Stunning Accumulated Depreciation Income Statement Schedule Vi Of Companies Act

Income statement when the asset is derecognized.

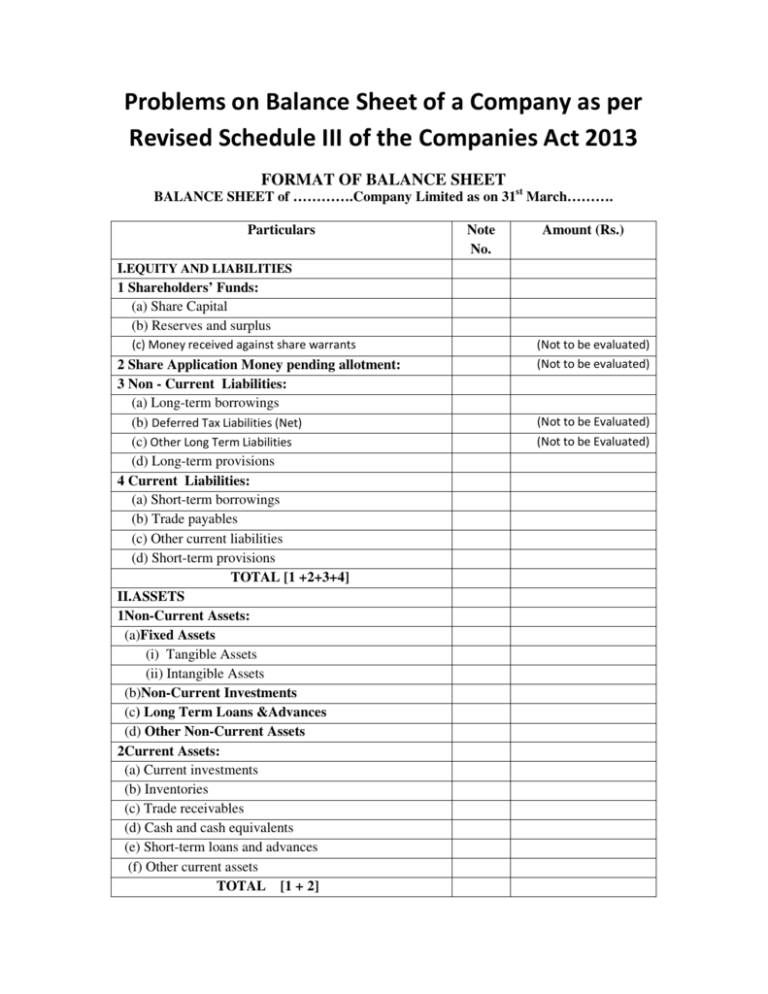

Accumulated depreciation income statement schedule vi of companies act. 3 Schedule III - Accumulated Provision for Depreciation and Amortization of Service Company Property 104 4 Schedule IV - Investments 105 5 Schedule V - Accounts Receivable from Associate Companies 106 6 Schedule VI - Fuel Stock Expenses Undistributed 107 7 Schedule VII - Stores Expense Undistributed 108. At the end of an assets operating life its accumulated depreciation equals the price the corporate owner originally paid assuming the resources salvage value is zero. This loss is charged to the Income Statement.

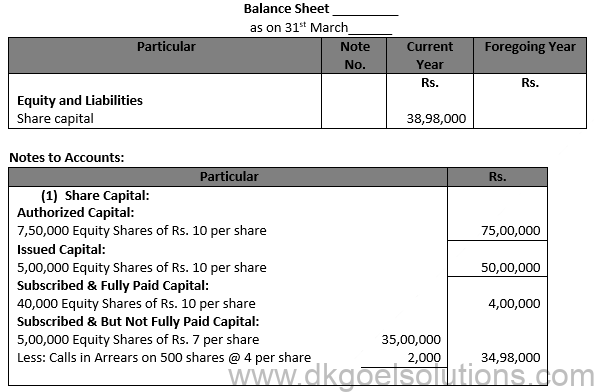

It is a contra-asset account a negative. Accumulated depreciation is the total depreciation expense a business has applied to a fixed asset since its purchase. Accumulated Depreciation 250 Carrying Amount 750 Provisions of Schedule VI to the Companies Act 1956 Part I of Schedule VI requires that if there is a revaluation or reduction in value of assets the balance sheet should show the increased or reduced figures in.

For 16 years ie from FY 2014-15 to FY 2029-30 higher depreciation would be charged. Accumulated depreciation is the total amount an asset has been depreciated up until a single point. These provisions are applicable from 01042014 vide notification dated 27032014.

