Wonderful P&l Us Gaap

The Financial Accounting Standards Board FASB and the International Accounting Standards Board IASB continue to review the accounting standards pertains to pension accounting in order to improve clarity provide additional guidance and accelerate.

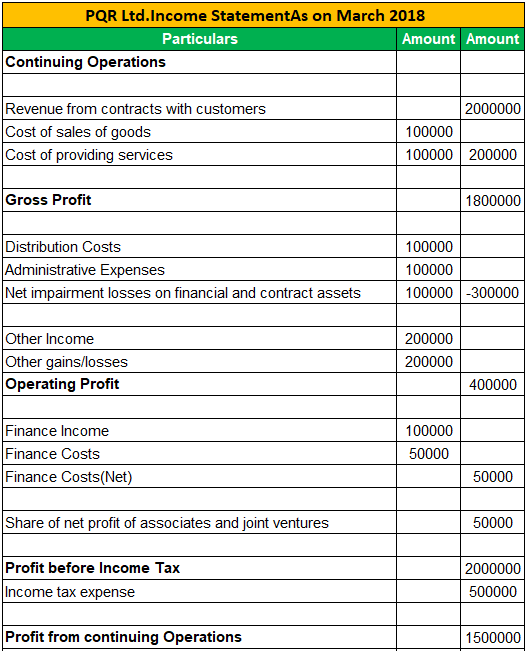

P&l us gaap. Creech Associate Professor of Accounting Briar Cliff University 3303 Rebecca Street Sioux City IA 51104 Phone. There is no particular format for PL Account under GAAP GAAP Generally accepted accounting principles GAAP are the minimum standards and uniform guidelines for the accounting and reporting. For IFRS Standards implementation efforts are complete except for insurance.

