Favorite Debit Balance Of Profit And Loss Account Balance Sheet Sample Problem

Understand the procedure of Preparing trading and profit and loss account and balance sheet of a business.

Debit balance of profit and loss account balance sheet sample problem. The following trial balance have been taken out. The stock on 21st December 1991 was valued at 25000. On the left hand side of the statement the liabilities and capital are shown.

Let us understand the trading account and profit and loss account in detail. 43500 will deduct from sundry debtors in balance sheet5 Provide for Income Tax 50Calculate net profit before charging income tax in profit and loss account and then calculate its50 and it will be shown as provision for income tax in the debit side of profit and loss accountand also it will be shown in the liability side in balance sheet6. Since stock at the end is an asset it will betaken to balance sheet.

The accounting equation and the double entry system provide an explanation why a companys profit appears as a credit on its balance sheet. Answer verified by Toppr. Green as at 31 march 2015.

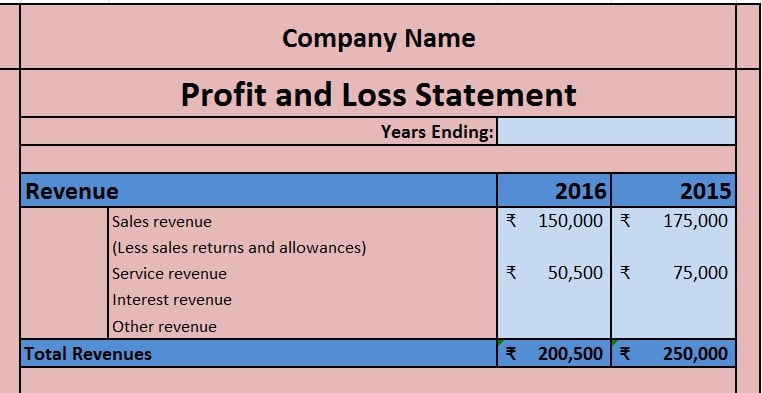

Assets liabilities and equity. Balances Opening stock on 1st April 2011 16000 Capital 80000 Purchases 75000 Sales 200000 Sales returns 5000 Purchases returns 2000. Create an income statement for 20xx year from the following data.

Recall the accounting equation we learned above. The debit balance of a profit and loss account denoted loss. The credit entry of 145000 is the gross profit for the period.

Profit and loss account shows the net profit and net loss of the business for the accounting period. The stock on 21st December 1991 was valued at 25000. The balance sheet and the profit and loss PL statement are two of the three financial statements companies issue regularly.