Breathtaking Deferred Tax Expense Income Statement

The effect of accounting for the deferred tax liability is to apply the matching principle to the financial statements by ensuring that the tax expense 2000 is matched against the pre-tax income for the accounting period 8000 while still recognizing that only 1850 is.

Deferred tax expense income statement. The tax associated with intra-entity asset transfers should be accounted for under ASC 740-10-25-3e and ASC 810-10-45-8. Like deferred revenues deferred expenses are not reported on the income statement. This means that the income tax expense in the income statement normally has a current and deferred element and current and deferred tax assets or liabilities are recognized in the balance sheet.

In Paper F7 deferred tax normally results in a liability being recognised within the Statement of Financial Position. Deferred tax expense may be negative which results in total tax expense being less than current income tax obligation. 2012 Farlex Inc.

Or in the income statement if it is recognized as income or expense in this year in the accounting base but not in the tax base. Income tax expense for the year 150011000. In some cases these transactions could significantly affect the consolidated financial statements.

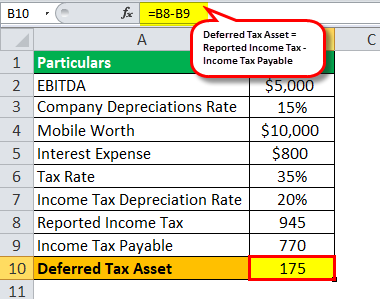

In Year 1 and 2 the deferred tax is a liability in the balance sheet and an additional expense in the income statement. Deferred tax expense is the sum of any increase in deferred tax liability over a period minus an increase in deferred tax asset over the period. Deferred income tax and current income tax comprise total tax expense in the income statement.

Accounting for Deferred Expenses. Consider the need for a valuation allowance. Deferred tax is accounted for in accordance with IAS 12 Income Taxes.

However it is. IAS 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable temporary differences. Deferred tax expense.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)