Fabulous Deferred Tax Expense In Income Statement

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

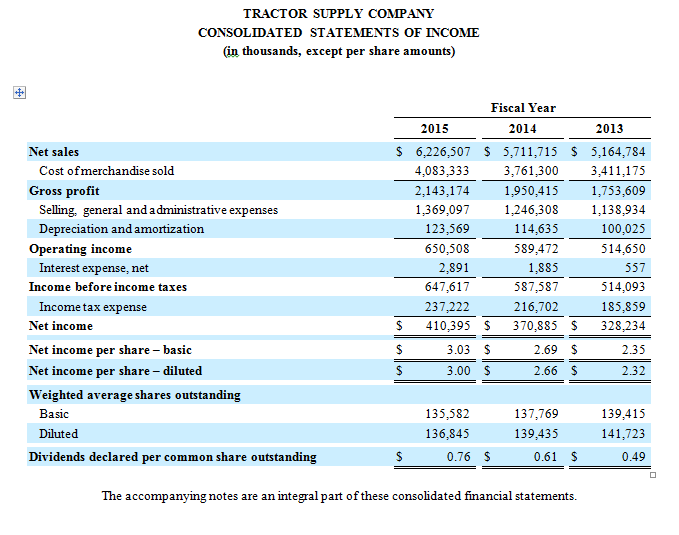

Like deferred revenues deferred expenses are not reported on the income statement.

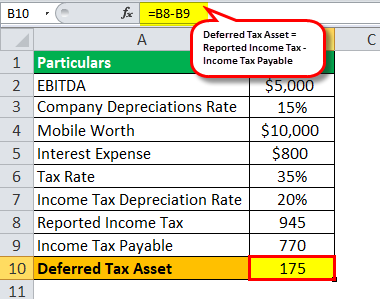

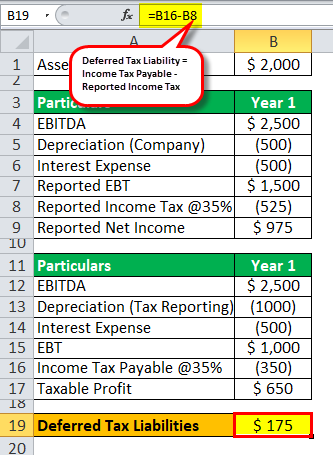

Deferred tax expense in income statement. For example deferred tax assets can be created due to the tax authorities. Deferred tax assets are often created due to taxes paid or carried forward but not yet recognized on the income statement. Deferred tax expense may be negative which results in total tax expense being less than current income tax obligation.

The amount of deferred tax expense income relating to changes in tax rates or the imposition of new taxes. As the expenses are incurred the asset is decreased and the expense is recorded on the income statement. Deferred tax expenses are placed aside and kept until the company or individual pays taxes either once per quarter or once per year.

Instead they are recorded as an asset on the balance sheet until the expenses are incurred. Deferred tax expense. Deferred tax is accounted for in accordance with IAS 12 Income Taxes.

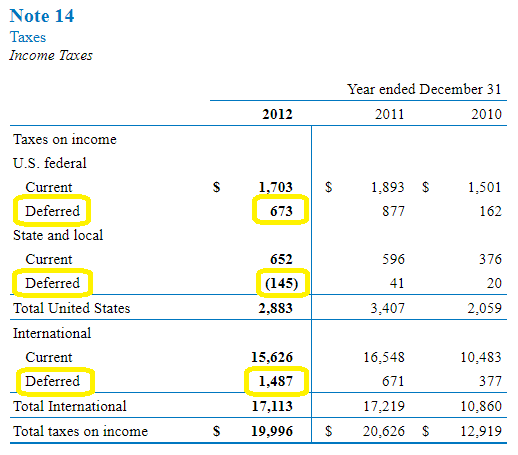

Or in the income statement if it is recognized as income or expense in this year in the accounting base but not in the tax base. Similarly deferred tax is a non-cash item and shall be treated accordingly in the operating activities section of the cash flow statement. The amount of the benefit arising from a previously unrecognised tax loss tax credit or temporary difference of a prior period that is used to reduce current tax expense.

Deferred income tax and current income tax comprise total tax expense in the income statement. A deferred tax asset arises when the carrying value of an asset is less than its tax base or carrying value of any liability is more than its tax base creating a deductible temporary difference. Income tax expense which is a financial accounting record is calculated using GAAP income.

However as youll learn in the course that is not always the case. Deferred Tax Asset Valuation Allowance 500 Income Tax Expense 500 Income Tax Expense on the income statement is reduced by 500 and net income is increased by 500. Income tax expense for the year 150011000.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)