Fabulous Treatment Of Closing Stock In Trial Balance

Closing Stock Ac Dr.

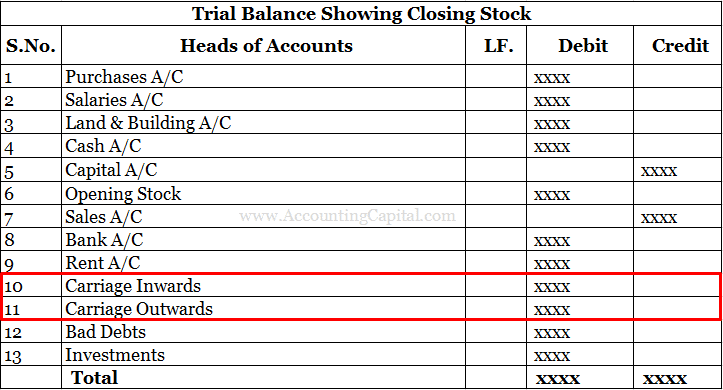

Treatment of closing stock in trial balance. Below is the journal entry for closing stock in this case. But sometimes in the Trial Balance Adjusted Purchase is given and this means Opening Stock and Closing Stock are adjusted through purchases. If it is included the effect will be doubled.

Ad Free Demo Account For Practice. Ad Free Demo Account For Practice. With Real Time Charts and Tools.

Closing stock is the leftover balance out of goods which were purchased during an accounting period. What you are saying is that the closing stock is not an expense of this period but is an expense of the next period. When closing stock appears inside the Trail Balance.

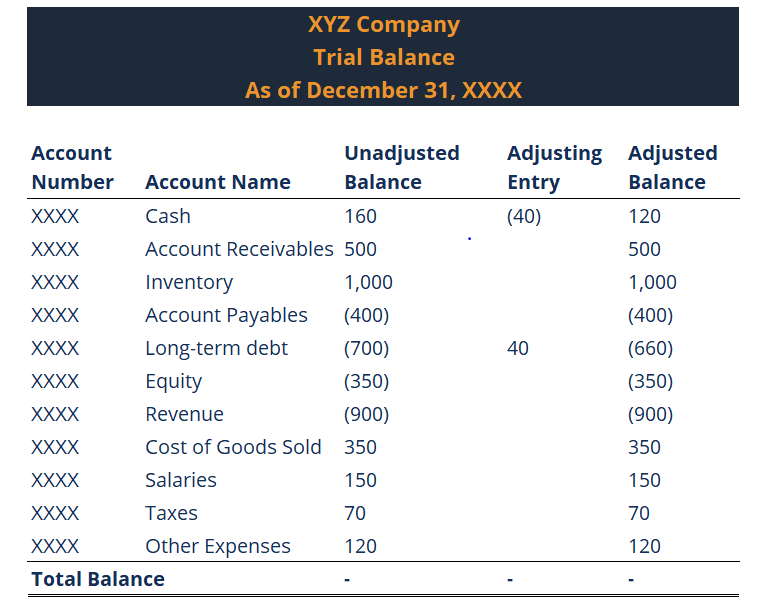

Then both Adjusted Purchases Ac and Closing Stock Account appear in the Trial Balance. Ad Try Stockopedia for free to join our supportive community of private investors. If both Purchase and the Closing stock is shown in the Trial Balance there will be a mismatch of 1500 MT 1500 MT x 375 562500 because the effect has been doubled in the Trial Balance.

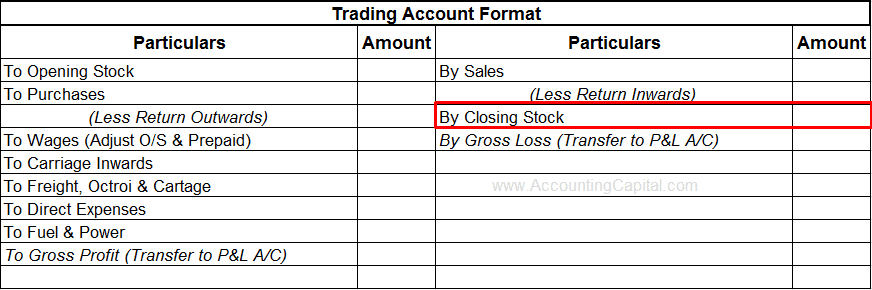

Total purchases are already included in the trial balance Hence closing stock should not be included in the trial balance again. You need to take it out of the stock account on the PL and put it in the Closing stock account on the Balance sheet. Treatment in Final Accounts When closing stock is given outside the Trial Balance.

It will be shown in the trading account balance sheet. - Jbsclasses 55 appear in the Trial Balance. The accounting treatment will be closing stock to be shown in Balance sheet under current assets and it.