Recommendation Statement Of Shareholders Equity Format

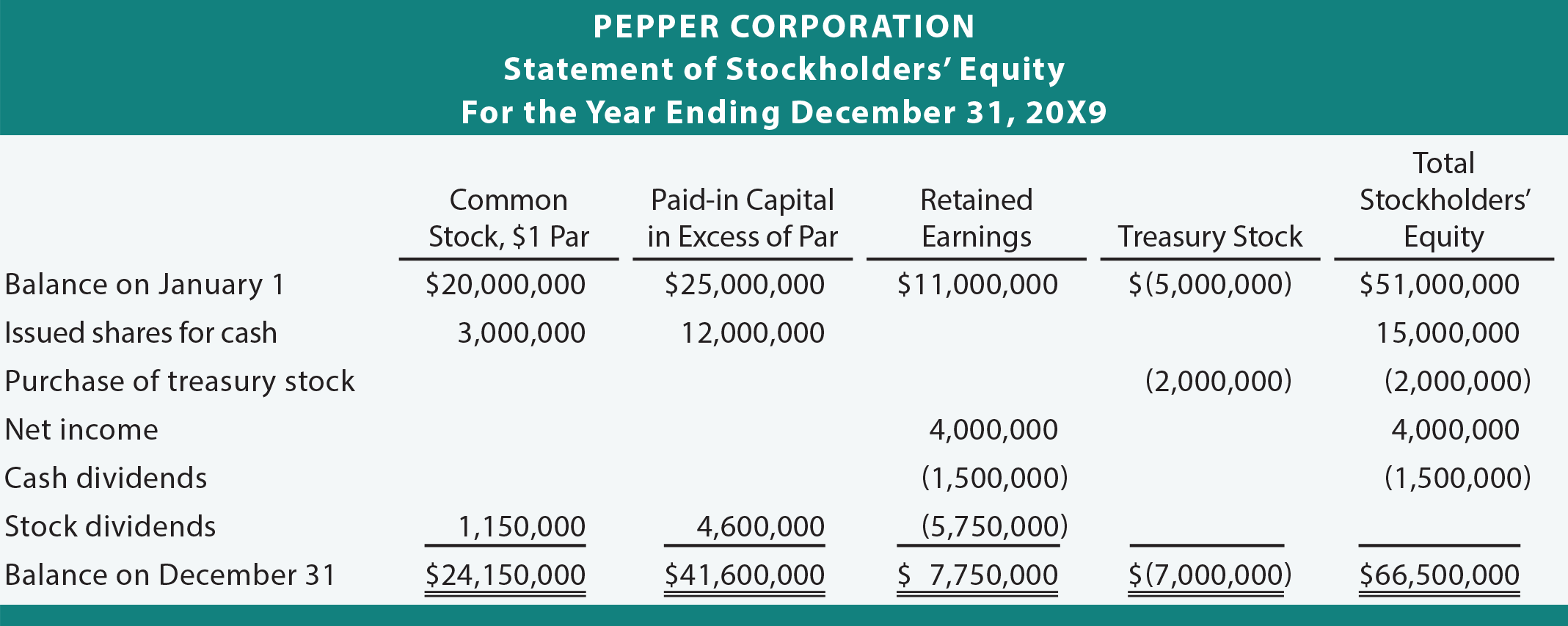

The equity components appear as column headings and changes during the year appear as row headings.