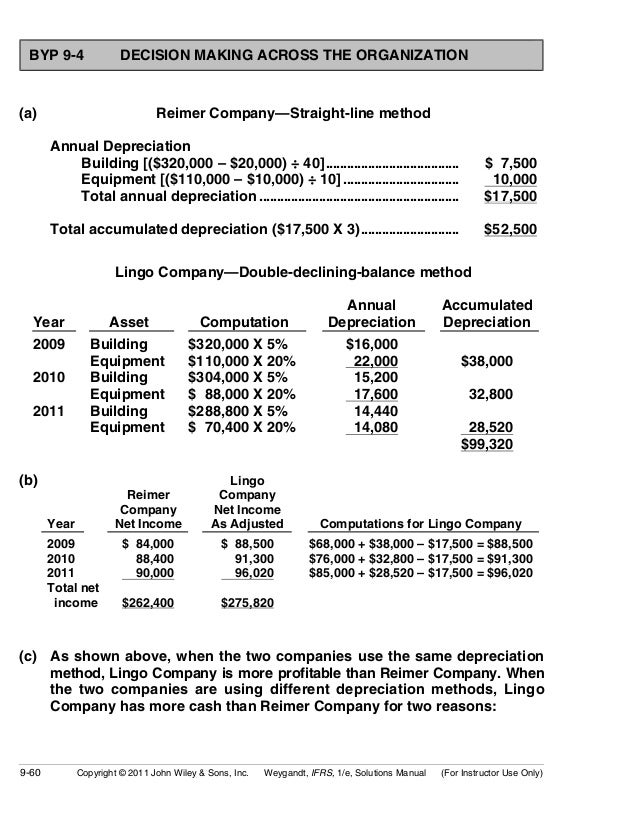

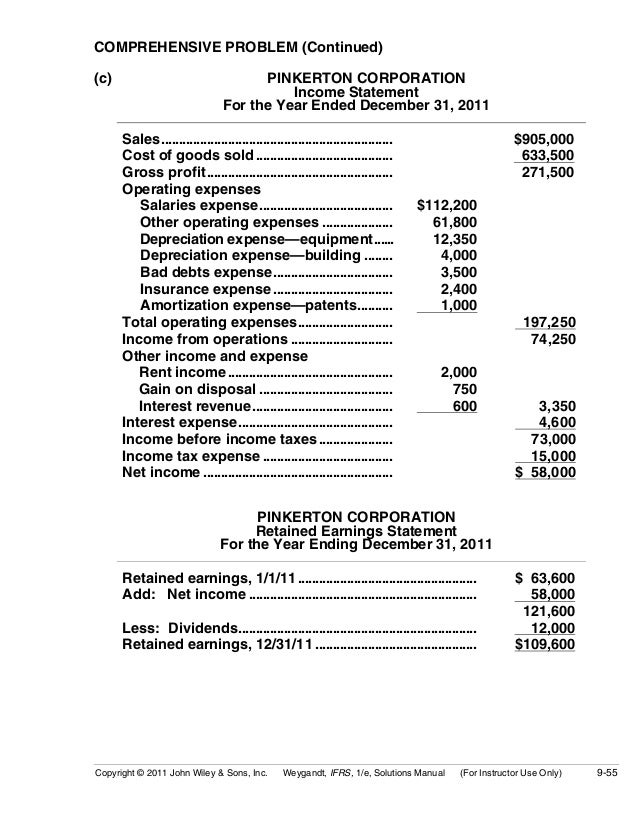

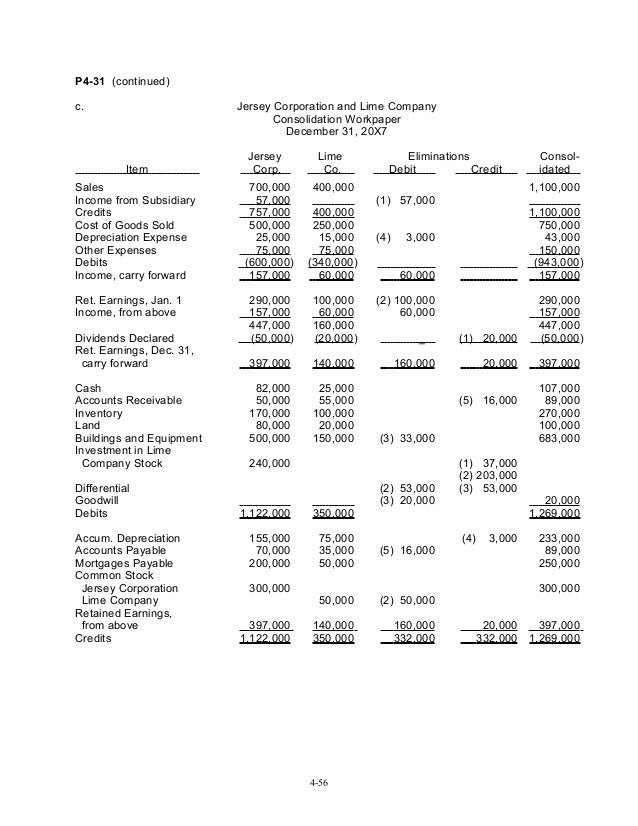

There are many depreciation methods that the entities could use. PPE is impacted by Capex since the asset was put into use. Depreciation expense is reported on the income statement as any other normal business expense while accumulated depreciation is a running total of depreciation expense reported on the balance.

Summarizing the depreciation schedule At the bottom of the depreciation schedule prepare a breakdown of the net change in PPE. Depreciation is calculated by considering useful life of asset cost and residual. Under the Companies Act the depreciation would be calculated on the basis of Useful life of the Asset.

Depreciation and amortization are on both though The Balance Sheet will typically show accumulated depreciation. Revised Schedule VI however do not apply to companies as referred to in the proviso to Section 211 1 and Section 211 2 of the Act ie any insurance or banking company or any company engaged in the generation or supply of electricity or to any other class of. Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)