Impressive Audit Of Accounts Receivables Problems And Solutions

Managing your AR effectively can help smooth out your finances and keep your company healthy and growing.

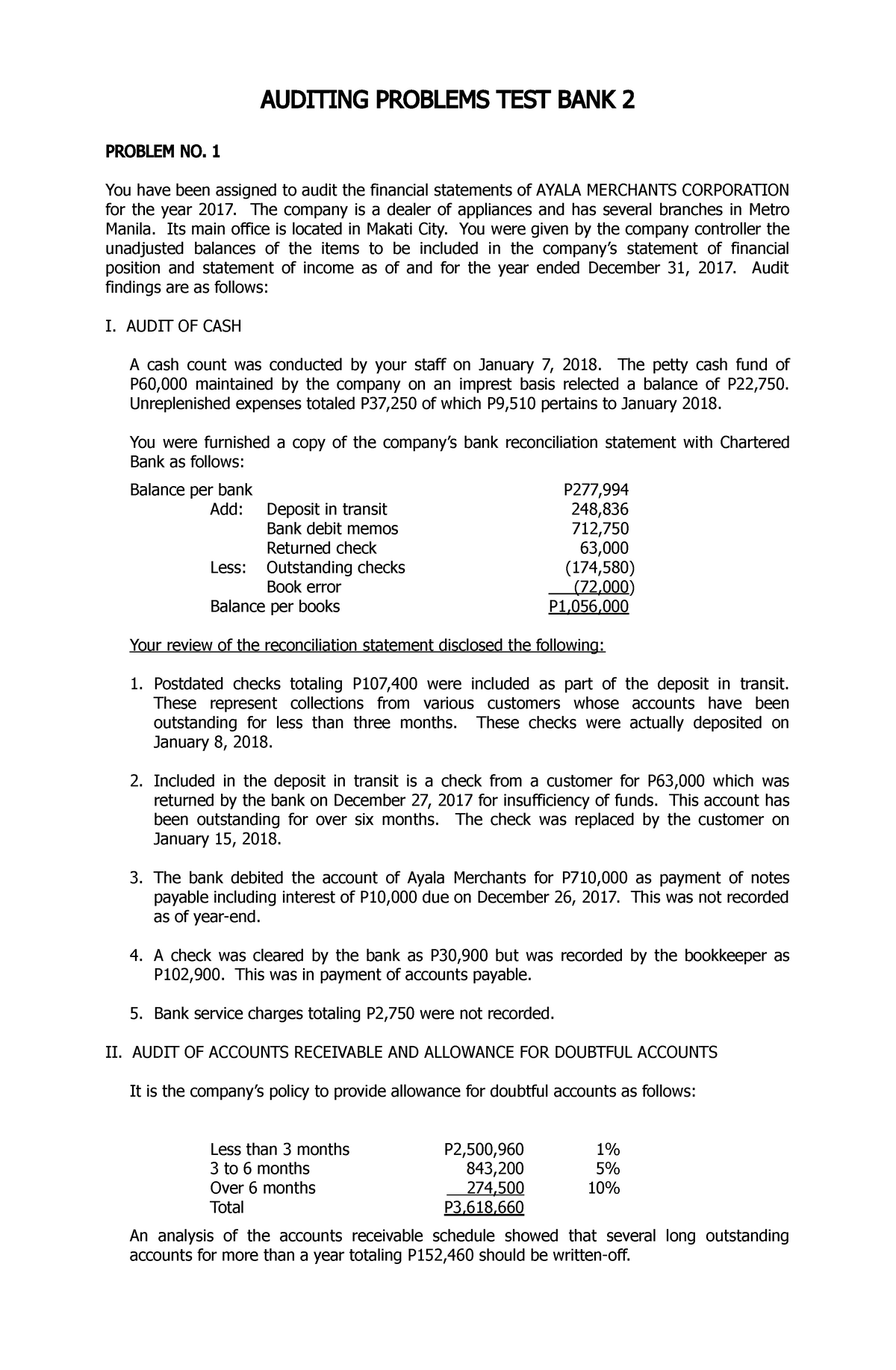

Audit of accounts receivables problems and solutions. Accounts receivables AR are the lifeblood of your company. AP CASH CASH EQUIVALENTS Q. Applying analytical procedures to find any unusual differences and reasons behind them.

