Outrageous Direct And Indirect Cash Flow

You may also see the indirect cash flow method referred to as.

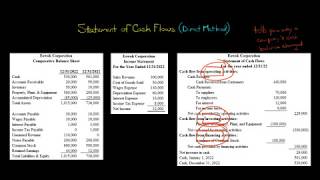

Direct and indirect cash flow. The statement starts with the operating activities section. The cash flow indirect method makes sure to convert the net income in terms of cash flow automatically. Adjustmen ts to re concile net inc ome to net c ash pr ovided by ope ra ting activities.

Attached is a description of those activities that go into the direct cash flow method. The differences between direct and indirect cash flow reports. And positive which includes cash flows like accounts receivable payments received and cash collected from customers.

There are two different ways a company can put together their cash flow forecast. The direct method and the indirect method. Notably the most commonly used cash flow method is indirect cash flow.

Either the direct or indirect method may be used to report net cash flow from operating activates. The direct method is perhaps the simplest to understand though it is often more complex to calculate in practice. The indirect method of cash flow is more informative than the direct method because it adds back the non-operating expenses and subtracts the non-operating income from the companys net income.

Deprecia tion Amortization expense xxx. Indirect Cash Flow Method. Though the Financial Accounting Standards Board generally prefers the direct method statement of cash flow both the direct and indirect methods of cash flow are in line with generally accepted accounting principles GAAP.

Cash flow statement-Indirect Method For the year ended December 31 2003. This transaction should be shown on the statement of cash flows indirect method as a n a. Two categories exist for direct cash flow cash coming from customers and cash disbursements.