Casual Treatment Of Prepaid Expenses In Cash Flow Statement

Prepaid expenses are not recorded on an income statement initially.

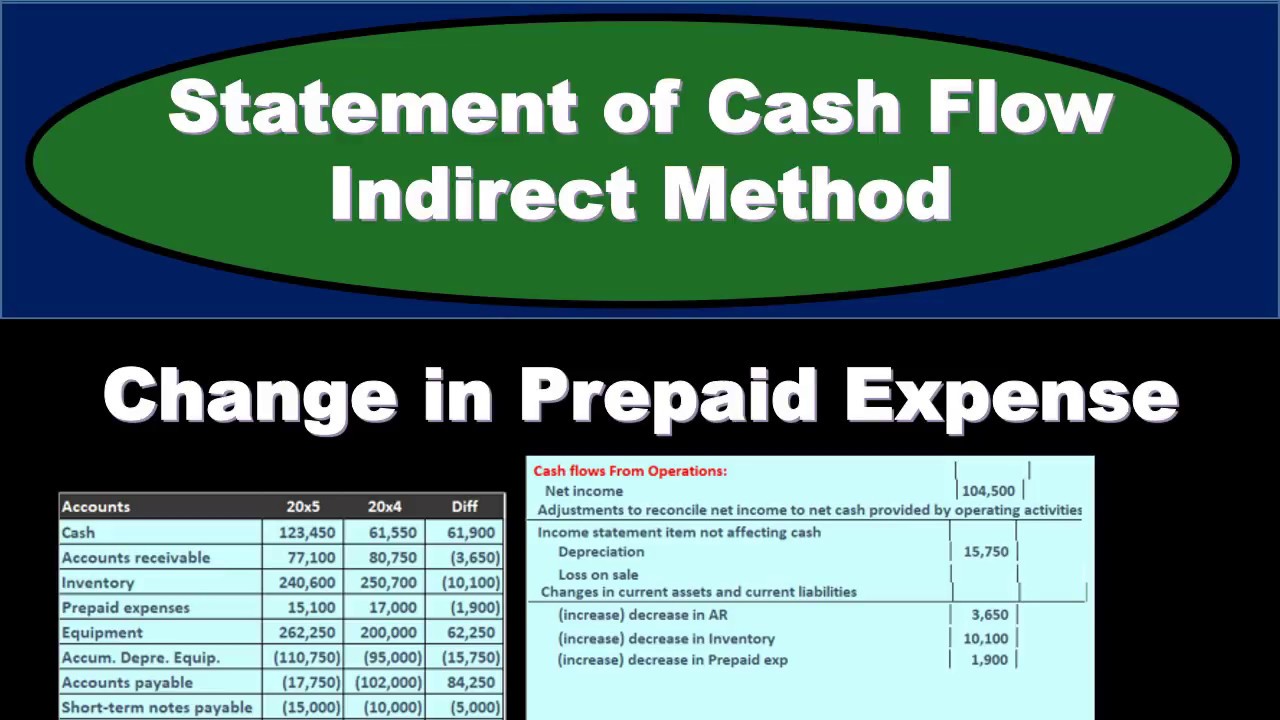

Treatment of prepaid expenses in cash flow statement. Interest Payments Beginning Interest Payable - Ending Interest Payable Interest Expense. An expenditure is recorded at a single point in. In this presentation we will continue with the statement of cash flows indirect method looking at the change in prepaid expenses were going to be using this information weve got the comparative balance sheet weve got the income statement and some additional information we will be working primarily with the difference in the comparative balance sheet with the use of a worksheet.

Instead prepaid expenses are initially recorded on the balance sheet and then as the benefit of the prepaid expense is. Operating expenses are typically paid on a monthly basis which is why any reduction in prepaid expenses will immediately benefit cash flow for the current month. The largest line items in the cash flow from the financing section are dividends paid repurchase of common stock and proceeds from the issuance of debt.

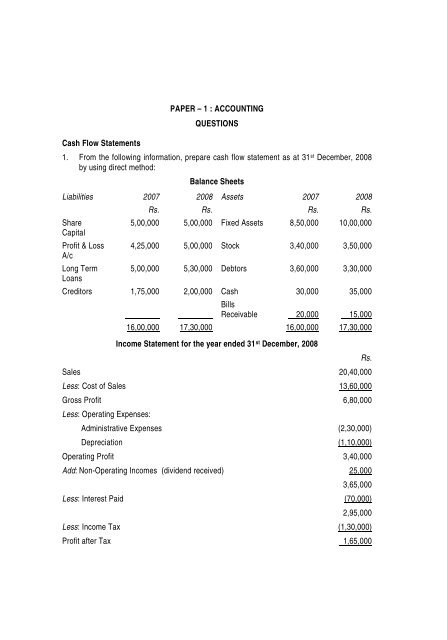

In order to prepare the cash flow statement we adjust the profit before tax with working capital adjustments and operating expenses and accrual is an operating expense payable. Decrease in Noncash Current Assets Decreases in current assets indicate lower net income compared to cash flows from 1 prepaid assets and 2 accrued revenues. The prepaid portion of the expense unexpired is reduced from the total expense in the profit loss account.

Cash Paid to Suppliers Cost of Goods Sold Increase or - Decrease in Inventory Decrease or - Increase in Accounts Payable Cash Paid for Operating Expenses Includes Research and Development Operating Expenses Increase or - decrease in prepaid expenses decrease or - increase in accrued liabilities. Statement of Cash Flows. Treatment of Prepaid Expenses in Final Accounts or Financial Statements.

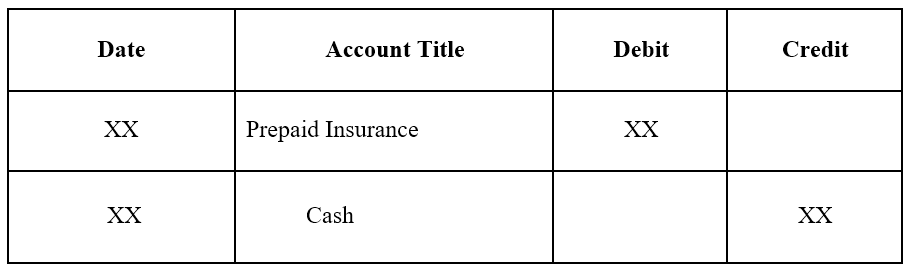

For example if the company prepays rent for 12 months the prepaid rent balance will increase for the 12 months of rent prepaid. Expenditure An expenditure represents a payment with either cash or credit to purchase goods or services. The adjusting entry on January 31 would result in an expense of 10000 rent expense and a decrease in assets of 10000.

Classification of certain cash payments and receipts in the statement of cash flows which has led to diversity in practice. Dividends paid and repurchase of common. Then It is deducted from financing Activities.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)