Fabulous Cash Flow Statement Exemption

On enactment of the European directive 201334 by Ireland it will be possible for small Irish companies to claim exemption from presenting a cash flow statement.

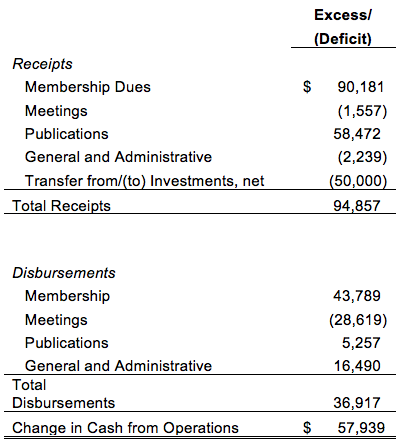

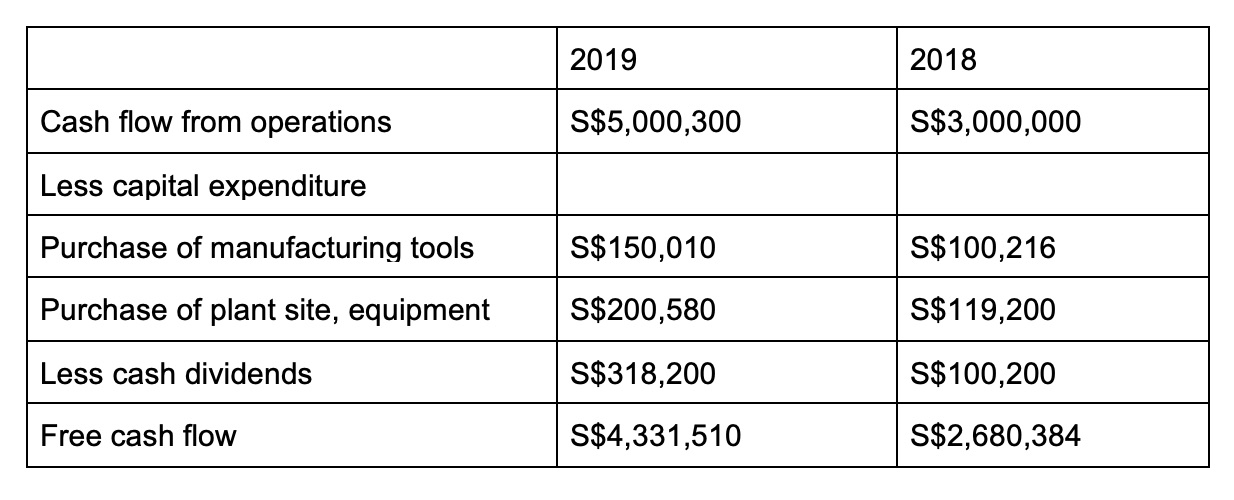

Cash flow statement exemption. An M would be entered in the size of company box in this situation. Cash flows are classified as either operating investing or financing activities depending on their nature. It is a statement that provides detailed analysis by which enterprises can determine the capacity of an organisation to generate cash and cash equivalents and planning on utilising such available cash into the business.

The statement of cash flows primarily that in ASC 2301 The accounting principles related to the statement of cash flows have been in place for many years. However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters. Paragraph 31B allows an entity that qualifies as small regardless of the reporting regime it applies to take an exemption unless a relevant SORP law or other relevant regulation prevents it from doing so.

On enactment of the European directive 201334 by Ireland it will be possible for small Irish companies to claim exemption from presenting a cash flow statement. Definition of Financial Statement as per CA 2013. Reduces profit but does not impact cash flow it is a non-cash expense.

