ANALYSIS. The EVEBITDA NTM ratio of Maruti Suzuki India Limited is significantly higher than the average of its sector Automobiles.

Maruti Suzuki Ratios Financial summary of Maruti Suzuki Maruti Suzuki Profit Loss Cash Flow Ratios Quarterly Half-Yearly Yearly financials info of Maruti Suzuki. Basic EPS Rs 14002. Diluted EPS Rs 140.

Pre Tax Margin 923. Diluted EPS Rs 145. Current Ratio.