Marvelous Iras Financial Statements

Ad Find Financial Statements Form.

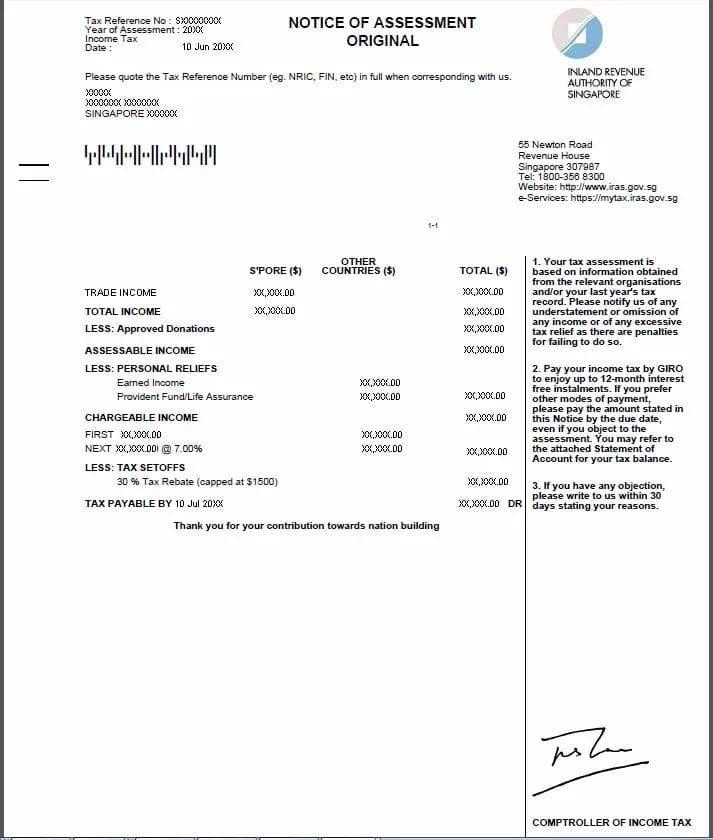

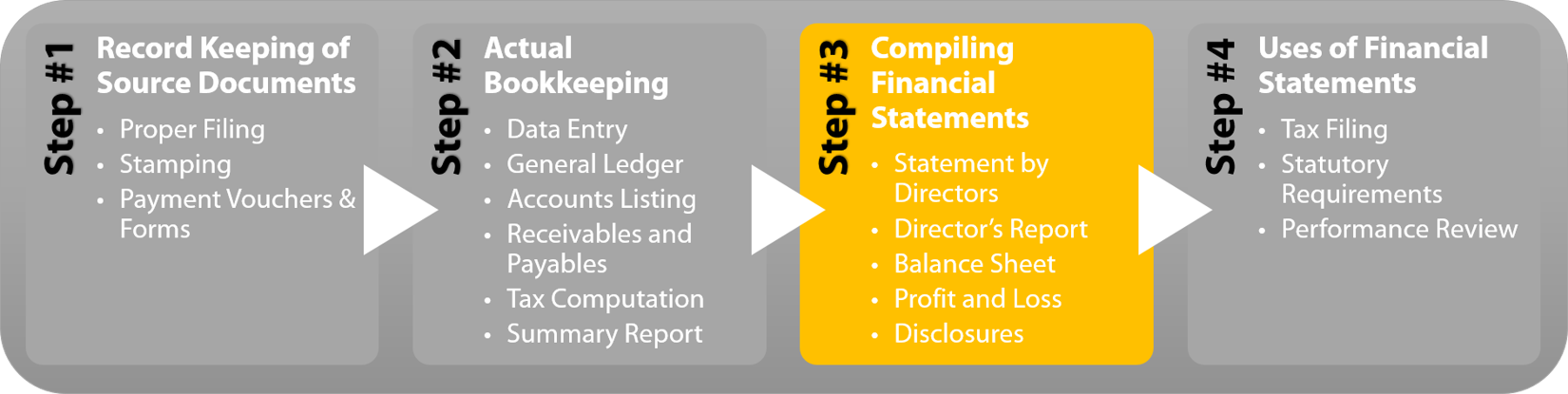

Iras financial statements. Ad Find Financial Statements Form. IRAS as part of your Form C-S and with ACRA as part of your annual return. The compilation report or unaudited financial statements is to be tabled when performing Annual Return Filing with ACRA and income tax filing with IRAS.

Ad Find Financial Statements Form. Prepare financial statements File with. Access your tax notices instantly anytime and anywhere on myTax Portal a safe and secured platform.

View past Annual Reports. Ensure that your contact details with us are up-to-date to receive timely notifications. Besides filing with ACRA and IRAS it is also important to get the compilation report or unaudited financial statements ready when tabled during the AGM.

Ad Find Financial Statements Form. Ad Find Financial Statements Form. When filing their corporate tax returns with the Inland Revenue Authority of Singapore IRAS companies are required to include their financial statements in the supporting documents.

The IFS serve to provide an illustration of the annual financial statements of a company whose principal activities are those of trading. Companies that have filed a full set of financial statements with ACRA in XBRL format are not required to file the same with IRAS. From May 2021 most IRAS notices will be digitised with paper notices minimised.

Ad Find Financial Statements Form. Financial Statements are also required for annual corporate tax submission to IRAS as well as Annual Return filing to ACRA. The disclosures contained in these IFS are made based on a hypothetical entity and certain assumptions have been made about the.

.jpg)