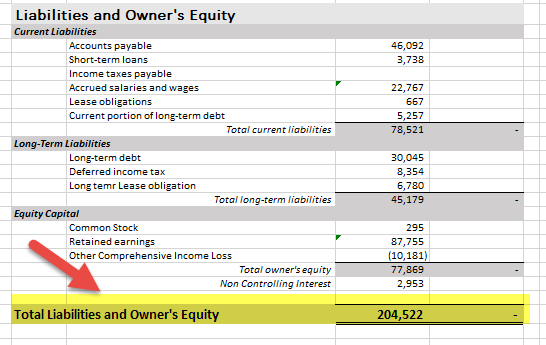

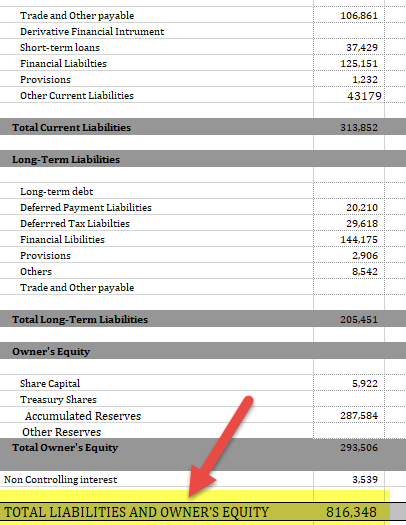

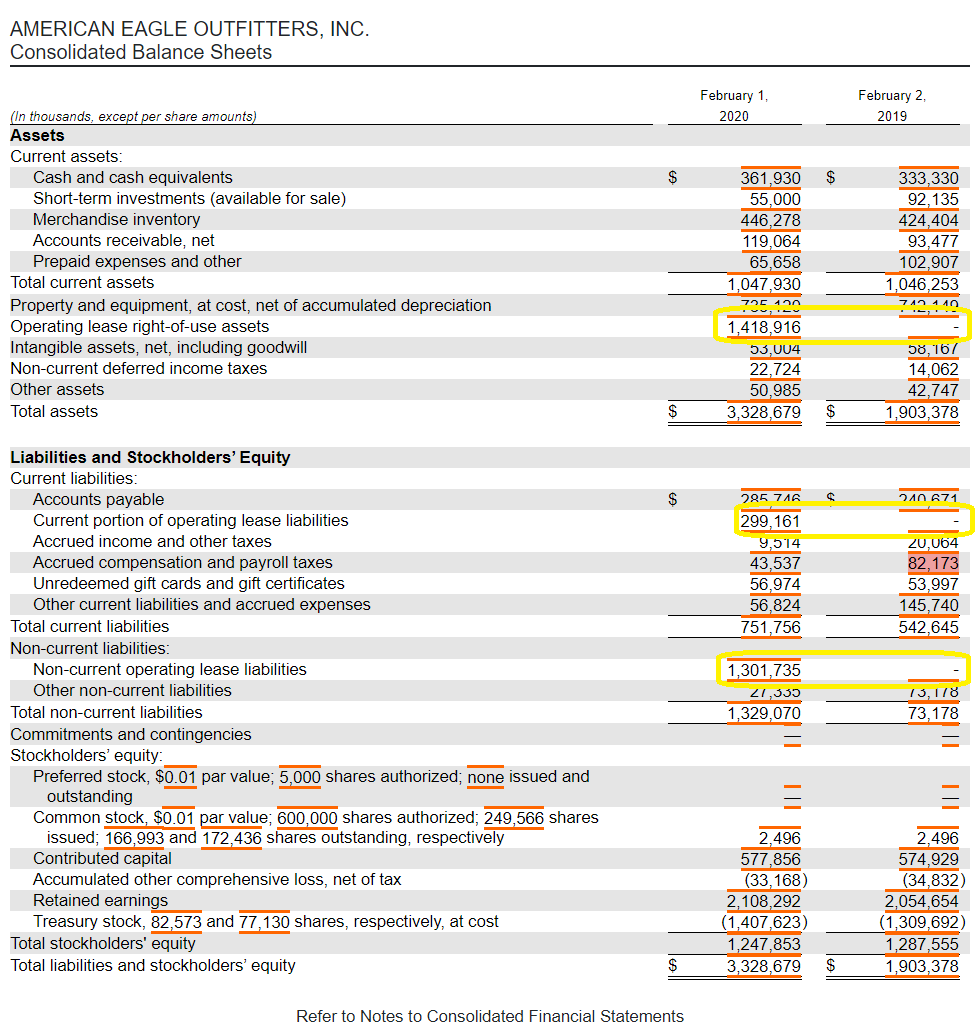

The Balance Sheet Approach requires companies to record both. The accounting for post retirement employee benefits is complex and poses many challenges under the US GAAP as well as the IFRS. We ended Fiscal 2019 with 1312 stores consisting of 1095 Company-owned stores and 217 licensed store locations Our Company-owned retail stores are located in shopping malls lifestyle centers and street locations in the United States Canada Mexico and Hong Kong.

Additional exposures may be hedged items. Other items of comprehensive income OCI do not flow through profit and loss. Their US GAAP information in SEC filings.

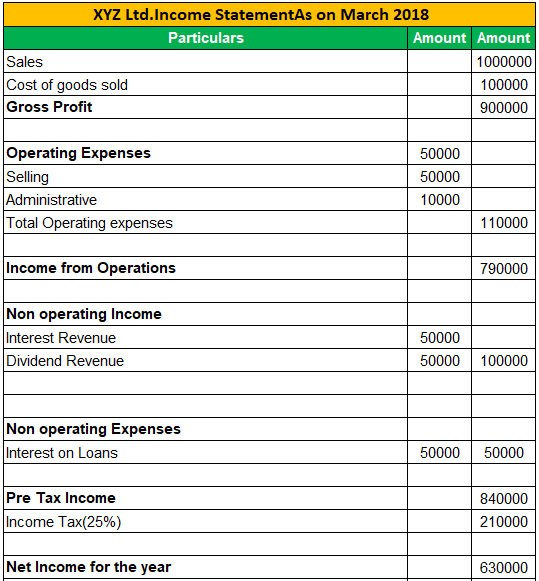

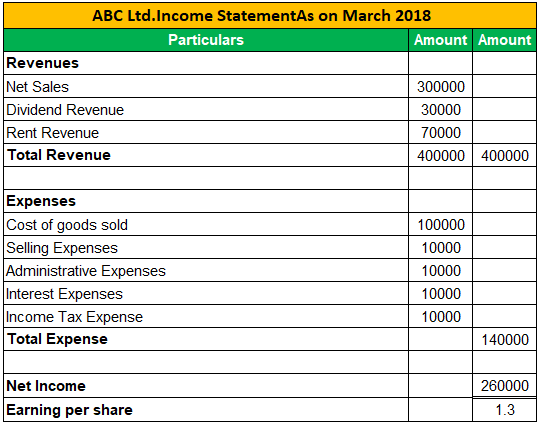

Liabilities or assets for the future tax consequences of. Major parameters included in Income Statement. In addition the ASU allows a company to elect to recognize the fair value changes of the excluded components in PL like current US GAAP or to amortize the initial value of the excluded component in PL over the term of the hedge.

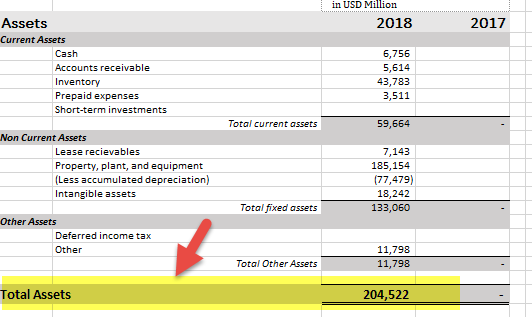

Recent events such as the fiscal crisis of 20072008 and the economic recession that followed have prompted concerns about whether investors have received sufficient notice of impending corporate bankruptcy. Excerpt from ASC 360-10-05-3 Property plant and equipment typically consist of long-lived tangible assets used to create and distribute an. GAAP requires the use of the Balance Sheet Approach to measure and record income taxes.

Tax expense incurred during the current year- that is the same expense that would be reported under the Tax Return Approach plus. What Is a Profit and Loss Statement PL. 20321 Change in valuation approach or valuation technique.

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)