Ace Provident Fund In Trial Balance

A Provident Fund is one type of investment that is jointly established by the employer and the employee.

Provident fund in trial balance. Employees Provident Fund Organisation EPFO in its circular dated 13 April 2018 has revised instructions to settle claims for Provident Funds PF and Employees Pension Scheme EPS withdrawals. Now total is equal to Employees contribution. Also note that your Aadhaar PAN and UAN must be linked to avail this service without any error.

Download the UMANG app. To get your PF balance through SMS type EPFOHO UAN ENG and send it to 7738299899. Each account should include an account number description of the account and its final debitcredit balance.

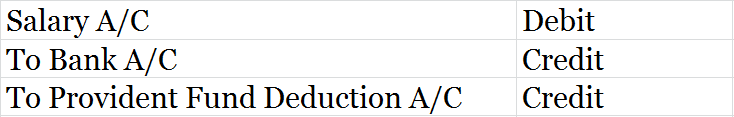

367 Provident Fund Ac 1 833 Pension Ac 10 110 Admin Charges onPF Ac 2 050 EDLI Ac 21 001 Admin Charges on EDLI Ac 22 Total employees provident fund. Payment of the Employees Provident Fund beyond the due date that is the 15th of the succeeding month would be liable to the payment of interest and penal damages by the lawyer. This can be done for reasons such as illness marriage housing etc.

Employers own contribution along with the employees share is. Access the EPFO website. If you arent you need to contact the responsible fund administrator.

In this scheme an employee has to contribute 12 of their basic income towards the fund every month. It also represents job welfare benefits offered to the employee. Passbook will be available after 6 Hours of registration at Unified Member Portal.

It is also governed by the Income Tax Act and the Pension Funds Act. Heres a look at the different ways in which you can check your PF balance. I want to know my provident fund balance.