Formidable Debenture Sinking Fund In Cash Flow Statement

As on 310316 As on 310315 I Equity and Liabilities 1.

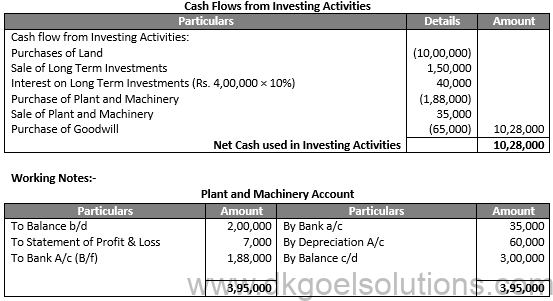

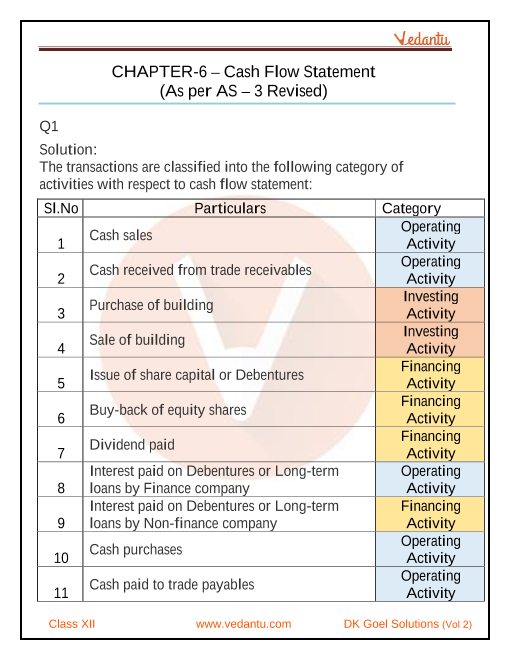

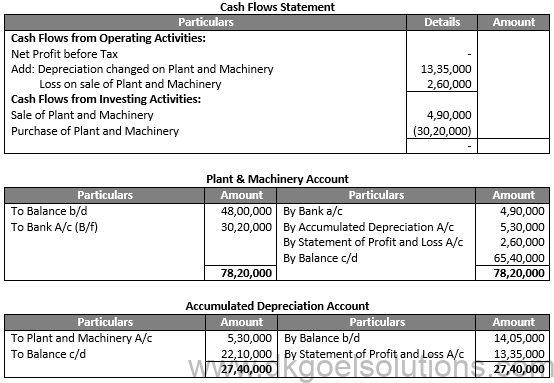

Debenture sinking fund in cash flow statement. Debentures with the exception of the Series C Debenture which has an annual sinking fund of 909 are redeemable at the greater of par value and the discounted value of future cash flows using an interest rate based on US. A From the following information provided prepare a Cash Flow Statement as per AS-3. Sinking fund means take one part of profit for repayment of debenture.

Treasury Securities and Canadian government bonds respectively having similar maturities. In corporate finance a debenture is a medium- to long-term debt instrument used by large companies to borrow money at a fixed rate of interest. The issue of debenture helps the company in borrowing the bulk amount od debts from the large section of the general public.

Simply estimate the annual budgeted amount for each of the items you have selected to include in your sinking fund. 1 It highlights the different sources and applications or uses of funds between the two accounting period. Fund flow statement.

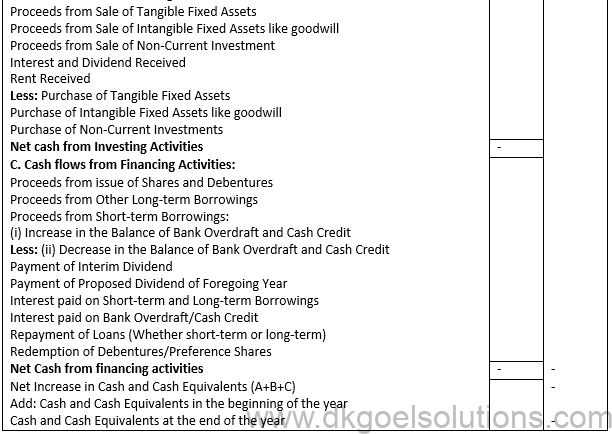

Fund Flow Statement 179 Importance or Uses of Fund Flow Statement Fund Flow Statements are prepared for financial analysis in order to meet the needs of people serving the following purposes. After studying and solving these problems you can solve any types of questions related to fund flow statement. IAS 7 Statement of Cash Flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

Balance Sheet of PQR Ltd. This is invested in such scheme which gives us Lumbsum amount so that we can easily repay the debenture without any tension. The legal term debenture originally referred to a document that either creates a debt or acknowledges it but in some countries the term is now used interchangeably with bond loan stock or note.

Sinking Funds debenture issues are grouped by sinking fund interest rates. A debenture is thus like a certificate of loan or a loan bond evidencing the. Then total the individual estimates and divide by 12 to convert the annual total to a monthly amount.