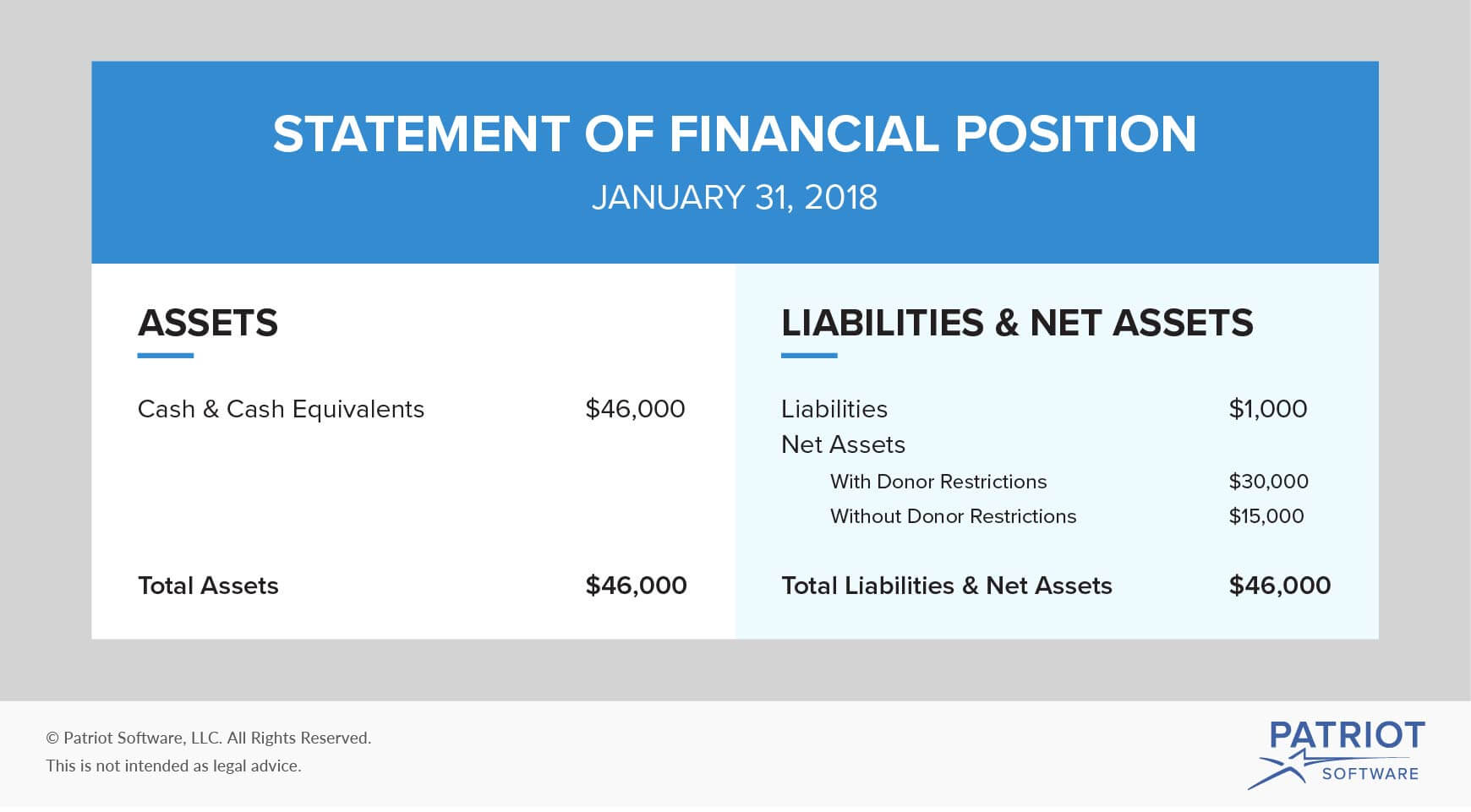

Disclosure exemptions FRS 101 paragraph 8 h states that a qualifying entity is exempt from preparing a statement of cash flows. Statement of Cash Flows - Exemption of Certain Enterprises and Classification of Cash Flows from Certain Securities Acquired for Resale - an amendment of FASB Statement No. Statement of cash flows reports A by B.

Under the small entity provisions within S1A of FRS 102 small companies who are not subsidiaries can claim exemption from preparing a cash flow statement. 95 Statement of Cash Flows to exempt from the requirement to provide a statement of cash flows a defined benefit pension plans covered by FASB Statement No. The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in.

All larger charities will be required to prepare a statement of cash flows. If the company is medium or large then a Cash Flow Statement is typically produced so no exemption would be shown this screen is not applicable to medium or large companies. Generally speaking investment companies are exempt from presenting a statement of cash flows in their semi-annual and annual reports provided they meet three conditions.