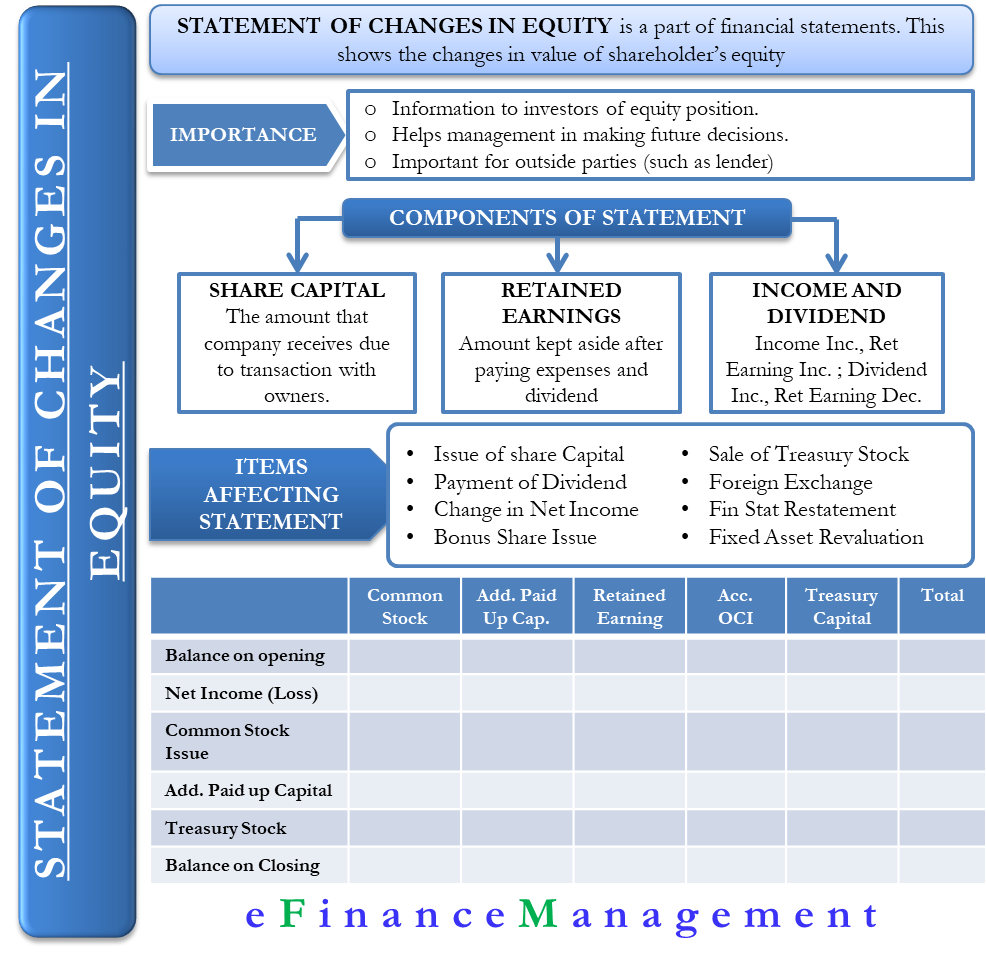

Statement of shareholders equity format. In this case it would be Statement of Changes in Owners Equity Statement of Owners Equity or simply Statement of Changes in Equity. The major components and headings in the statement of stockholders equity include. The statement consists of four sections.

Stock treasury stock additional paid-in capital and retained earnings. Things that cause changes in shareholder equity earnings dividends issuing stock and repurchasing stock The elements that typically make up the statement. This in depth view of equity is best demonstrated in the expanded accounting equation.

Movement in shareholders equity over an accounting period comprises the following elements. Additions during the period. Retained earnings or accumulated deficit when negative Accumulated other comprehensive income or loss Treasury stock an amount that is a subtraction A common format of the statement.

Statement of shareholders equity example. The first line contains the name of the company. Like any other financial statement the statement of stockholders equity will have a heading showing the name of the company time period and title of the statement.

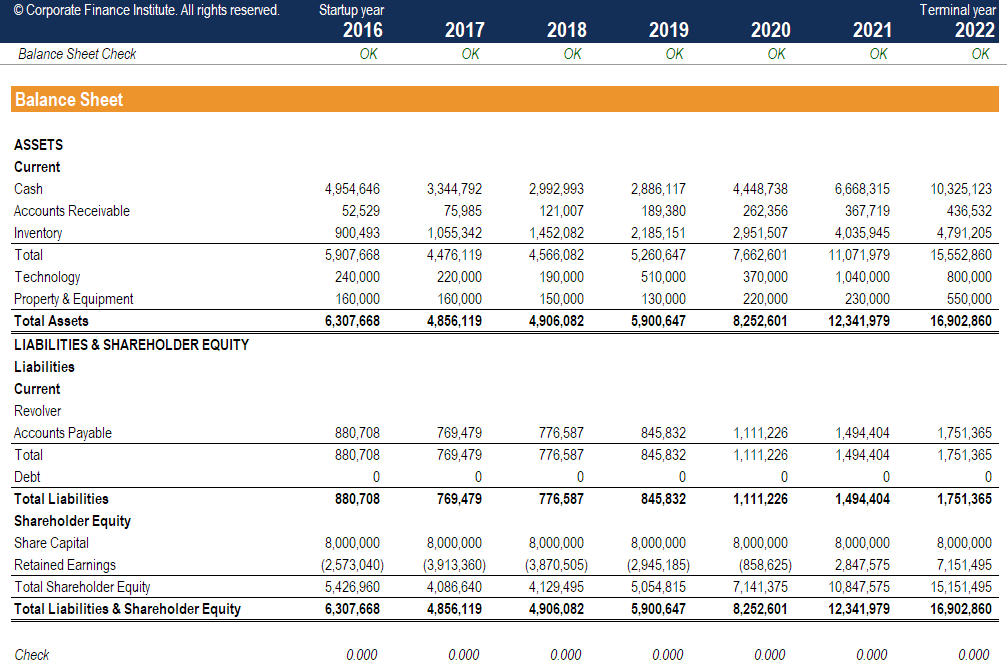

A statement of shareholder equity is a section of the balance sheet that reflects the changes in the value of the business to shareholders from the beginning to the end of an accounting period. Format of Statement of Stockholders Equity Since the statement includes net incomeloss a company must prepare it after the income statement. It contains share capital and retained earnings.

Under international reporting guidelines the preceding statement is sometimes replaced by a statement of recognized income and expense that includes additional adjustments for allowed asset revaluations surpluses. If the statement of shareholder equity increases it means the activities the business is pursuing to boost income are paying off. It highlights the changes in value to stockholders or shareholders equity or.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)