AP INVENTORIES QUIZZER Q. The key is knowing that the audit process is designed to help the organization find issues or nonconformities before someone else does or before they become major issues. The following data are available.

Assess the allowance for doubtful accounts. 20000 48000 16000 P 52000. So in performing your audit procedures perform procedures to ensure that accounts receivables and revenues are not overstated.

Audit standards require that auditors review estimates for management bias. Write-off 100000 ALLOWANCE FOR BAD DEBTS Jan. A Problem 2 In your audit of MENDOZA COMPANY for the past calendar year you find the following accounts.

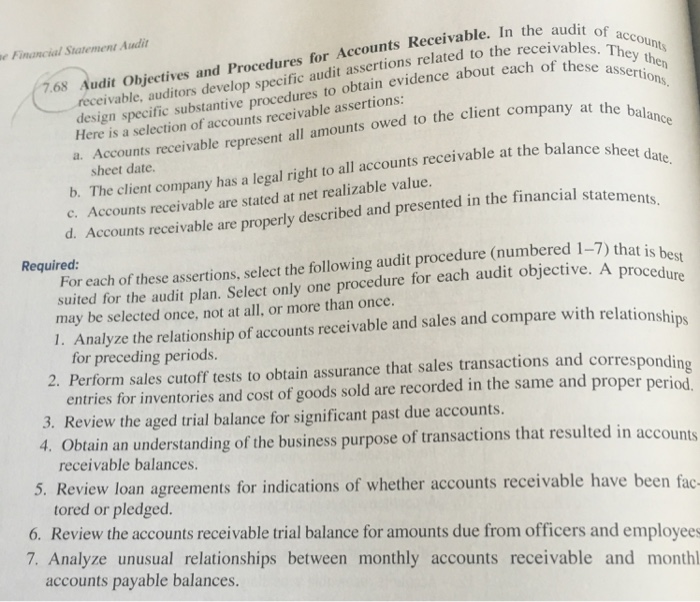

1 2002 P 95000 last years receivables P 85000 Dec. Ad Choose Your Accounts Payable Tools from the Premier Resource for Businesses. Chapter audit of receivables problem the accounts receivable of franco company were stated at in balance sheet submitted to banker for credit.

