Formidable Comparative And Common Size Statement Business Balance Sheet Example

There are two types of comparative statements which are as follows.

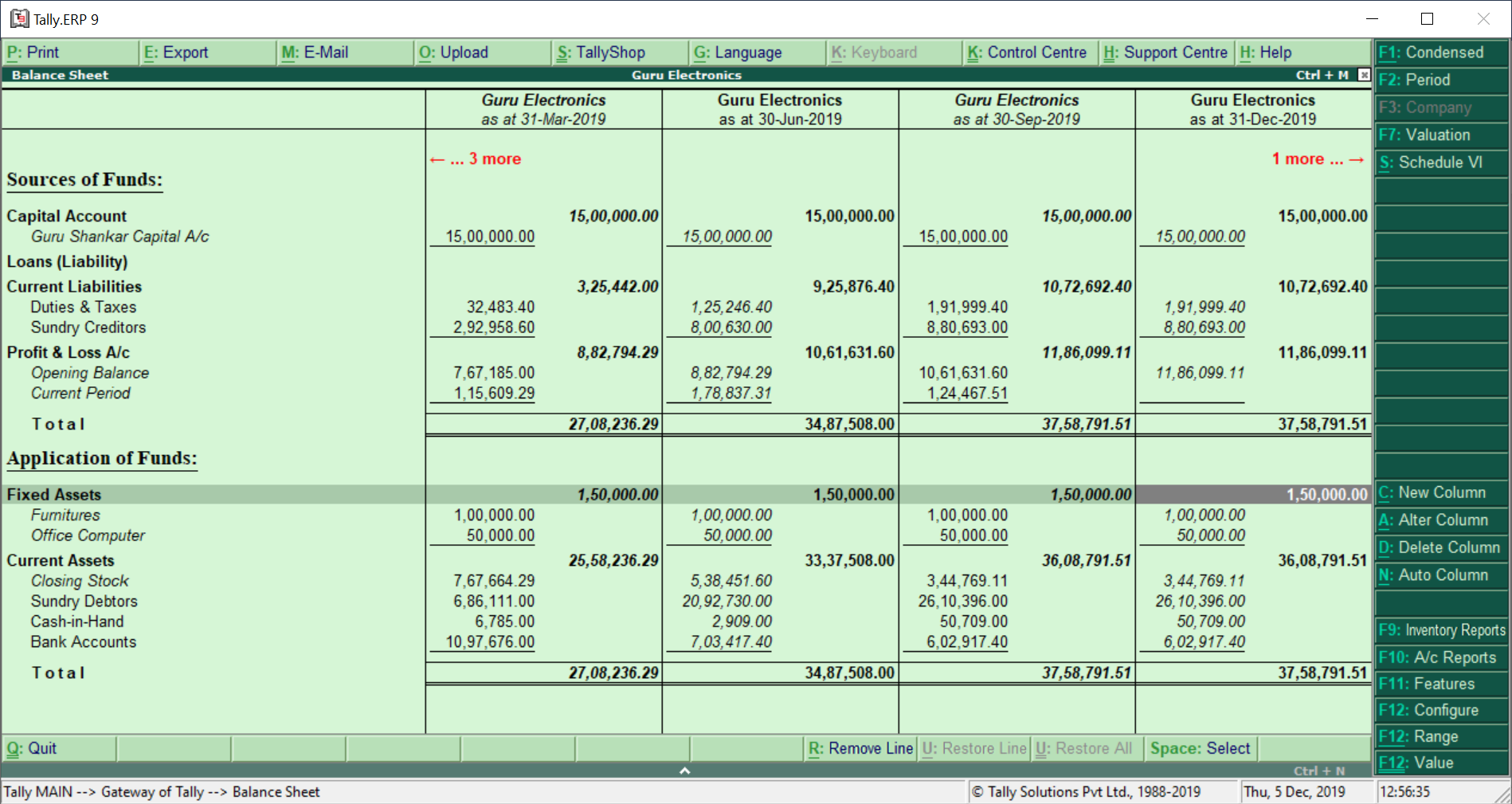

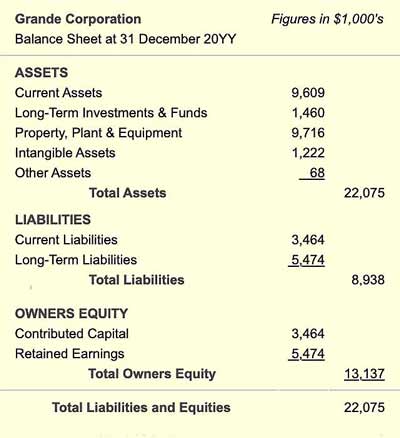

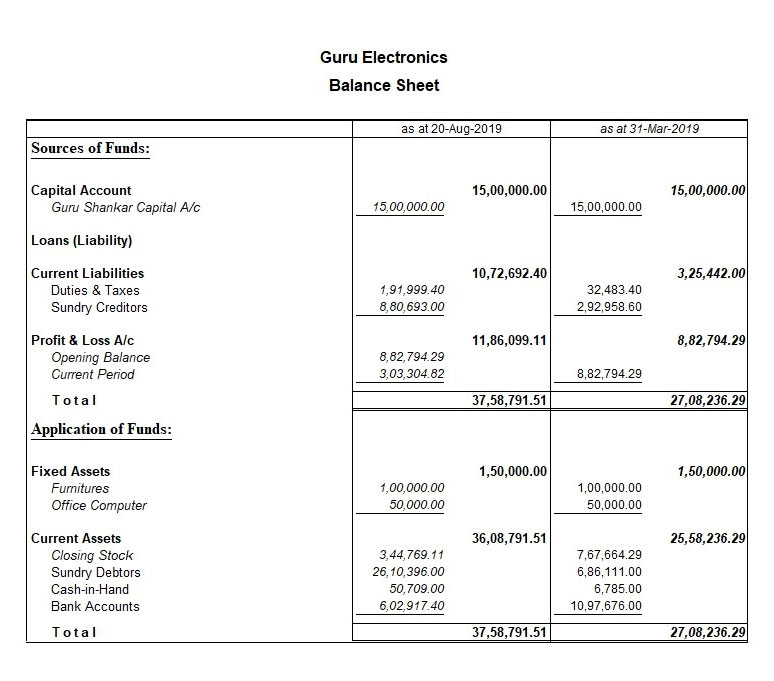

Comparative and common size statement business balance sheet example. For full course visit. Another variation is to present the balance sheet as of the end of each month for the past 12 months on a rolling basis. Common size statements are useful in comparing results with similar companies.

