Exemplary Carillion Financial Statements

Carillion PLC Annual stock financials by MarketWatch.

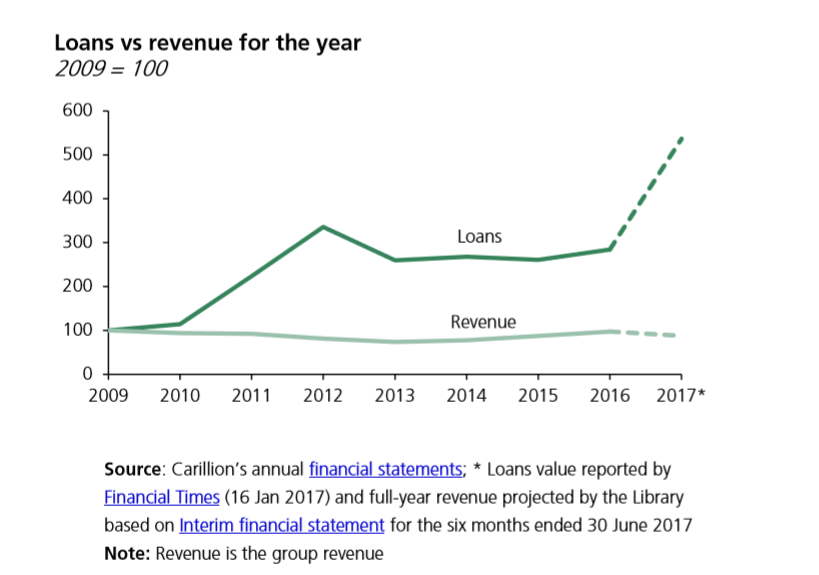

Carillion financial statements. At the time of its collapse in January 2018 Carillion had 29m in cash and owed more than 13bn to its banks and had a pension deficit of about 800m Bloomberg Share on Twitter opens new. As SP flagged up in March in its 2013 financial statement Carillion mentioned that it had begun using an early payment facility but did not explain what this meant. Carillions financial statements offered no clue as to how it was accounting for long-term contracts.

Report and financial statements 55 Independent auditors report to the members of Carillion plc Financial statements 56 Consolidated income statement 57 Consolidated statement of comprehensive income 58 Consolidated statement of changes in equity 59 Consolidated balance sheet 60 Consolidated cash flow statement. However the company earned 7330m from its operations for a Cash Flow Margin of 167. The company had a joint venture with hospital infrastructures which is.

They presented to us as self-pitying victims of a maelstrom of. Get detailed data on venture capital-backed private equity-backed and public companies. A set of financial statements with an unqualified audit opinion should be able to give investors some comfort as to the performance of their investments.

Carillions board Carillions board are both responsible and culpable for the companys failure. In September 2017 Carillions half-year financial statements showed that the companys operating profit before tax fell to minus 12b Carillion 2017. The FCA did not name individuals but said.

A new accounting standard IFRS 15 will shortly come into force offering much more rigour and disclosure about the measurement of revenues on. View Carillion stock share price financial statements key ratios and more at Craft. View the latest CLLN financial statements income statements and financial ratios.

