Fun Accounting Standards For Private Enterprises

Its that time of year again - Accounting Standards for Private Enterprises ASPE 4 Section 1591 Subsidiaries What has changed at a high-level.

Accounting standards for private enterprises. In December 2018 the Accounting Standards Board concluded its project to re-examine the special treatment 1 for preferred shares issued in a tax planning arrangement provided by Section 3856 Financial Instruments by issuing final amendments to paragraph 385623. Ad Download accounting software free. ASPE or Accounting Standards for Private Enterprises is a relatively new concept designed to make accounting simpler for small to medium-sized business owners.

The new standards have been issued and are available for 2009 reporting for entities that choose to adopt them early. These publications have been compiled to provide you with a high-level overview of Accounting Standards for Private Enterprises ASPE included in Part II of the CPA Handbook Accounting as of January 1 2021. The number 1 preferred choice for business users everywhere for stability and ease of use.

This document is intended to help enterprises that will use Accounting Stan-dards for Private Enterprises ASPE analyze the various options available and make informed decisions. Section 1591 Subsidiaries replaces both Section 1590 Subsidiaries and AcG-15 Consolidation of Variable InterestEntities. In the Blue Ribbon panels report to FAF in January 2011 it concluded that the current US.

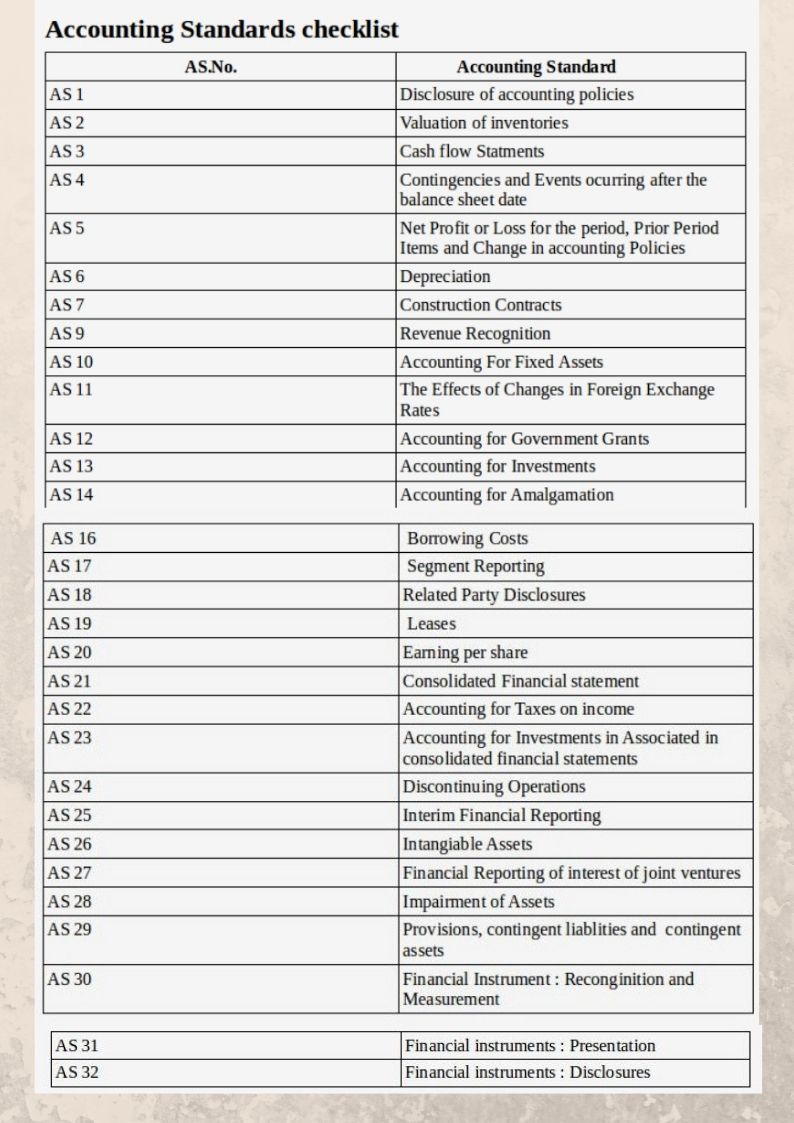

You can find more about each of the standards that form part of Part II - Accounting Standards for Private Enterprises ASPE by selecting the standard you are interested in from the following table or from the left navigation where we have categorized the standards into groupings based on their nature. Learn about the November 2020 amendments to Section 3462 Employee Future Benefits under accounting standards for private enterprises ASPE in Part II of the CPA Canada Handbook Accounting. Our team will keep you informed of the latest developments and assist with any of your assurance or accounting.