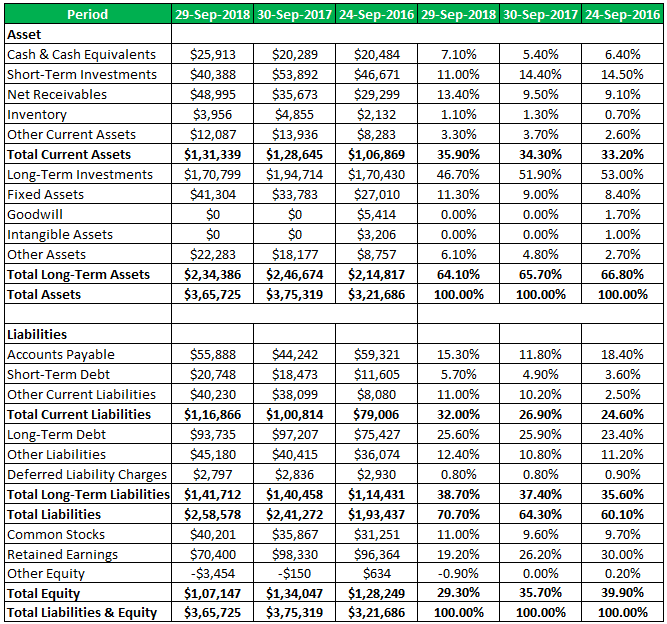

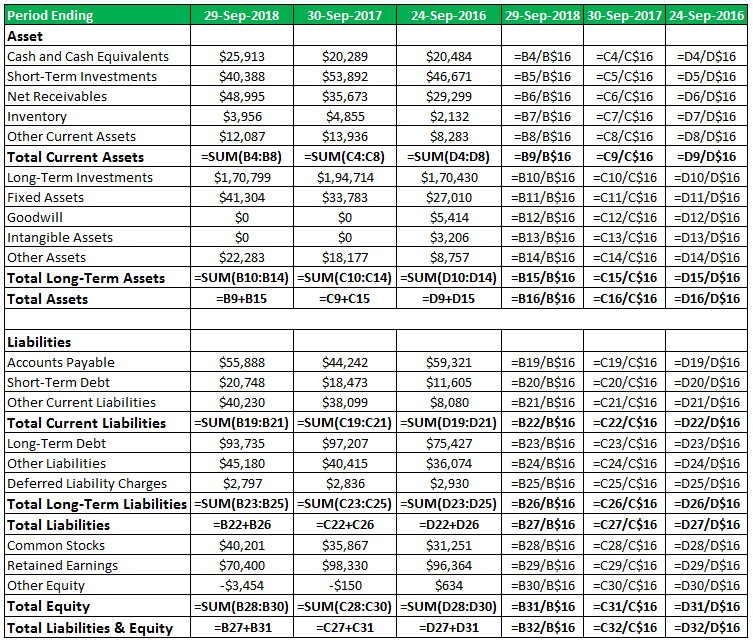

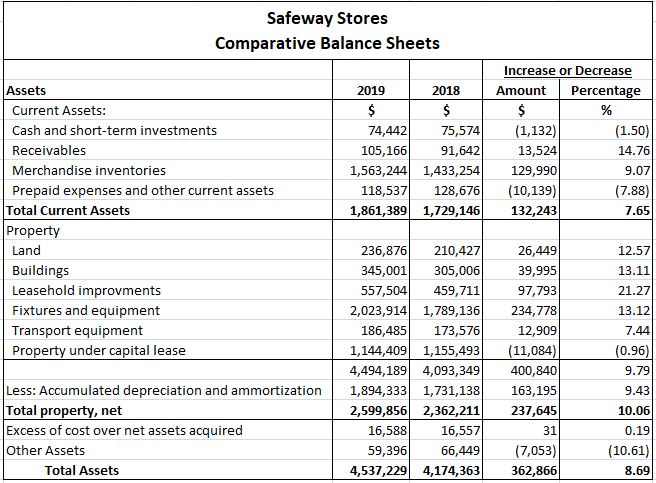

Common-size financial statements present all items in percentage terms. A date-to-date comparison within the company helps a business owner or investor identify financial performance trends over time. In the comparative statement the base year values are compared with the current year and in the common size statement the value of the current year compared by calculating the share of the percentage of the particular item out of the total of the balance sheet or net sale if comparing profit and loss account.

91-8800215448In this lecture I have discussed and explained the format procedure and utilit. Typically investors will look at a companys common size balance sheet and common size income statement. Balance Sheet provides information about financial position of the enterprise.

For example a comparative balance sheet could present the balance sheet as of the end of each year for the past three years. Common size analysis can be conducted in two ways ie vertical analysis and horizontal analysis. Stakeholders use financial statements to gather information about an organization and perform financial analysis.

For example if total sales revenue is used as the common base figure then other. By Sathish ARJul 24 20199 mins to read. The decrease of cash from 98 of total assets to only 19 is highlighted here.

Balance sheet items are presented as percentages of assets while income statement items are presented as. Lets take a look at an example of a normal balance sheet and a common size balance. Each item ofasset as a percentage of totalasset andeach liability as.