Looking Good A Personal Cash Flow Statement Presents

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Take-home pay is a persons earnings after deductions for taxes and other items.

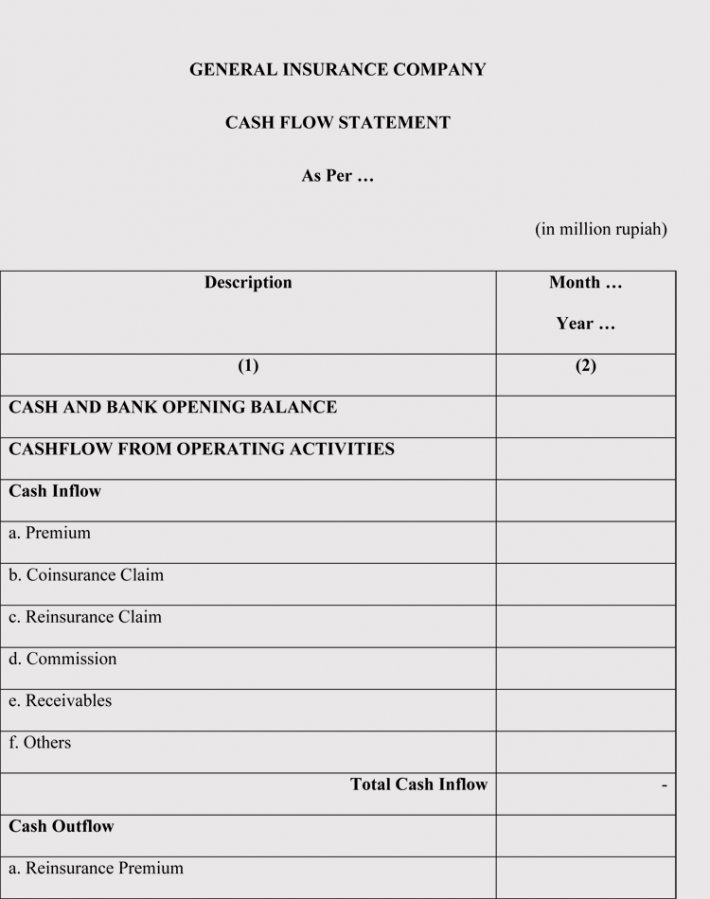

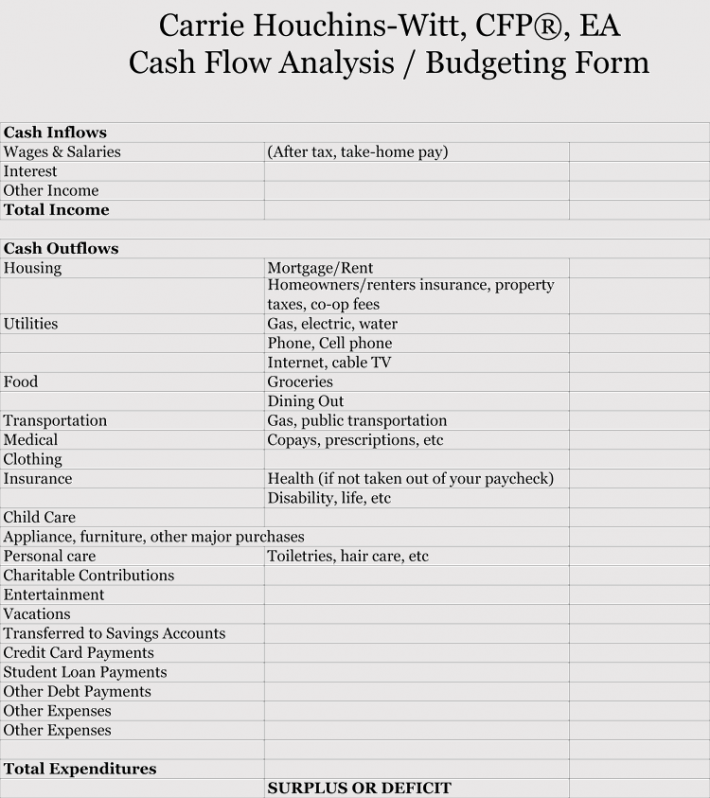

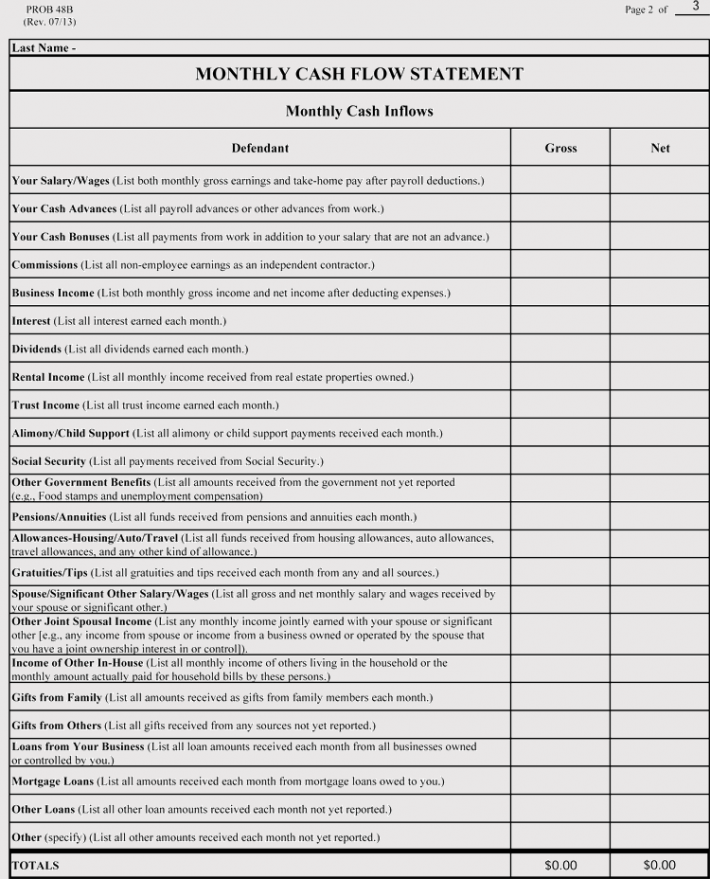

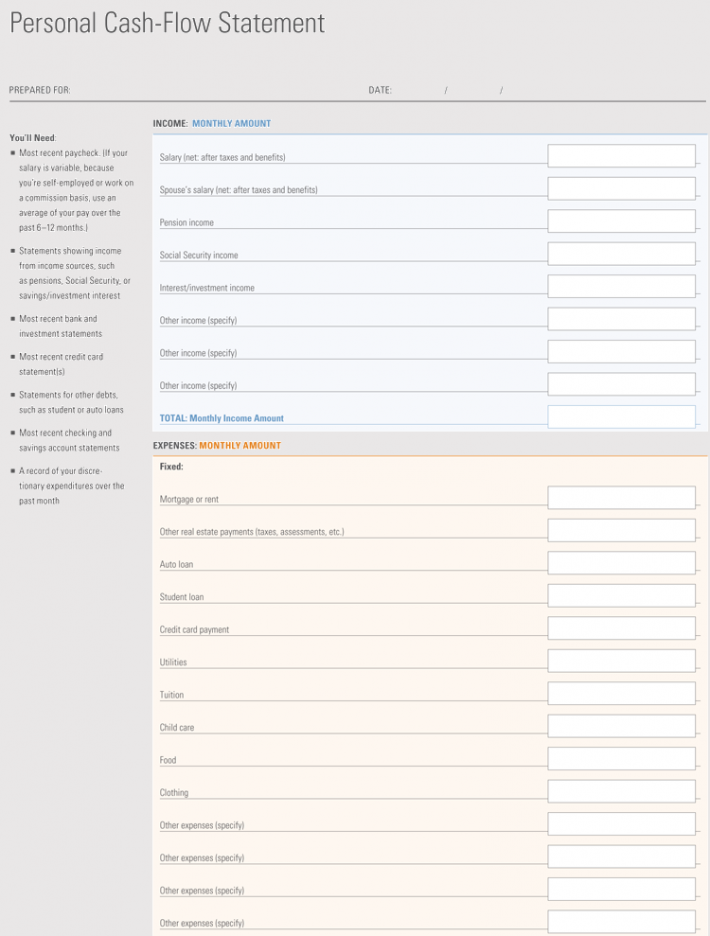

A personal cash flow statement presents. Indicate the cash flow from operating. This accessible simple cash flow template allows users to keep track of where their money is going with charts and daily monthly and yearly buckets. Its important to note that the cash flow statement covers the flows of cash over a period of time unlike the balance sheet that provides a snapshot of the business on a specific date.

It starts with the Net Income from the Income Statement. Cash flow statements shows a summary of cash _____. The heading of the cash statement it has three lines.

Steps To Create A Cash Flow Statement. Statement of Cash Flows also known as Cash Flow Statement presents the movement in cash flows over the period as classified under operating investing and financing activities. Easily modify this simple cash flow statement example to match your personal finances.

Along with balance sheets and income statements its one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. Personal balance sheet and the cash flow statement come from financial institutions businesses or the government. A cash flow statement tells you how much cash is entering and leaving your business.

This cash flow statement puts you in control of how to manage your cash. The cash flow statement measures how well a. Add total income and expenses and you have a personal cash flow statement.

If your cash flow statement is negative then it is time to look for ways to right the ship and turn things around. The first line contains the name of the company. Like the rest of the financial statements the cash flow statement is usually drawn up annually but can be.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)