Heartwarming Investment In Subsidiary Elimination Entry

CR Investment in sub.

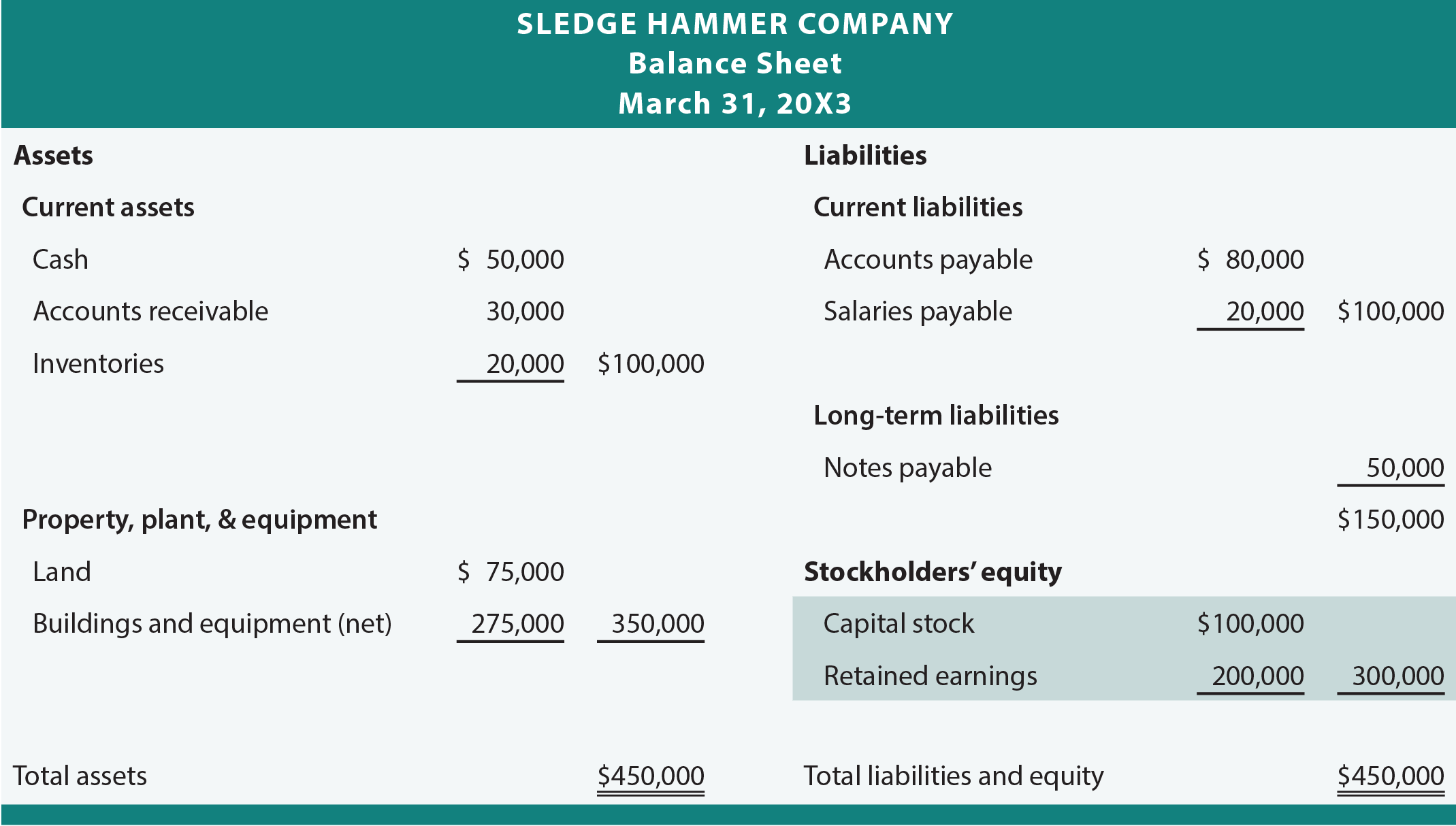

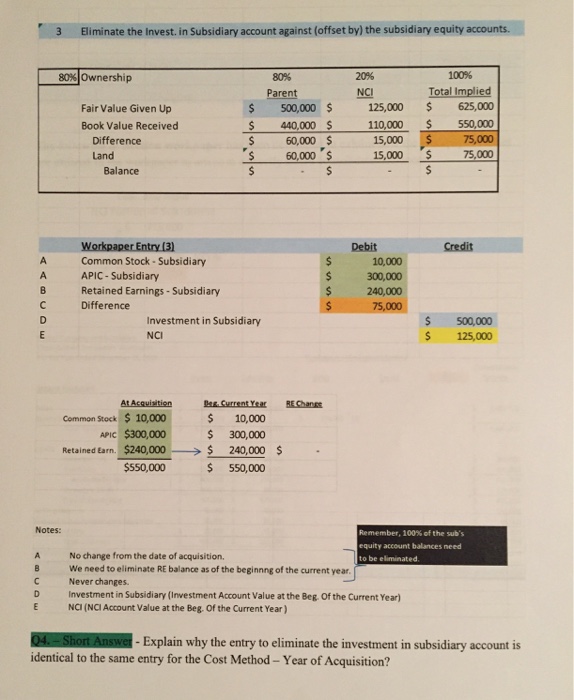

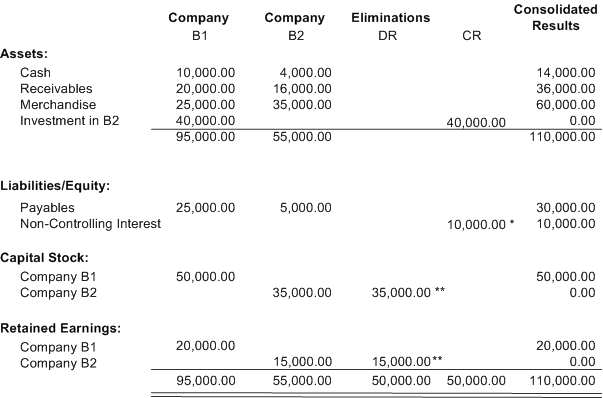

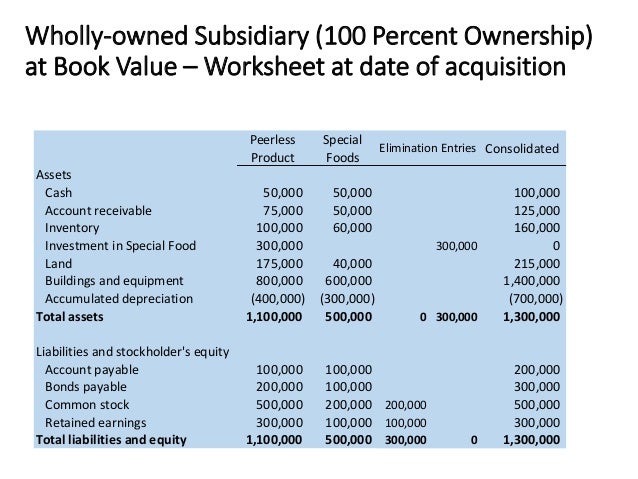

Investment in subsidiary elimination entry. In the consolidated balance sheet eliminate intercompany loans and the amount of capitalised interest from any outstanding intercompany loans. 1 The subsidiarys paid-in capital accounts original investment 2 Beginning retained earnings past earnings dividends. Types of Elimination Entries 1.

Thus on the consoldiated BS there was no investment but there was a Goodwill as an Intangible FA. Assuming the investment is held at cost then the entry will be. Therefore the elimination entry eliminates.

Whereas the subsidiary company will report the same transaction as equity in its balance sheet. The investment account represents the initial investment adjusted for the parents cumulative share of the subsidiarys income and dividends. DR Reserves of sub at time of acquisition.

Some other elimination entries need to be placed in the consolidated workpapers each time consolidated statements are prepared for a period of years. The investment in the subsidiary. Eliminate inter-company investments -- that is is the parents shareholding stakes in the subsidiaries.

This is when a subsidiary borrows from a parent for capital investments eg to build an office building. The DebitCredit columns reflect a worksheet only entry that will be used to process the elimination of the 400000 Investment account against the 300000 equity of the subsidiary 200000 capital stock and 100000 retained earnings. Elimination of intercompany debt.

The existing groups Parent had an Investment in Subsidiary which was eliminated on consolidation - Cr. If 100 share capital of an entity is owned by the parent company then such an entity will be referred to as wholly-owned subsidiary. The parent company will report the investment in subsidiary as an asset in its balance sheet.