Marvelous Steps In Forecasting The Income Statement

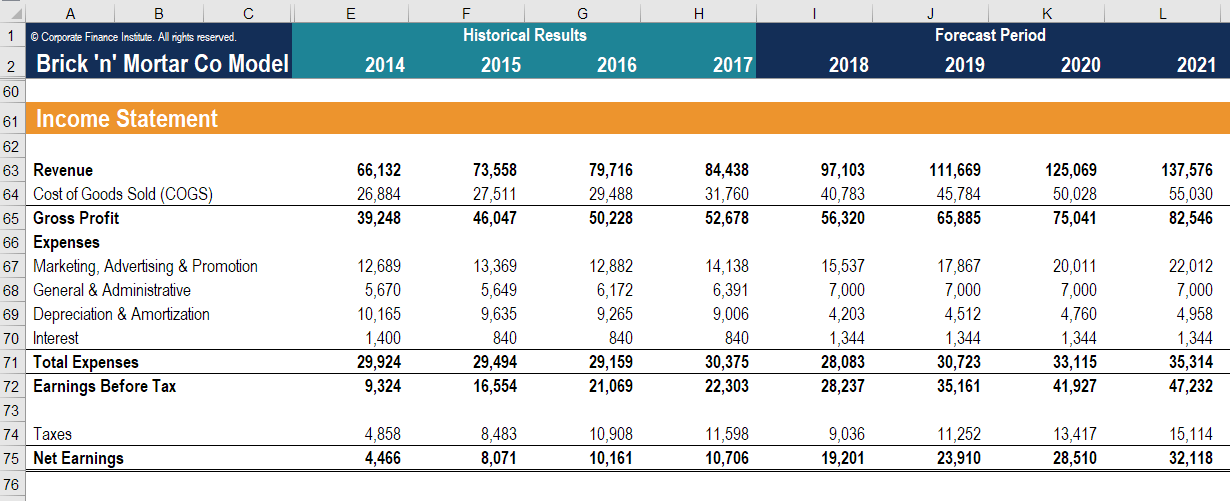

Complete the forecast of your income statement for the next three to five years.

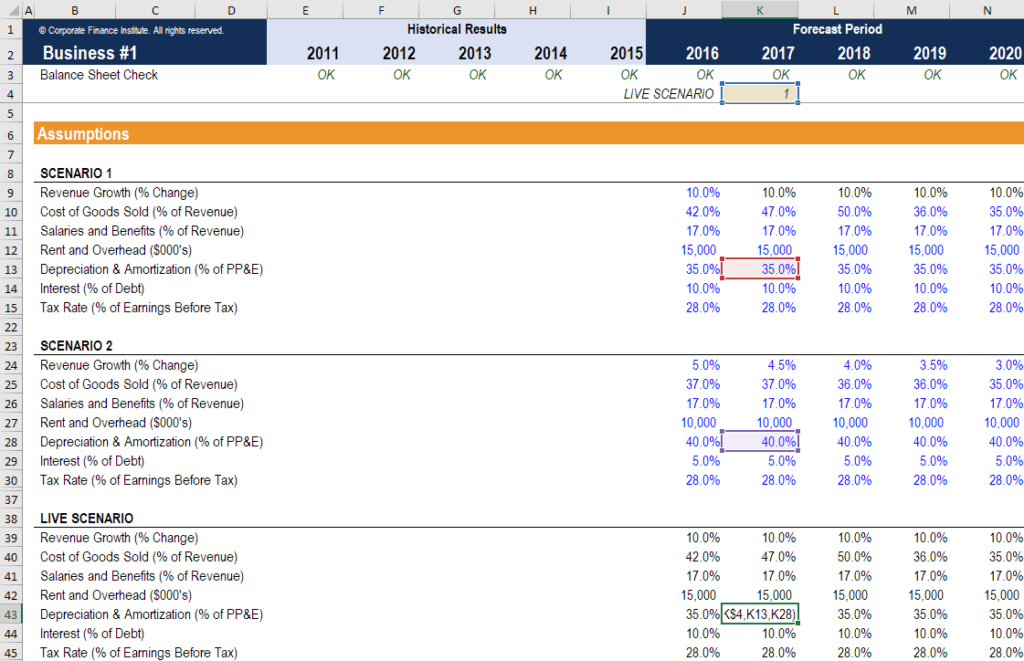

Steps in forecasting the income statement. From income statement forecast. Keep in mind this is your sales goal. Most inputs are required in the first step.

The final step in forecasting the balance sheet is projecting your cash position. EBIT or Operating Income. Select one or more forecasting models.

CFIs financial modeling courses. General economic forecast unfolds an overall setting within which forecasts about the prospects of the firms business can be projected. Net sales are gross sales minus sales returns sales allowances and sales discounts.

Lets say you made 30000 in sales this. As an example of income statement forecasting consider the Elvis Products InternationalEPI statements that you created in Chapter 2. The first step in our cash flow forecast is to forecast cash flows from operating activities which can be derived from the balance sheet and the income statement.

Projected Equity Equity Last Year Net Income - Dividends Change in Equity. Open the workbook thatyou created for Chapter 2 and make a copy of the Income Statement. Less cost of goods sold.

It should also use it to establish relationships between expenses and revenue to spot trends in operating profit ratios and for comparison of actual results against a projection. Creating the pro forma Income Statement First set a goala projectionfor sales in the period youre looking at. If possible try to include units in your forecast because it can be easier to attribute costs to units rather than revenue.