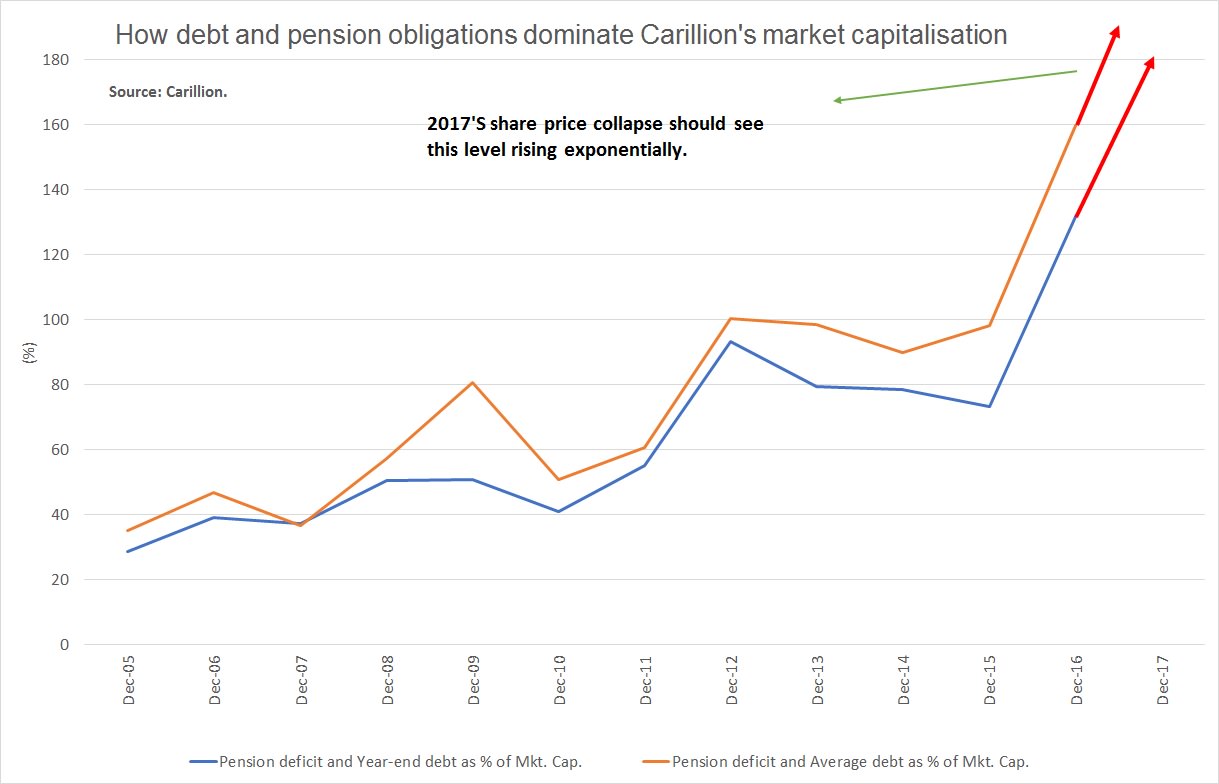

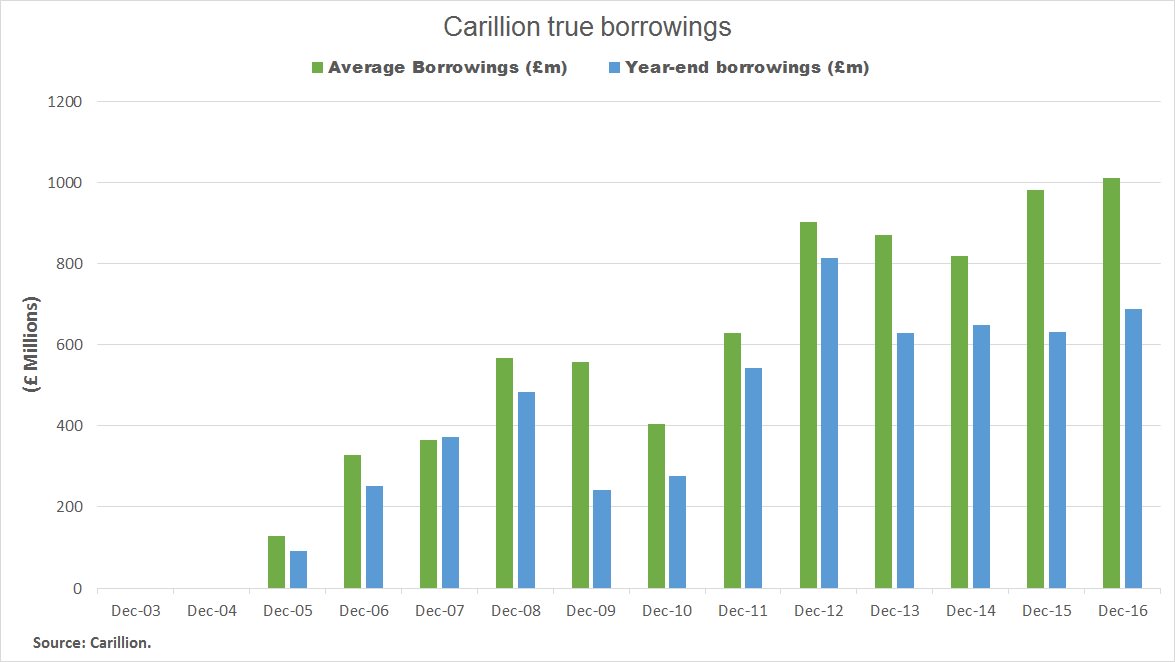

Carillion was a heavy user of reverse factoring leading it to rack up hundreds of millions of pounds in debt to its supply chain without recording it as such. Carillion went into liquidation in January 2018 with liabilities of nearly 7 billion and just 29 million in cash. Carillion under fire for raising dividend as pension deficit grew.