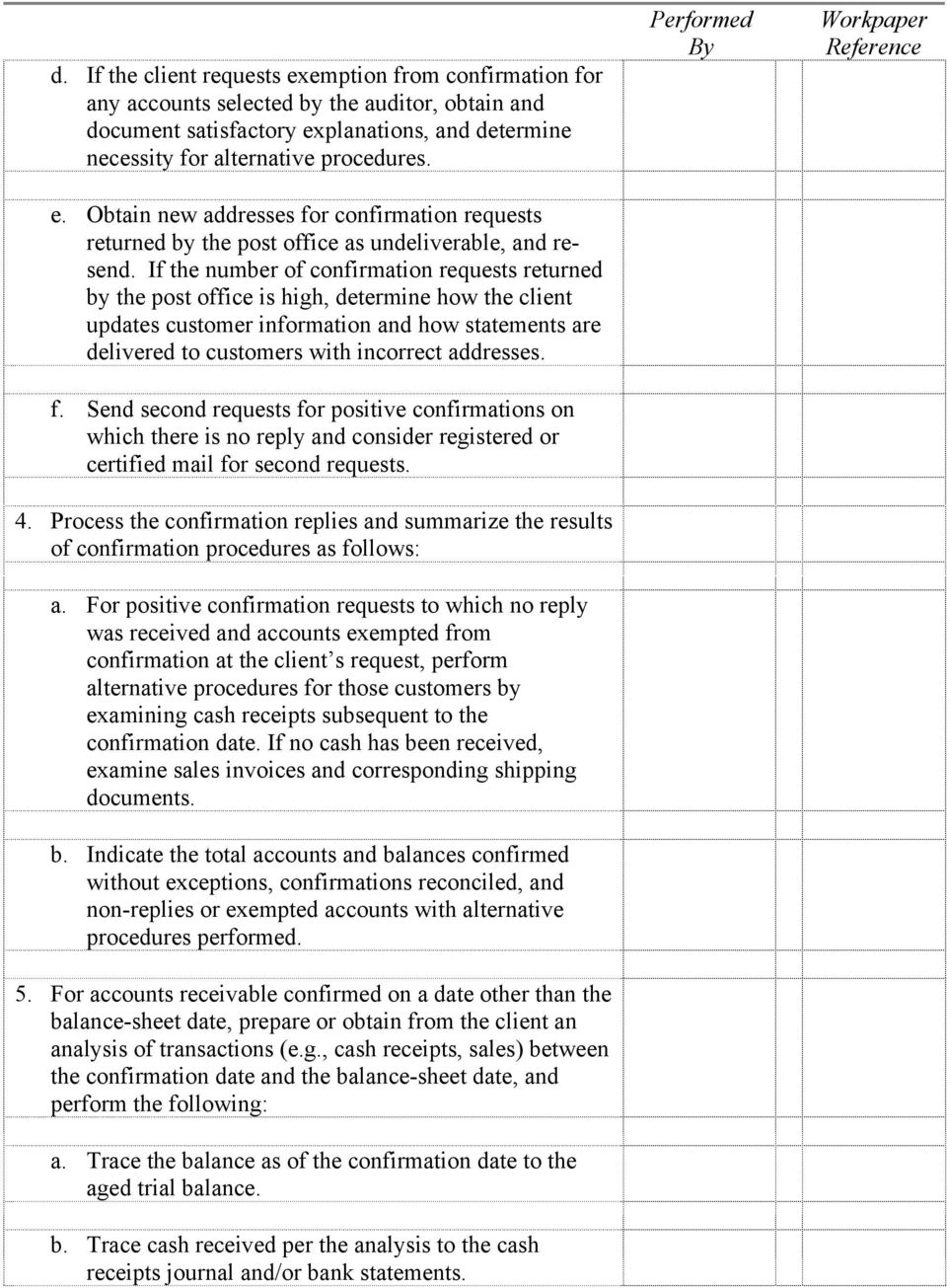

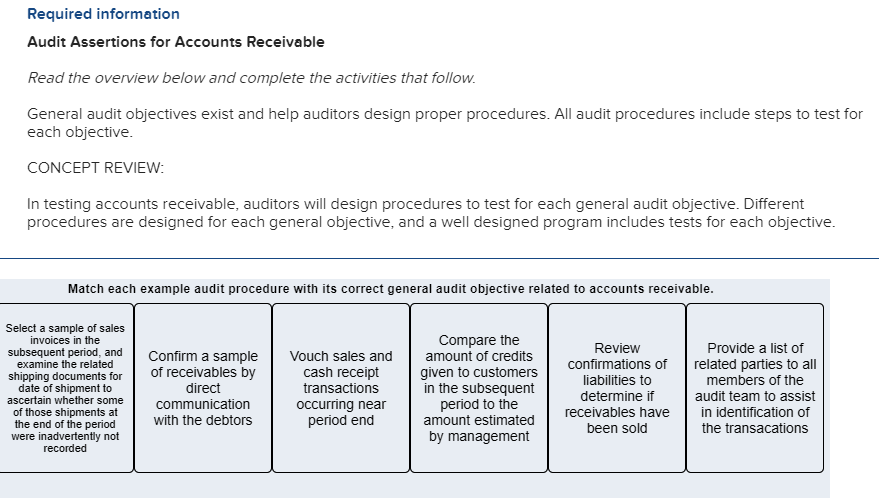

OTHER COMMON AUDIT PROBLEMS INCLUDE FAILURE to exercise due professional care and the appropriate level of professional skepticism overreliance on inquiry as a form of audit evidence deficiency in confirming accounts receivable failure to recognize related party transactions and assuming internal controls exist when they may not. Beginning balance Provision per general ledger Write-offs Balance end. For example review the cutoff procedures at period-end.