Spectacular Under Ifrs The Extraordinary Item Presentation

Unusual or exceptional items.

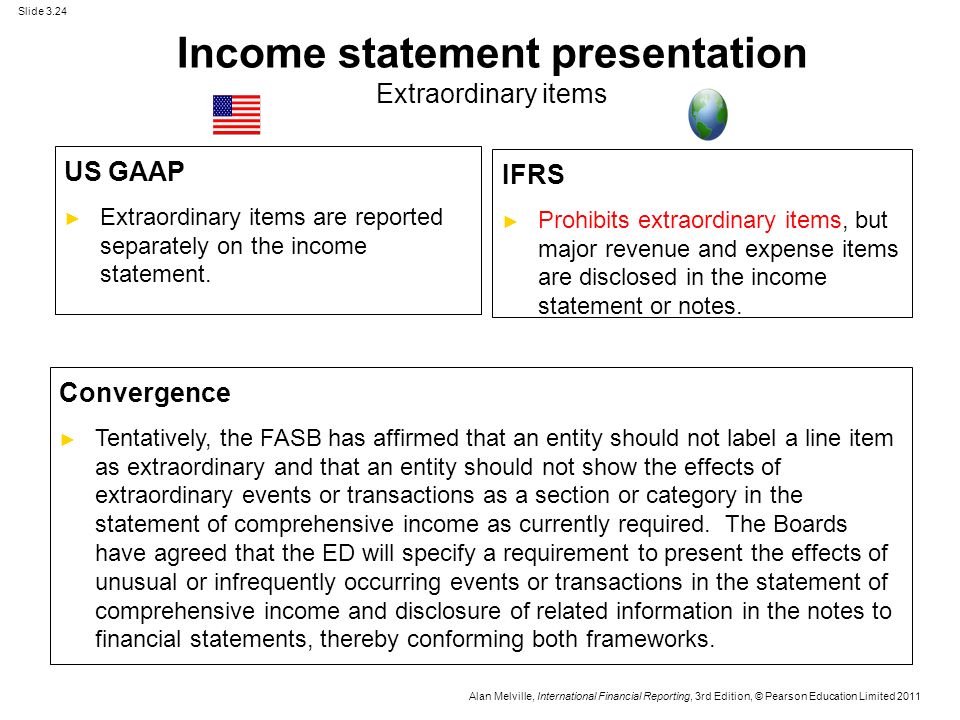

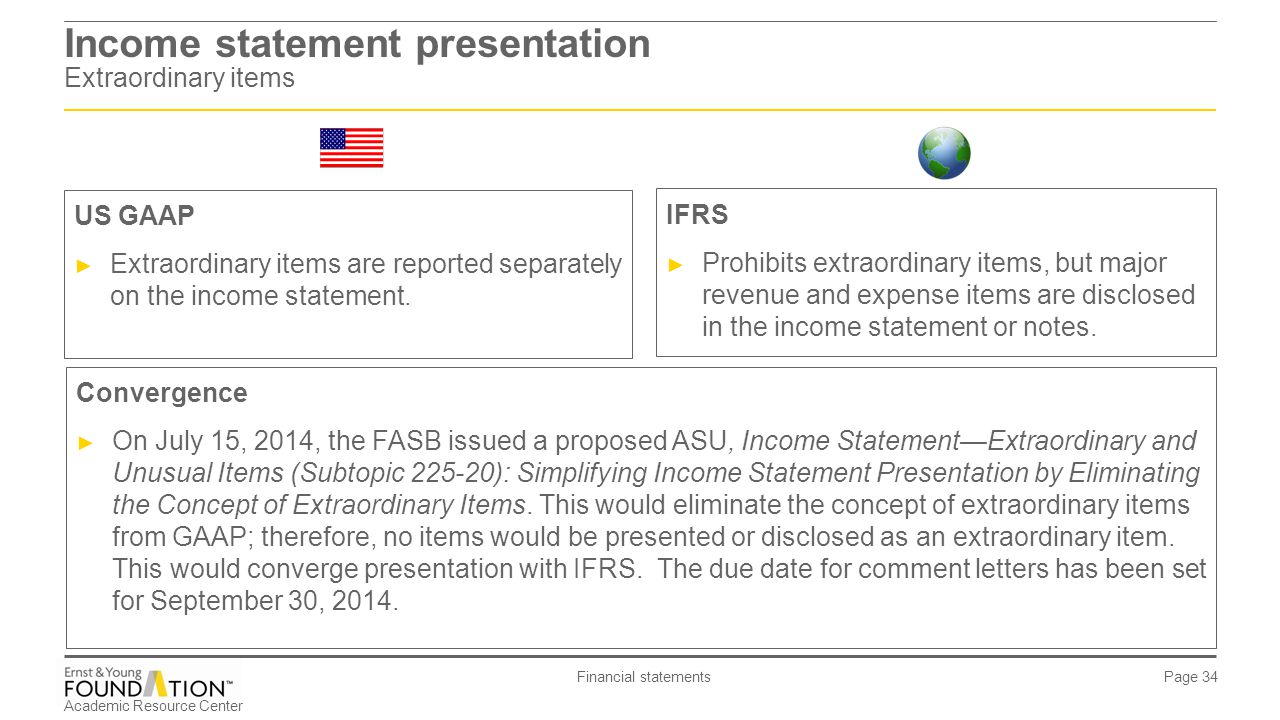

Under ifrs the extraordinary item presentation. IAS 185 Items cannot be presented as extraordinary items in the financial statements or in the notes. The EssentialsCash Flow Statements. The IFRS does not hold special distinctions for items of operational nature that occur irregularly or infrequently.

However the presentation disclosure or characterization of an item as extraordinary is prohibited. Items currently classified as extraordinary are only a subset of the items of income and expense that may warrant disclosure to assist users in predicting an entitys future performance. Extraordinary Items under IFRS.

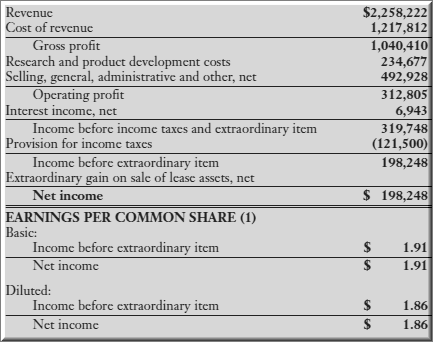

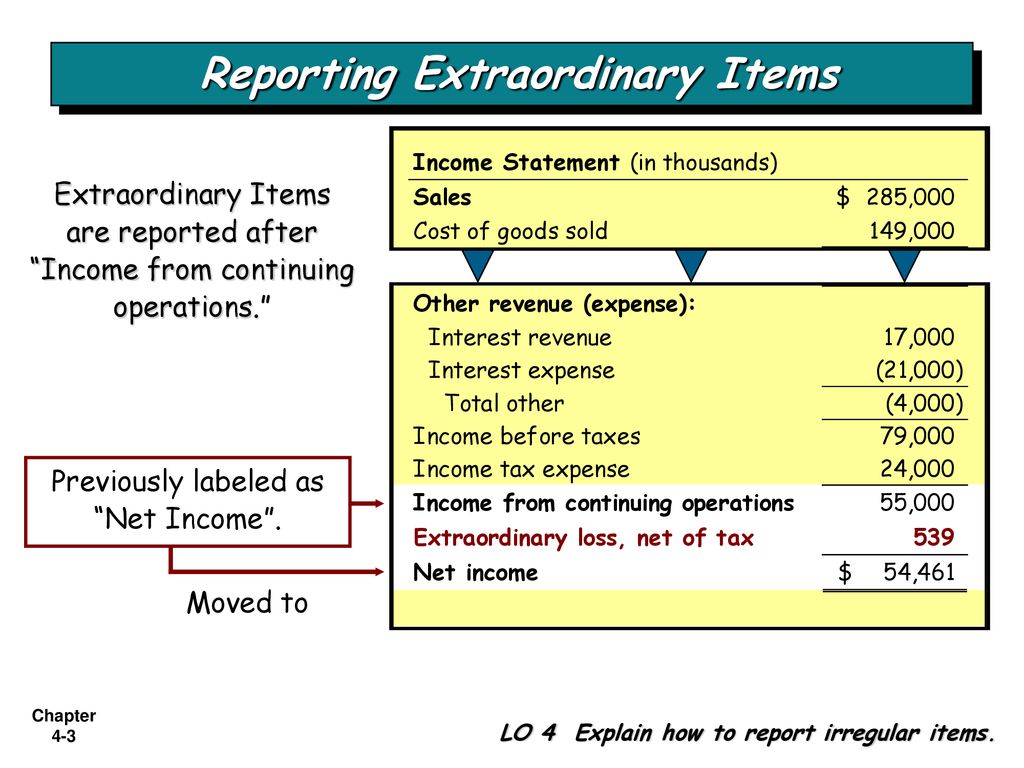

Thus both of the following criteria should be met to classify an event or transaction as an extraordinary item. Has not changed from current rules b. Extraordinary Items Extraordinary items are events and transactions that are distinguished by their unusual nature and by the infrequency of their occurrence.

What you need to know about the cash flow statement. The nature or function of a transaction or other event rather than its frequency should determine its presentation within the income statement. The nature or function of a transaction or other event rather than its frequency should determine its presentation within the income statement.

IFRS does not describe events or items of income or expense as unusual or exceptional. Rather all results are disclosed as revenues finance costs post-tax gains or losses or results from associates and joint ventures. There is no special distinction for items of operational nature that are rare.

However companies are not allowed to describe such items as extraordinary. This preview shows page 8 - 10 out of 21 pages. Has been eliminated c.

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)