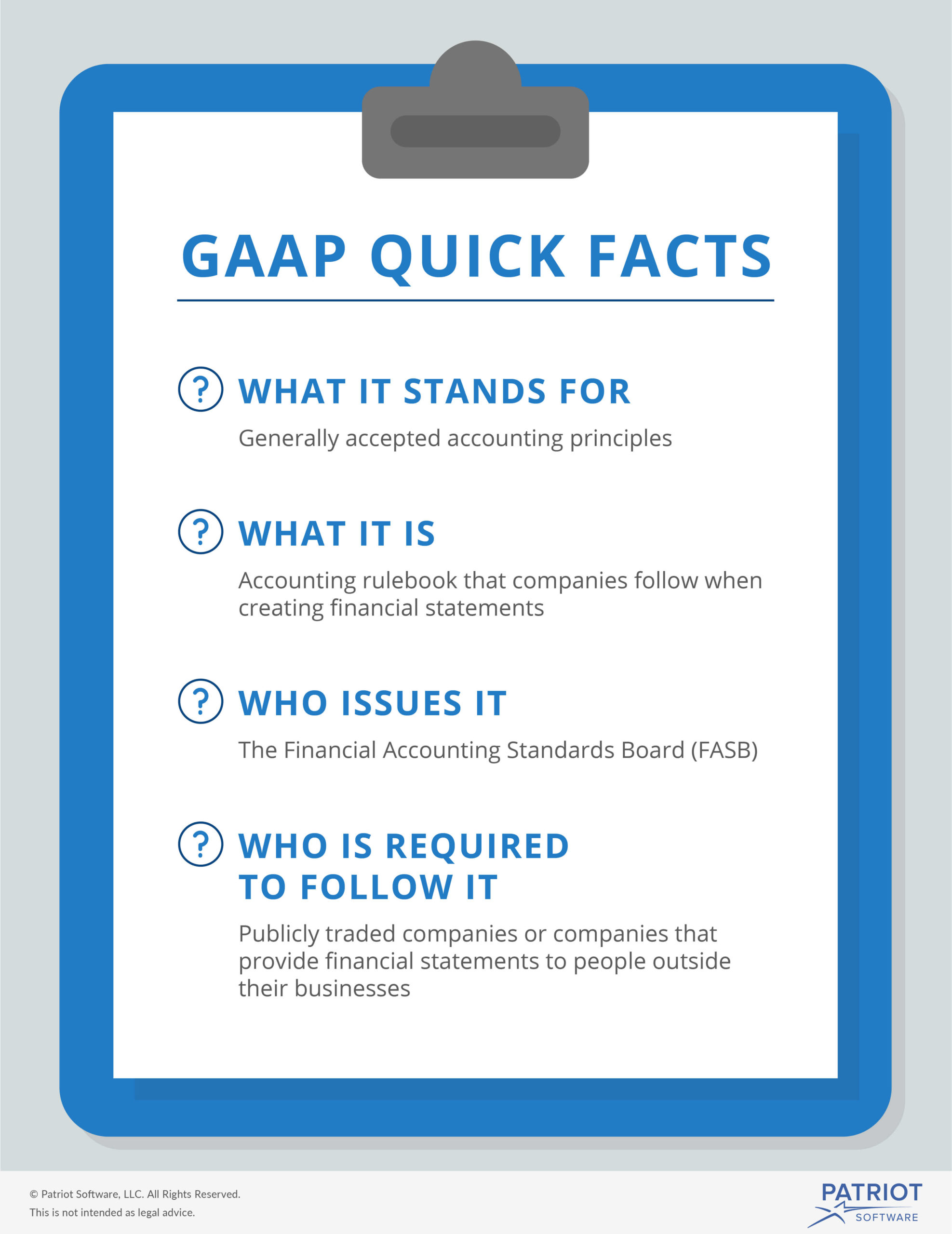

The Canadian Accounting Standards Board AcSB has released the new set of standards that will apply to private enterprises Accounting Standards for Private Enterprises or ASPE. Canadian publicly accountable enterprises will be required to use International Financial Reporting Standards IFRS for fiscal years beginning January 1 2011. ASPE Briefing Section 3462.

The standards are effective for annual financial statements relating to fiscal years beginning on or after January 1 2011. Perfect for small businesses. Section 1500 - First-time Adoption.

/paper-with-title-international-financial-reporting-standards--ifrs---850740234-6e303822ed5e4800b523b0ac24db396c.jpg)