Unbelievable Cash Receipts From Interest And Dividends Are Classified As

Either financing or investing activities.

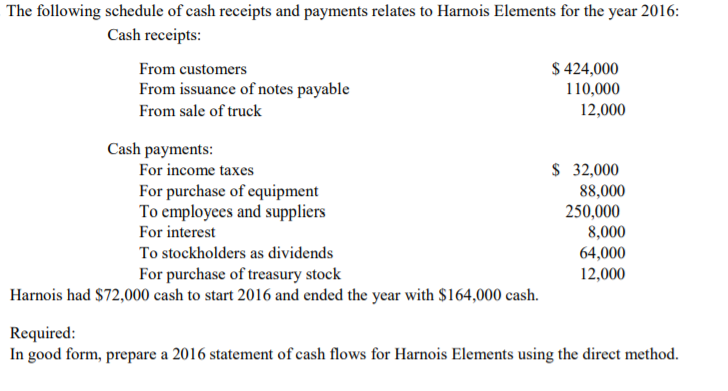

Cash receipts from interest and dividends are classified as. On a statement of cash flows prepared by using the direct method cash receipts from interest and dividends are classified as. Financing activities O B. Cash receipts from interest and dividends are classified as a.

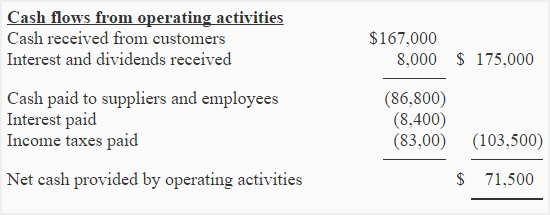

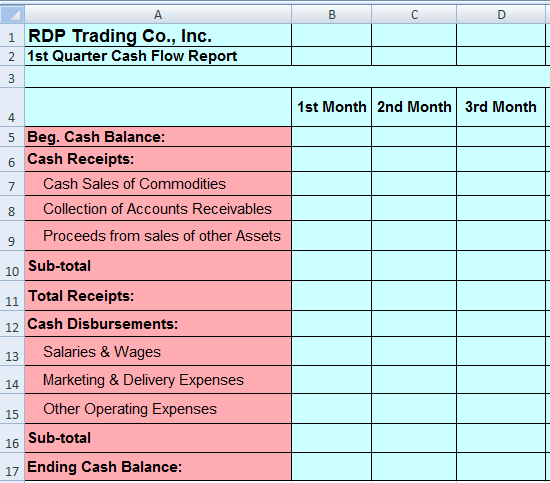

Alternatively interest paid and interest and dividends received may be classified as financing cash flows and investing cash flows respectively because they are costs of obtaining financial resources or returns on investments. Cash flows received from interest and dividends are classified as operating activities on the statement of cash flows per US GAAP. Question 17 Cash receipts from interest and dividends are classified in the Statement of Cash Flows as A operating activities.

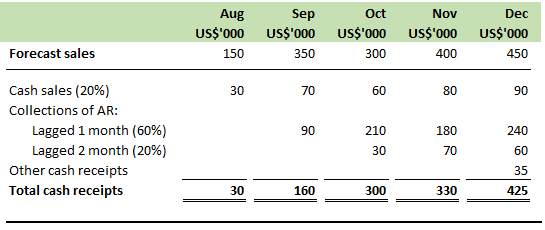

Cash receipts from interest and dividends are classified as. Other cash receipts not classified in the other categories. Cash receipts from futures contracts forward contracts option contracts and swap contracts classified as investing activities Dividends received classified as investing activities Interest paid classified as investing activities.

Cash will soon become extinct as it happened with the first money. Shells skins and minted coins. Interest paid and interest and dividends received may be classified as operating cash flows because they enter into the determination of profit or loss.

Investing activities O C. Harden Corporation engaged in the following transaction. The state wants to control everything including cash turnover.

That means in case of statement of cash flows relating to financial institutions things are clear. Payment of interest and dividend are shown as cash inflows being non-operating expenses Receipt of interest and dividend are shown as cash outflows being non-operating incomes. Where are interest and dividends classified on statement of cash flows.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)